Going back to the macro introduction, remember when we quickly imposed the equilibrium condition Y=AD? What does it mean that Y is not equal to AD? Here’s a quick reminder.

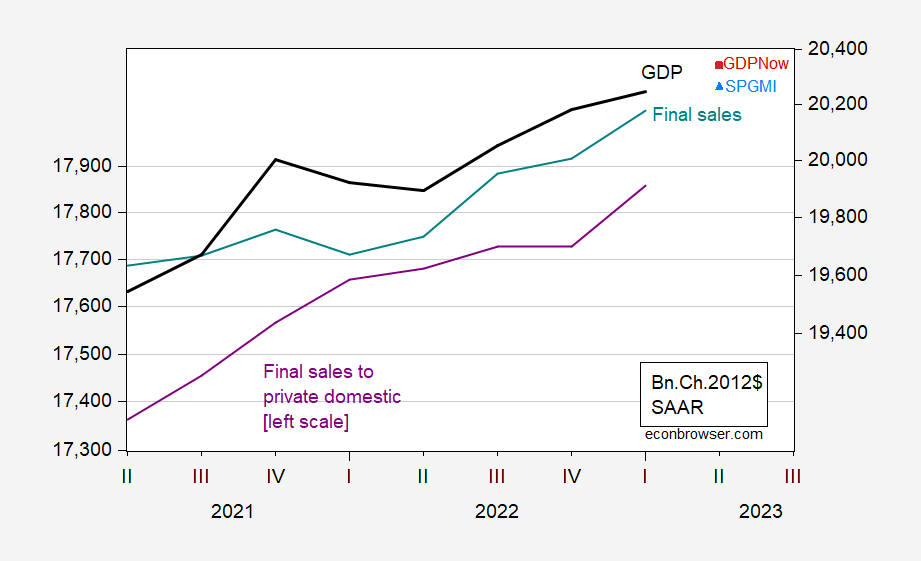

Aggregate demand (AD) is usually measured in terms of final sales. Income or output (Y) can be measured in terms of expenditure or income. The regular pictures are AD and GDE, as shown in Figure 1 below.

figure 1: GDP (black, right log scale), final sales (teal, right log scale), final sales to domestic private buyers (purple, left log scale), all in billions Ch.2012$ SAAR. Source: BEA 2023Q1 Second Edition.

The difference is in stock buildup/decrease. If all inventory changes are required, then final sales are a good measure of total demand. The latest data showed that final sales rose rapidly at 3.4%, while GDP (SAAR) came in at 1.3%. Final sales include sales to foreign buyers less imports. A supposedly better measure of domestic private demand is final sales to nongovernment domestic buyers; this series is not necessarily more stable (growth rates have higher standard deviations than final sales). The series grew 2.9% in the first quarter.

Emphasizing Y (which can be measured in many ways) versus final sales emphasizes that aggregate demand can deviate from income.

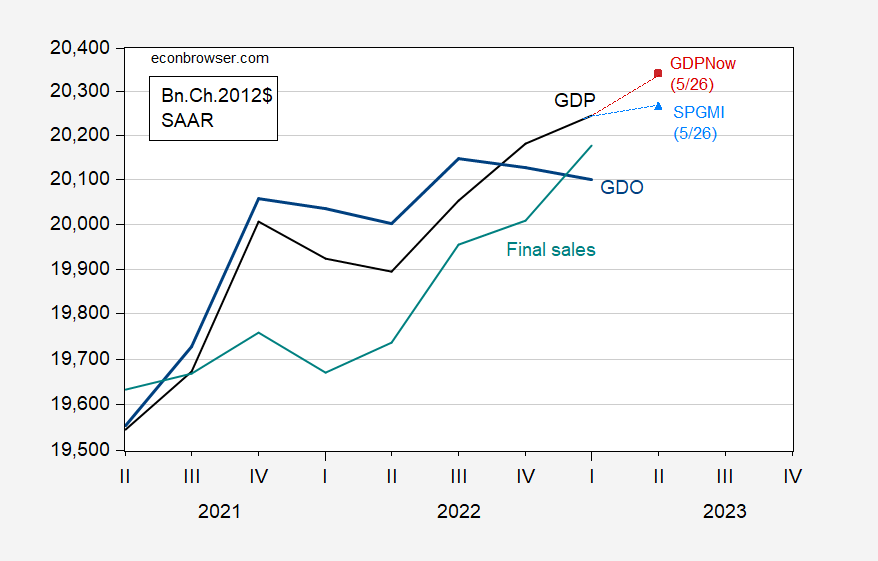

image 3: GDP (black), GDPNow (red squares), SPGMI GDP tracking (sky blue triangles), GDO (bold blue), final sales (teal), all in billions. 2012 $SAAR. Source: BEA 2023Q1 Second Edition, Federal Reserve Bank of Atlanta, SPGMI.

If one really believes that GDO is output and final sales are aggregate demand, then demand seems strong. However, GDO (as the average of GDP and GDI) is not constructed in a way consistent with the calculation of final sales – after all, final sales are simply gross domestic expenditure (which we call GDP) minus inventory accumulation. If the largest measurement errors are in C, fixed I, and G, then one might think that final sales are more like GDO minus inventory investment.

In fact, inventory investment is a highly volatile component of GDP. In the last business cycle (2Q09-4Q19), the standard deviation of inventory accumulation was about the same as the standard deviation of GDP (2012 EUR 1 billion) – 60 billion vs 62 billion 1.2 billion SAAR.Unfortunately, I don’t know how much the stock has been modified recently; the last research I found was Holcim (REstat 1984).

In any event, I think it is useful to consider our best estimates of output/income and aggregate demand when considering where the economy is headed.