through ways Homayun Khatami, Eric Hazan, Hamza Khanand Kim Roar, McKinsey Quarterly

Suddenly, for better or worse, virtual worlds are in the zeitgeist. Investments double in 2022, driven by big moves (such as Microsoft’s $69 billion acquisition of Activision Blizzard, now under antitrust scrutiny) and small moves (some $12 billion to $14 billion in venture capital and private equity investments) more than one time. Everyone has heard about the success of some of the big gaming companies: Roblox reports over 58 million daily active users in 2022,1 while Fortnite surpasses 20 million daily active users in 2020 and over 9 billion in sales between 2018 and 2019 $2 et cetera are being invested; Meta continues to spend at least $10 billion a year on metaverse development. However, investors are asking metaverse companies questions about when they can expect tangible, near-term results from their investments in these companies.

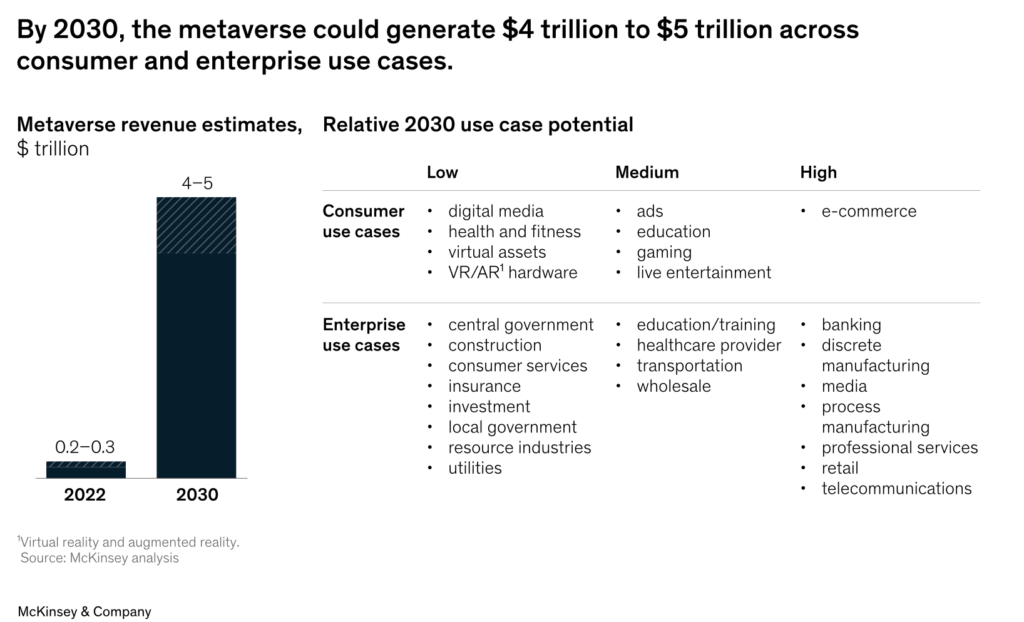

How should CEOs think about the Metaverse? Is this a big opportunity or a big risk? Our answer: The opportunities are huge—and the risks are not what you think. The companies that are building the Metaverse see it as the next iteration of the internet (see this McKinsey explanation for more). As with any technology this broad and all-encompassing (it’s similar in scope to artificial intelligence), the potential is enormous. We estimate that the Metaverse will generate $4 trillion to $5 trillion in value by 2030; see our report for all the details.

reasons for optimism

When we estimated the market cap of Metaverse activity in June 2022, we calculated it to be between $200 billion and $300 billion. It’s bigger now, and in eight years or so it could be $4 trillion to $5 trillion (chart), roughly the size of the economy of Japan, the world’s third-largest economy. Exponential growth is possible due to a combination of forces: the appeal of the Metaverse spans gender, geography and generations; consumers have shown that they are ready to purchase Metaverse assets; they are open to adopting new technologies; companies are investing heavily in all required infrastructure; brands experimenting in the metaverse find happy customers.

The sheer size got the CEO’s attention. As the old saying goes, a billion here, a billion there, and soon you’re talking real money — $5 trillion is billions. For context, we estimate that the path to net-zero emissions will require $3.5 trillion in annual spending, with the ongoing shift to cloud computing providing an opportunity for an additional $3 trillion.

The numbers we put on the potential of the metaverse are so high because the metaverse is a combined technology: it combines elements of many of the top trends that the McKinsey Technology Council has deemed most promising this year, including artificial intelligence, immersive reality, advanced connectivity, and Web3 . This is the main reason the CEO should be interested; the other is that the metaverse touches many parts of the enterprise. A CEO is a natural integrator who can mobilize the company’s resources for a coherent, value-oriented response. With the support of the CEO, the Metaverse effort is less likely to fall into “pilot purgatory.”

…

Long way to go

Skeptics point out that other technologies sometimes take a long time to reach their commercial potential. Artificial intelligence is one; even after the decades-long “AI winter,” many analysts believe AI has yet to reach its potential, although recent advances in generative AI have raised many skeptics. Self-driving cars are another matter. Is there a risk that the Metaverse will suffer a similar fate? In other words, where are we in the hype cycle? The peak of inflated expectations? Or have you entered the trough of disillusionment?

In our opinion, the development of the metaverse is still several years away from a real tipping point. It could easily take longer (though that’s no reason not to prepare).

as Brian Solis, Salesforce recently shared with usGenerational changes such as Web 1.0, social media, and mobile “rarely happen overnight. They take years and are the cumulative result of incremental technological advances, changing consumer demands, and cycles of experimentation.” An apt description of the obstacles the Metaverse had to overcome.

“Generational changes such as Web 1.0, social media, and mobile rarely happen overnight. They take years and are the cumulative result of incremental technological advances, changing consumer demands, and cycles of experimentation.”

The technology isn’t ready to support the Metaverse at scale: 5G networks, edge computing, hardware and software advancements have to come online (and they’re in the works). Right now, the audience is primarily gamers and tech-savvy folks; others will have to be recruited (and our surveys indicate they’re very interested). Many Metaverse transactions are conducted with cryptocurrencies; we have all seen the shortcomings of crypto as a reliable, secure system of transactions. Finally, there is no connection between all the different parts of the Metaverse (Roblox, Sandbox, etc.). An integrated or true metaverse is still a long way off.

Please click here for the entire article.

Read McKinsey’s interview with Brian Solis about the Metaverse here.

about the author

Homayoun Hatami is managing partner of global client capabilities and a senior partner in McKinsey’s Paris office, where Eric Hazan is a senior partner. Hamza Khan is a partner in the London office. Kim Rants is an Associate Partner in the Copenhagen office. The authors would like to thank Nikita Pillai and Adam Ridemar for their contributions to this article.