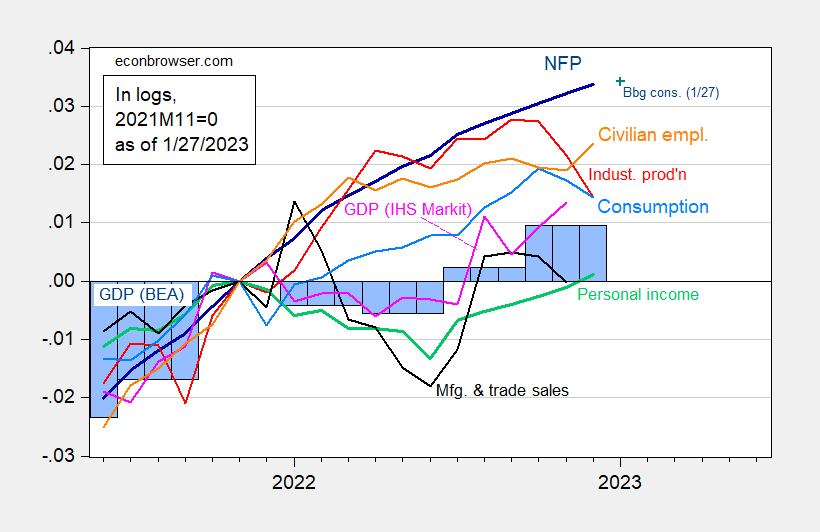

With the release of consumption and personal income for December 2022, real manufacturing and trade sales for November, and 4Q GDP, we have the following chart of business cycle indicators tracked by the NBER Business Cycle Dates Committee, and the monthly IHS Markit GDP:

figure 1: Non-farm payrolls, NFP (dark blue), Bloomberg consensus as of 1/27 (blue+), private employment (orange), industrial production (red), China’s personal income excluding transfers in 2012 (green), Sales for Manufacturing and Trade Ch.2012 (black), Consumption for Ch.2012 (light blue) and Monthly GDP for Ch.2012 (pink), GDP (blue bars), all log normalized to 2021M11=0 . Q3 Source: BLS, Fed, BEA, from FRED, IHS Markit (nee Macroeconomic Advisers) (published 1/3/2023), Bloomberg (as of 1/27) and author’s calculations.

While GDP grew at 2.9% Q/Q SAAR in 4Q, beating Bloomberg’s forecast (2.6%) (see jims post), rising inventories point to a recession in the first quarter of 2023. Our nowcast/tracking estimates for Q1 have slowed markedly with consumption slowing and December exports weakening (not shown).

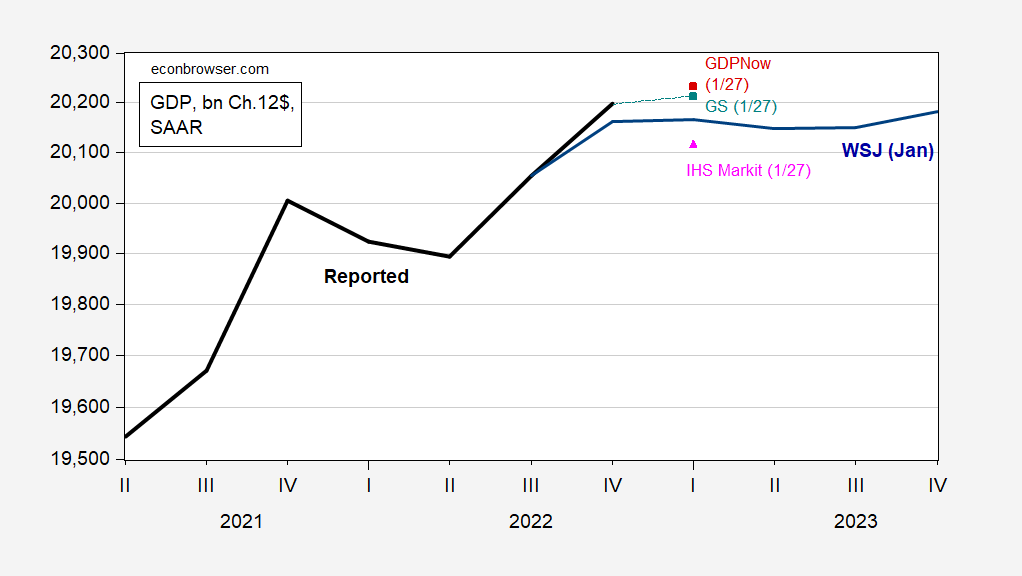

figure 2: GDP (bold black), WSJ December survey average (dark blue), GDPNow (red squares), Goldman Sachs (turquoise squares), IHS Markit/S&P Global (pink triangles), all in billions. 2012 $SAAR. Source: BEA 2022Q4 advance, WSJ, Federal Reserve Bank of Atlanta (1/27), Goldman Sachs (1/27) and IHS Markit (1/27), and author’s calculations.

IHS Markit tracked a 1.6% decline in the first quarter (Q/Q SAAR).