from a new job Paper by Jan Eeckhout (UPF Barcelona), h/t Torsten Slok:

The current approach to measuring monetary policy inflation is to use the average annual rate of inflation. When inflation changes rapidly, whether rising or falling, the annual average rate biases data too far in the past and delays six months to convey the true price level. I suggest using instantaneous inflation as a more appropriate measure of price change. This measure weighs noise in the data against the precision of instantaneous price changes. Judging from the latest inflation data, the instantaneous inflation rate in the United States and the Eurozone has returned to the 2% target, and the period of high inflation is over. This is not the case in the UK, Japan and Australia.

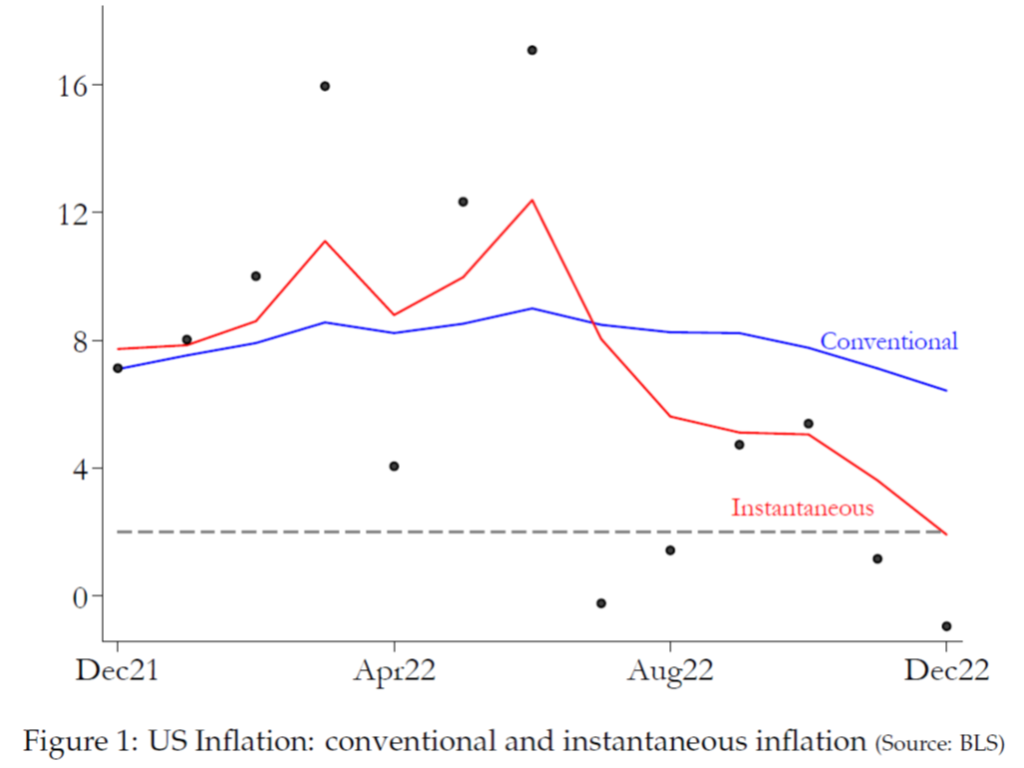

Note that this is in relation to the debate we have on this blog about the relative merits of 12-month inflation (or some would prefer to use 17 or 18-month annualized inflation), 3 months or 1 month. 12 months is too much old data, 1 month is too noisy. The image below shows regular 12 months (blue) and 1 month (or month-on-month) as black circles.

Using a polynomial kernel with weights a=4 (0 for the regular measure, ie weighting each month’s inflation equally), the author gets the red line, which he calls “instantaneous inflation”. (See Figure B1.a in the paper, which shows, relative to simple 12-month change, a=0, more recent observations are given more weight than earlier observations).

The author states:

I find a smoothed inflation rate of 2% for December 2022, the inflation target (see Figure 1, where a = 0 corresponds to the traditional measure and a = 4 corresponds to the instantaneous inflation measure with a bandwidth parameter of 4… ..Tradition [year-on-year] The inflation gauge for December was 6.5%.