It’s Wednesday and there’s a lot going on in terms of data releases – housing finance, construction, and today the Australian Bureau of Statistics releases the latest – Monthly Consumer Price Index – Covers the period up to April 2023. On an annualized basis, monthly all-item CPI growth was 6.8%, down from 6.9%. There is some stickiness in some components of the CPI, but headline inflation peaked last year and is slowly falling as the factors that initially weighed on it are fading. Tomorrow I plan to discuss the apparent tension in the Modern Monetary Theory (MMT) community over whether rate hikes are expansionary or contractionary. But today we’re just thinking about the data and listening to some dubs.

Australian inflation continues to fall

Today’s data showed that monthly CPI growth slowed to 0.68% from 0.77% in March.

This new experimental monthly series from the ABS covers only about 60% of the items that appear in the more detailed quarterly releases, although the ABS notes that it is “continuing to improve the monthly CPI indicator as much as possible and adding a new monthly series of indicators electricity prices in

So, over time, the metric will get closer and closer to the more accurate standard quarterly metric.

For now, however, it still provides good information for assessing the direction of inflationary pressures.

ABS Media Release (31 May 2023) – Year-to-month CPI rises 6.8% in April – point out:

For the year ending April 2023, the monthly Consumer Price Index (CPI) measure rose 6.8%…

The 6.8% annual growth rate for the month was higher than the 6.3% annual growth rate reported in March 2023, but lower than the high of 8.4% recorded in December 2022…

It is important to note that a significant contributor to the increase in annual mobility in April was motor fuel. The halving of fuel excise duty in April 2022 (which was fully abolished in October 2022) is influencing the annual trend in April 2023.

Again we see a price effect of government discretion, independent of the overall spending situation in the economy.

The RBA’s interest rate hikes are all premised on demand-side problems.

Clearly, the current rate of inflation would be much lower if the government had not manipulated the fuel excise tax.

So it would be a crime for the RBA to use this figure to argue that inflation isn’t falling fast enough and then use that to justify further rate hikes.

But the logic of taking it for granted has long since disappeared at the RBA.

I’ll talk about that later.

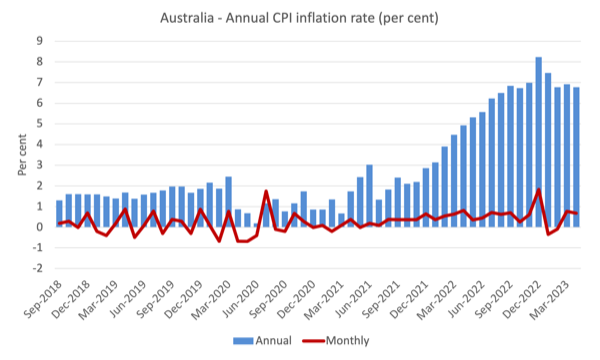

The chart below shows that the annual inflation rate is heading in one direction – falling rapidly.

The blue bars show the annual rate, while the red line shows the monthly change in CPI for all items.

1. In December 2022, an annual growth rate of 8.2% is recorded.

2. In January 2023, the annual rate is 7.5%.

3. In February 2023, the annual rate is 6.8%.

4. In March 2023, the annual rate is 6.9%.

5. In April 2023, the annual rate is 6.8%.

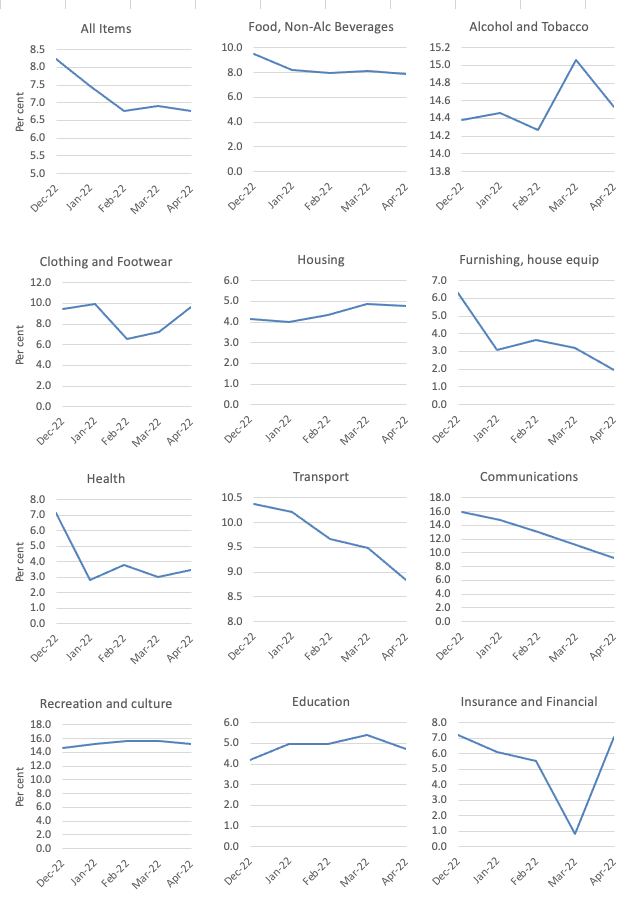

The graph below shows the movement of the major components of the CPI for all projects between December 2022 and April 2023.

In general, the initial sources of CPI pressure are the rapid decline and some derivative components – such as clothing and footwear (derivatives, because transportation costs were once higher).

Part of the rise in education costs is the result of price gouging by private school operators, who realize they can get ahead of rising unit costs without anyone noticing.

Rising health care costs due to indexation arrangements for private health insurance – again an administrative artifact inspired by the privatization of health protection.

The financial sector is back in town looking for big profits (see chart below).

But overall, inflation is falling as supply factors ease.

Interestingly, the RBA Governor appeared today before the Senate Budget Committee, the committee tasked with grilling public figures on what they are doing.

The RBA boss was questioned at today’s Economic Legislative Council hearing, but the official transcript is yet to come out.

However, the ABC radio and television service covered the hearing and we understand that:

1. The RBA admitted today that it has been underpaying an “unspecified” number of staff by thousands of dollars.

And if that wasn’t bad enough, it also brought in private management and accounting firm PricewaterhouseCoopers to work out a solution.

Why is this shameful?

PwC has now been found to have systematically used confidential information obtained from their consulting contracts with the federal government on tax policy to help their private clients increase profits.

The consultancy aims to advise on policies to combat corporate tax avoidance.

It now appears that PwC has abused the trust necessary to negotiate contracts with governments to advance its own agenda and undermine a public purpose.

Neoliberalism has seen public services hollowed out, with these accounting and management consultancies moving in to fill the space for policymaking.

Public policy aims to promote the general well-being.

But PwC sees the consultancies as an open door to help it deal with unwitting governments handing over classified information through these contracts.

So the RBA’s continued use of PwC is a scandal in itself.

But we now know that PwC has many contracts worth millions or even billions of dollars with various government departments.

Corruption is palpable.

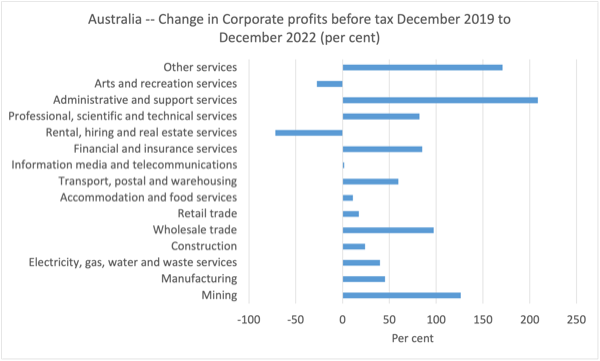

2. The governor was asked if profit gouging was causing inflation, he flatly denied it and said “profits outside the resources sector are not going up”.

So is this statement accurate?

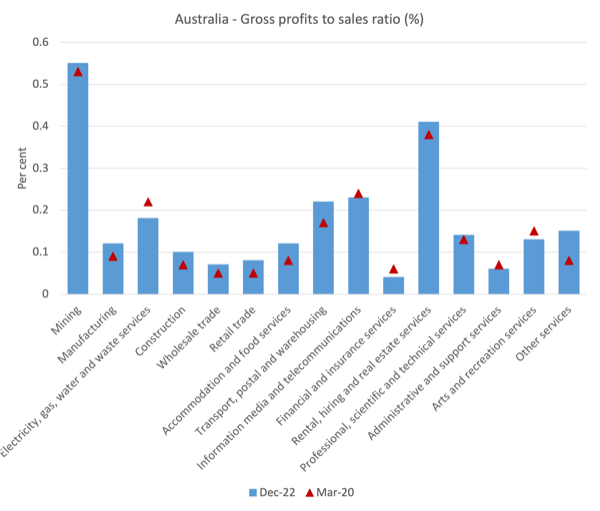

The first graph, drawn from official ABS data, shows that profits have been rising in most industrial sectors and the second shows that profits have risen in most sectors relative to sales.

Since the outbreak, the profits of the resources industry have increased significantly. But so are many other sectors.

The graph shows the ratio of gross profit to sales, with the red triangles representing the March 2020 quarter when the pandemic began, and the blue bars representing the December 2022 quarter results.

If the bar is above the triangle, it means the company is expanding its profit per unit of sales.

This is clearly already happening across the industry.

It is a pity that members of the Senate committee were not better informed and incapable of forcing the RBA governor to retract his claims.

His assertions are of course a cover for what he is doing with monetary policy.

If profit fraud is the main factor driving inflation (and it is, despite his denials), he cannot justify raising interest rates.

3. Given that wages clearly aren’t driving inflation events, the governor is again playing the inflation expectations card, as the old sorry trick of “we risk a wage-price spiral” justifying rate hikes is getting a bit flimsy.

So what else to do but resort to another old trick? Here’s one reason he raised rates last time in the face of falling inflation:

…is to reinforce the community’s idea that we are serious about this and we will do what is necessary to bring inflation down…

But with inflation already peaking in the second half of 2022 and no data to suggest that inflation expectations are not benign, the claim that rates must continue to rise for people to realize the RBA is serious is dangerous at best.

4. He tried to try to push the blame back on fiscal policy by claiming that “the capital stock is out of line with population growth meaning Australians have less capital available to work” and that the government needs to invest more.

In particular, he noted that more housing stock is needed and that more government investment must be made.

But he has previously warned that if the government does not tighten fiscal policy, interest rates will rise more than they have already done so.

Why did the senators not accept his opinion?

Music – Saint Germain

Here’s what I’ve been listening to this morning at work.

This track – Dubbing Experience II – appeared on the debut studio album in 1995 – avenue – French Band – Saint Germain.

Maybe calling St Germain a band pushes it a bit, since it’s a state alias for the French house and jazz producer who has assembled some real musicians to accompany his samples and other effects.

Regardless, it’s a beautifully crafted dub that I reacquainted with yesterday on a long flight from Perth to Melbourne.

The whole album is worth listening to.

Enough for today!

(c) Copyright 2023 William Mitchell. all rights reserved.