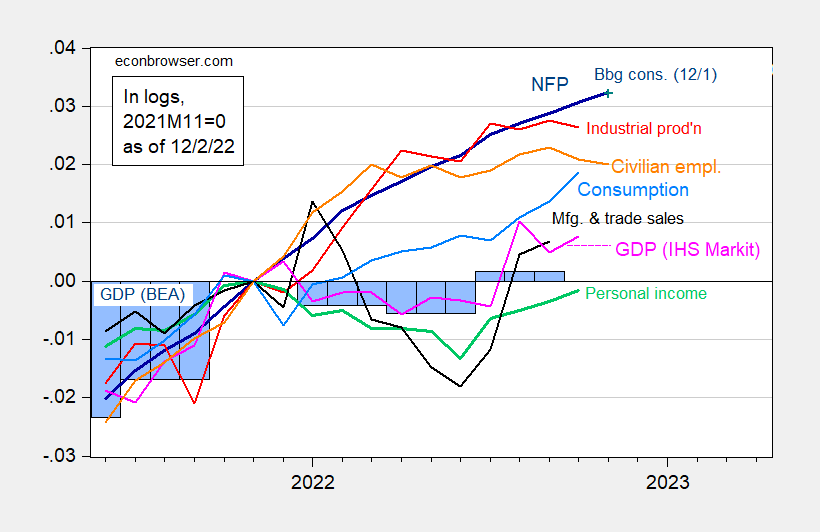

NFP payrolls unexpectedly rose by 263K (versus Bloomberg consensus of 200K). Here is a graph of the results of some of the key metrics followed by the NBER Business Cycle Dating Committee.

figure 1: Nonfarm payrolls, NFP (dark blue), Bloomberg consensus as of Dec. 1 (blue+), civilian employment (orange), industrial production (red), personal income excluding 2012 Chinese transfers (green) , Sales for Manufacturing and Trade Ch.2012 (black), Consumption for Ch.2012 (light blue) and Monthly GDP for Ch.2012 (pink), GDP (blue bars), all log normalized to 2021M11= 0. Q3 Source: BLS, Fed, BEA, from FRED, IHS Markit (nee Macroeconomic Advisers) (published 12/1/2022), and authors’ calculations.

Note that despite the unexpected uptick in employment, the picture of the economy’s overall trajectory has barely changed (relative to the consensus change shown in blue + in Figure 1).

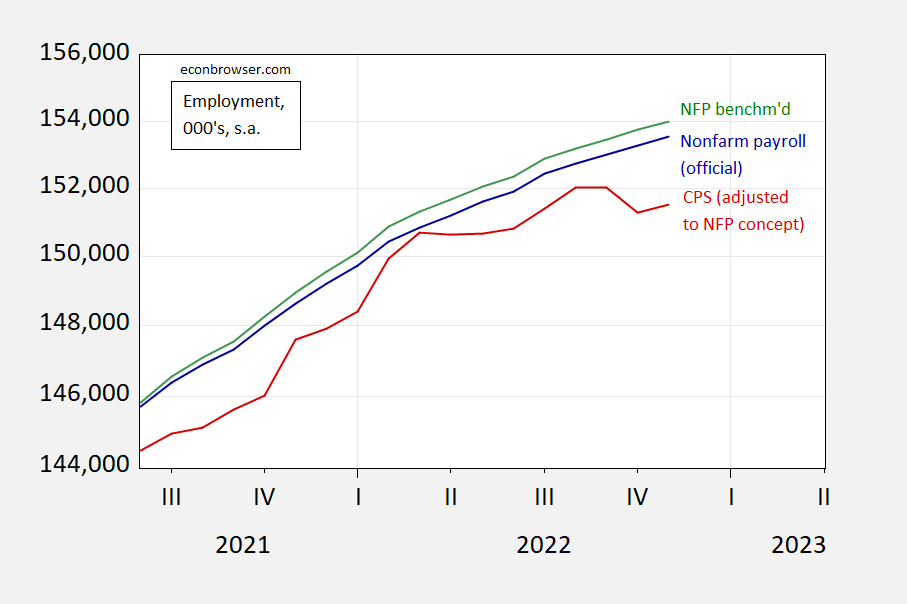

Note that the employment data show continued divergence in trends between the establishment (CES) and household (CPS) surveys. That being said, the corporate series usually gets close to full weight in indicators that track the economy – mostly because of the higher relative stability of the CES indicator (see Furman).I show below the NFP series, the NFP series accounts for Raising Preliminary Baseline for March 2022 Employment Rateand Family Employment Series Adjusted to the NFP Concept.

figure 2: Non-farm payrolls (blue), NFP employment are adjusted against the March 2022 preliminary baseline revision (teal), while civilian employment is adjusted for the NFP concept (red). Sources: U.S. Bureau of Labor Statistics and authors’ calculations.

The household employment series, adjusted to the NFP concept, showed an overall downward trend in the overall household civilian employment series, but this was not the case in last month’s data. This implies a (possibly partial) peak in the household series in September 2022, which some observers see as signaling the onset of a recession—that is, the household series signals a recession earlier than the business series.

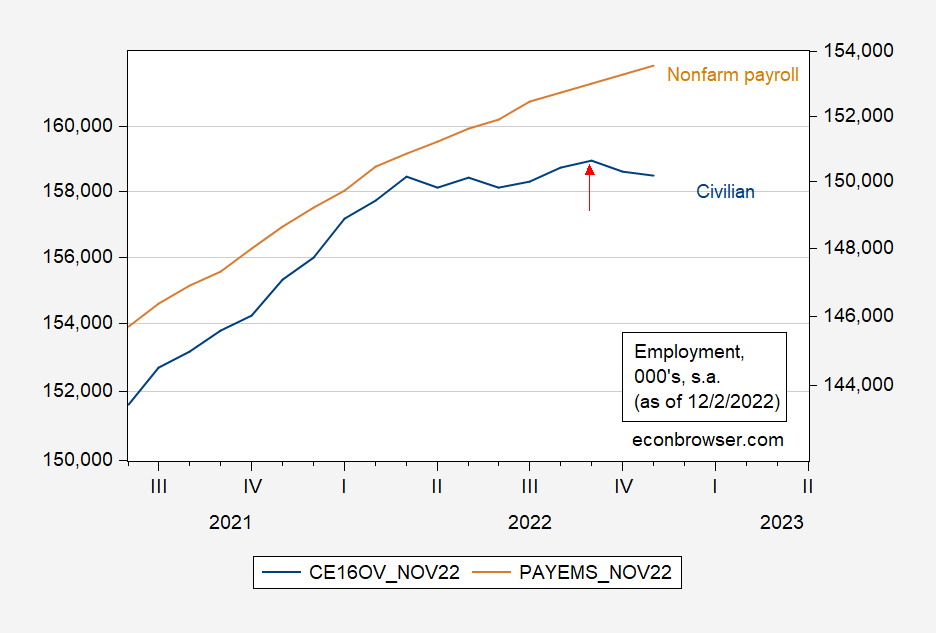

image 3: Civilian employment 16+ (blue, left log scale), nonfarm payrolls (tan, right log scale), both at 1,000, seasonally adjusted as of Dec. 2, 2022. Source: BLS via ALFRED, NBER.

as i was before famousthe strength of the proposition that household series have such enhanced predictive power is very weak (assessed at least using the last four U.S. recessions).

In addition, please further note that judging from the private employment peak in September 2022, there will be no recession in the first half of 2022.