The Australian Bureau of Statistics (ABS) released its latest labor force data today (16 March 2023) – Australian workforce – For February 2023. My overall assessment is that February’s results were much stronger after two months of declines, some of which were related to anomalies during the holiday season. All things one would expect improved – employment rose by 64,600 (0.5%) with a bias toward full-time work; the number of unemployed fell by 16,500 to 507,500 and the official unemployment rate dropped 0.3 percentage points to 3.5%; and the participation rate A rise of 0.1 percentage points though with some caveats – the underlying (“hypothetical”) unemployment rate is closer to 5.1% rather than the official 3.5%, suggesting that the labor market remains weak. 1,343,200 Australian workers are still unemployed in one way or another ( official unemployment or underemployment). The problem is that the RBA is obsessed with increasing unemployment, mistaking inflationary pressures from the labor market, which will raise rates further and ultimately kill job growth.

A summary of the ABS labor force (seasonally adjusted) estimates for February 2023 is:

- Employment rose by 64,600 (0.5%) — full-time employment rose by 17,900 and part-time employment rose by 1,800.

- The number of unemployed fell by 16,500 to 507,500.

- The official unemployment rate fell 0.3 percentage points to 3.5%.

- The participation rate rose by 0.1 percentage point to 66.6%.

- The employment-to-population ratio rose 0.2 percentage points to 64.3%.

- Total monthly hours increased by 72 million hours (3.9 percent).

- The underemployment rate fell 0.4 percentage points to 5.8% (-43,400). Overall, there are 835,700 underemployed workers. The overall labor force underutilization rate (unemployed plus underemployment) fell by 0.4 percentage points, or 9.4 percentage points. A total of 1,343,200 people were unemployed or underemployed.

In its– media release – The ABS states:

The seasonally adjusted unemployment rate fell to 3.5% in February…as the number of employed rose by about 65,000 and the number of unemployed fell by 17,000, the unemployment rate fell to 3.5%. This is back to the levels we saw in December…

…the employment-to-population ratio rose 0.2 percentage points to 64.3% in February, returning to December 2022 levels.

Participation rose 0.1 percentage point to 66.6% in February, also returning to December 2022 levels…

In February 2023, the seasonally adjusted monthly hours worked increased by 3.9%.

Conclusion: The softness in employment data over the past few months is not a harbinger of a major contraction – not yet.

The employment rate is up, the participation rate is up, and the unemployment rate is down.

This is usually a sign of a good combination of events emerging.

How this will affect the RBA’s decision-making is unknown, but it is more likely that they will use this as an excuse for more rate hikes.

Employment increased by 64,600 (0.5%) in February 2023

1. Full-time employment increased by 17,900, and part-time employment increased by 1,800.

2. The employment-to-population ratio increased by 0.3 percentage points to 64.3%.

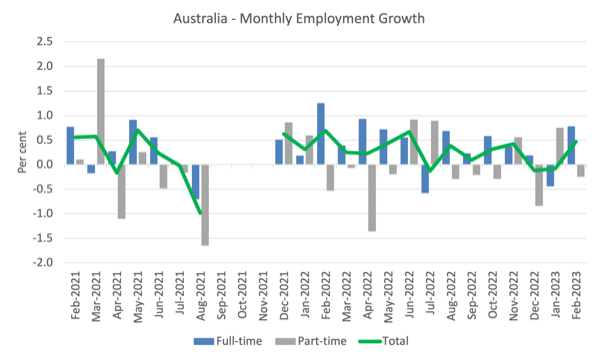

The chart below shows the monthly growth in full-time (blue bars), part-time (gray bars), and total employment (green line) for the 24 months ending February 2023, using seasonally adjusted data.

I took observations from September 2021 to January 2021 – they were outliers due to the Covid wave at that time.

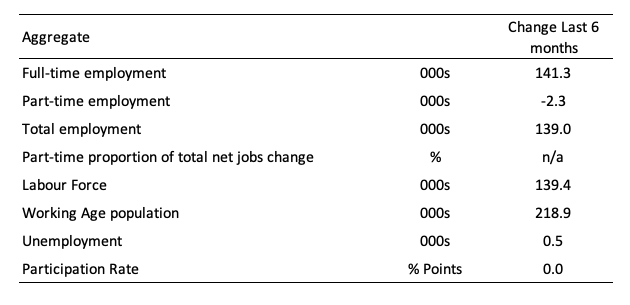

The table below provides an accounting summary Labor market performance over the past six months Provides a longer-term perspective, breaking through monthly changes and better assessing trends.

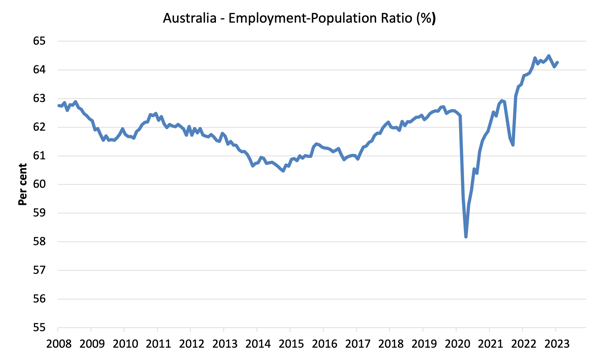

Given changes in workforce estimates, sometimes check Employment Population Ratio (%) Because the underlying population estimate (the denominator) is less cyclical and subject to change than the labor force estimate. This is another measure of the robustness of economic activity to the unemployment rate, which is sensitive to fluctuations in the labor force.

The graph below shows the employment-to-population ratio since January 2008 (ie since the global financial crisis).

In February 2023, the ratio increased by 0.2 percentage points to 64.3%.

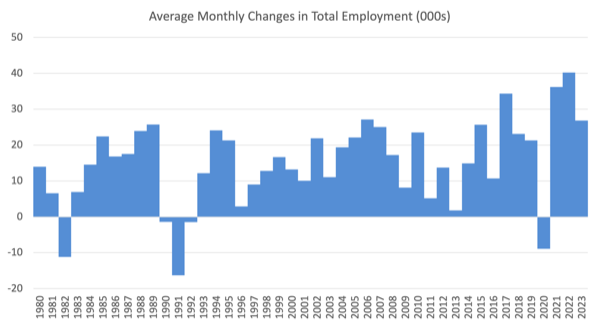

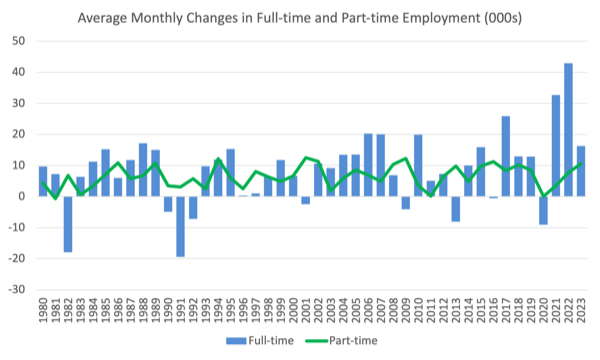

For perspective, the chart below shows the average monthly employment change over the calendar years from 1980 to 2022 (so far).

1. Average employment change of -880 in 2020, increasing to 36,000 in 2021 as lockdown measures eased.

2. The average monthly change in 2022 is 37,700.

3. The average change so far in 2023 is 26,800 (but this reflects poor January results).

The graph below shows the average monthly change (in thousands) of full-time and part-time employment (bottom graph) since 1980.

72 million more hours worked (3.9%) in February 2023

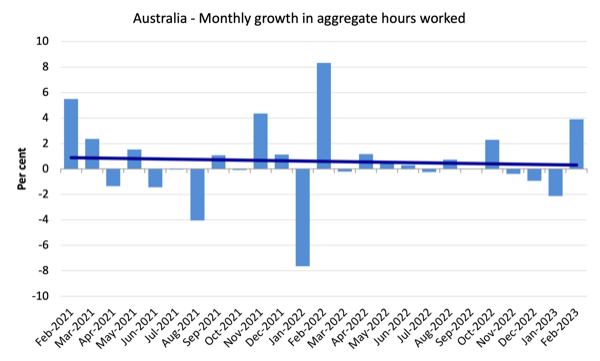

The chart below shows the monthly growth (in percent) over the last 24 months.

The dark linear line is the simple regression trend for monthly variation (sloped upward by the two outlier results).

This month’s results broke the weak past 12 months. The trend is down, but that could change if the coming months are as strong as February.

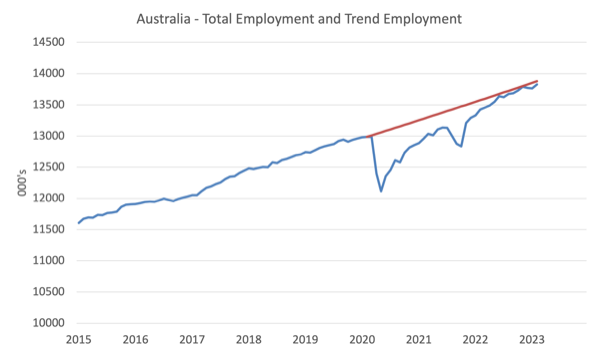

Actual and Trend Employment

The Australian labor market is now larger than it was in February 2020, with employment now close to returning to pre-pandemic trends.

The graph below shows total employment (blue line) and what it would have been if growth had continued at the average rate from 2015 to April 2020.

In February 2023, the job vacancies decreased by 39,000 to 50,800.

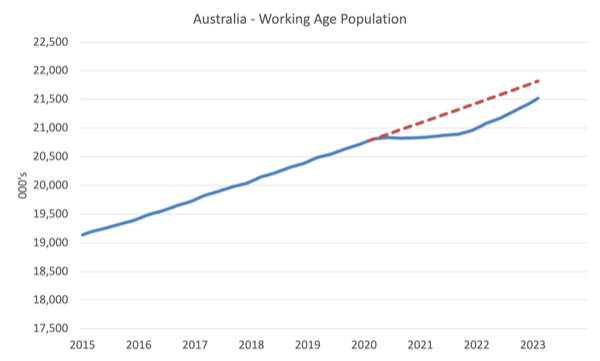

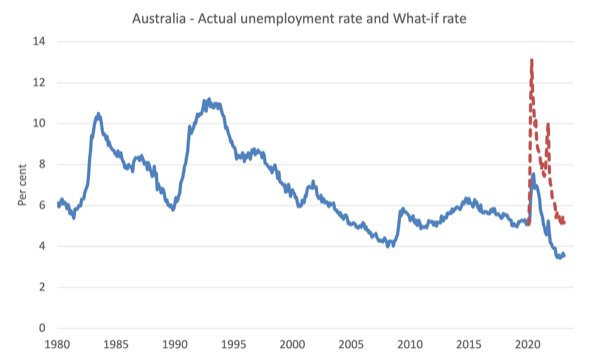

Population slowdown – “what-if” unemployment analysis

The graph below shows Australia’s working-age population (15+) from January 2015 to February 2023. The dashed line is projected growth if the pre-pandemic trend continues.

The difference between the two lines is that the working-age population fell after Covid immigration restrictions.

The civilian population in February 2023 is 300,000 fewer than if pre-Covid trends continued.

The chart below shows the evolution of the real unemployment rate since January 1980 to February 2023, the dashed line is the “assumed” rate assuming the most recent peak participation rate (recorded in November 2022 = 66.8%), extrapolated labor Age population (based on growth rates from 2015 to February 2020) and actual employment since February 2020.

It shows what the unemployment rate would be given real job growth if the trajectory of the working-age population followed past trends.

In this blog post – Australia’s external border closure cut unemployment by around 2.7 percentage points (April 28, 2022), I provide a detailed analysis of how I calculated the “hypothetical” unemployment rate.

Therefore, taking into account employment performance since the pandemic, the unemployment rate in February 2023 would be 5.1%, rather than the current 3.5%.

The finding skews sharply different from what has happened since the pandemic began.

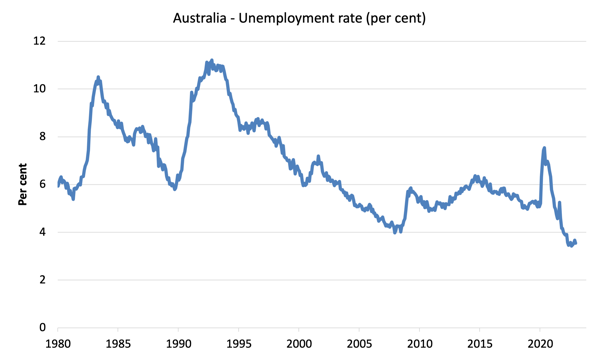

Unemployment falls by 16,500 to 507,500 in February 2023

The decline in the unemployment rate and unemployment rate reversed two consecutive months of increases.

The unemployment rate fell because the net change in employment (64,600) outstripped growth in the labor force (10.6 million).

As a result, the unemployment rate fell back to 3.5% (down 0.2 percentage point) and the participation rate also rose, with the data countering any notion that the labor market is shrinking into recession.

However, also keep in mind the “what-if” analysis above, and look at the impact of declining engagement below.

The chart below shows the national unemployment rate from January 1980 to February 2023. Longer time series help to form some perspective on what is currently happening.

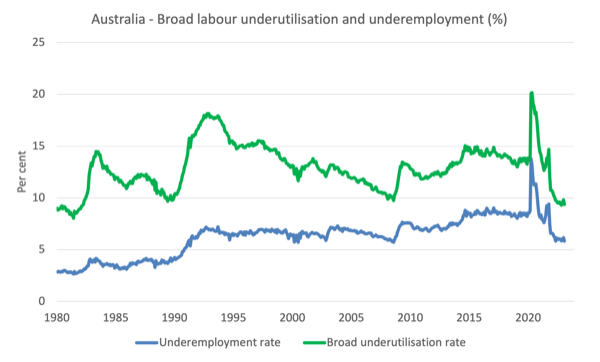

The broad labor underutilization rate fell 0.4 percentage points to 9.4% in February 2023

1. The underemployment rate decreased by 0.4 percentage points to 5.8% (a decrease of 43,400).

2. The total number of underemployed workers is 835,700.

3. The total labor force underutilization rate (unemployed plus underemployment) fell by 0.4 percentage points, or 9.4 percentage points.

4. The total number of unemployed and underemployed workers was 1.3432 million.

Both the unemployment rate and the underemployment rate have fallen as full-time employment has increased—a very good result.

The chart below plots Australia’s seasonally adjusted underemployment rate (blue line) from April 1980 to February 2023 and the broad underemployment rate (green line) for the same period.

The difference between the two lines is the unemployment rate.

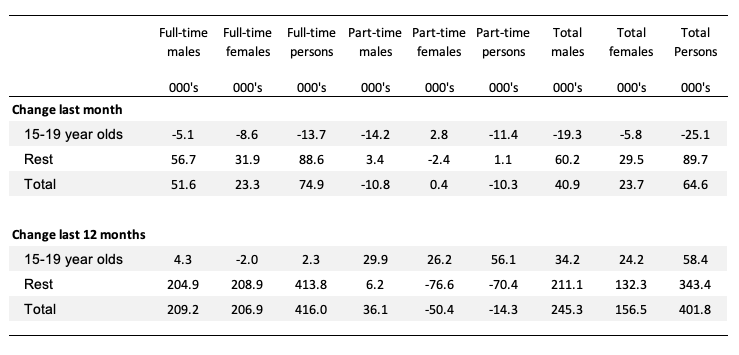

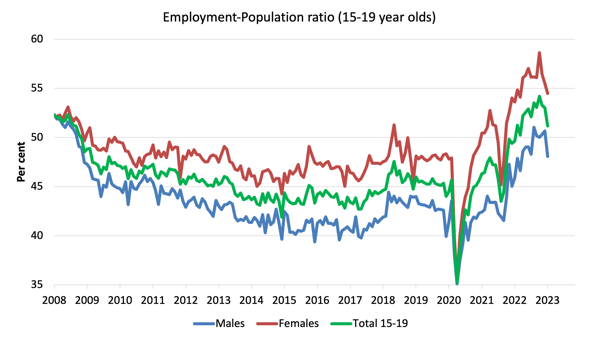

Labor market for teens worsens again in February 2023

While the rest of the labor market improved in February, conditions worsened for teens.

The table below shows the distribution of net employment by full-time/part-time status and age/gender category (15-19 and others) for the past month and the past 12 months.

To put teen employment in context of size (relative to their size in the population), the chart below shows the employment-to-population ratios since June 2008 for males, females, and the total population ages 15-19.

You can interpret this graph as describing the change in employment relative to each cohort’s underlying population.

Judging from recent developments:

1. The proportion of males decreased by 2.6 percentage points from the previous month.

2. The proportion of women decreased by 1.0 percentage points.

3. The overall youth employment-to-population ratio dropped by 1.8 percentage points.

in conclusion

My standard monthly caveat: Given the way labor force surveys are constructed and conducted, we always have to interpret monthly movements with caution.

My overall rating is:

1. After two months of decline (partly related to holiday anomalies), February results were much stronger.

2. Everything is in place – employment rose by 64,600 (0.5%), with a bias toward full-time work; the number of unemployed fell by 16,500 to 507,500, and the official unemployment rate fell by 0.3 percentage points to 3.5%; the participation rate rose by 0.1 percentage points.

3. A few caveats though – the underlying (“hypothetical”) unemployment rate is closer to 5.1% rather than the official 3.5%, suggesting that the labor market remains weak.

4. There are still 1,343,200 Australian workers who are unemployed in some way (officially unemployed or underemployed).

5. The problem is that the RBA, bent on increasing the unemployment rate, mistook inflationary pressures coming from the labor market, would raise rates further and ultimately kill job growth.

Enough for today!

(c) Copyright 2023 William Mitchell. all rights reserved.