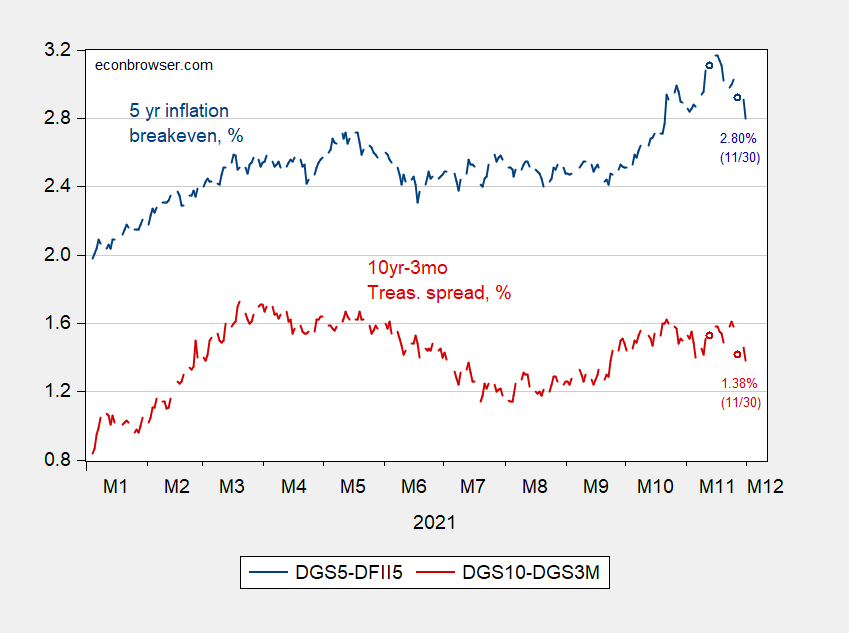

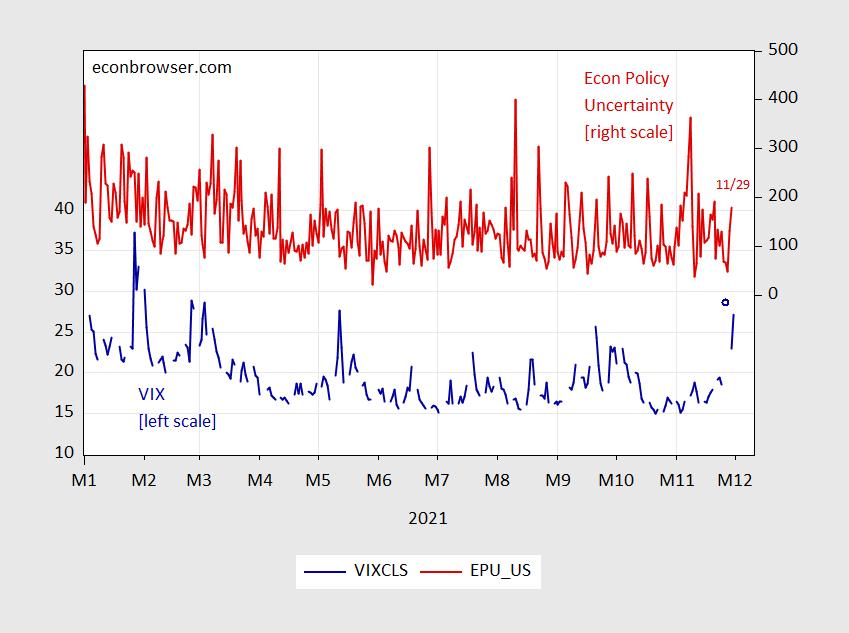

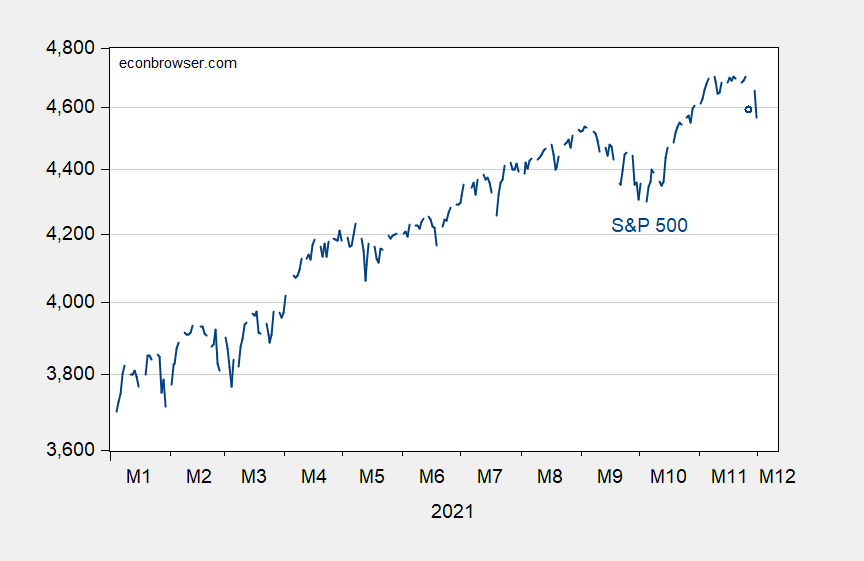

The five-year inflation break-even point (unadjusted) has fallen, the 10-year-3 month maturity spread has fallen, the VIX and EPU have risen, and the S&P 500 has fallen.

figure 1: Five-year inflation balance (blue), ten-three-month government bond spreads (red), both in %. Source: Ministry of Finance calculated by FRED and the author.

Ignoring the inflation risk period and the adjustment of the liquidity premium, it implies that the five-year inflation expectation has fallen to 2.8%, and the growth outlook has returned to September’s level.

figure 2: VIX (blue, left scale) and economic policy uncertainty index (red, right scale). Source: CBOE via FRED, policyuncertainty.com.

Risk and policy uncertainty are also at recent highs, but they are still dwarfed by the highs of the Trump era (VIX at 83, 27.2; EPU at 862, November 29 at 180).

image 3: S&P 500 index (blue, logarithmic scale). Source: Standard & Poor’s through FRED.

Given this background (due to Omicron’s low expectations for growth and possible profits, and the higher interest rates in Powell’s statement on the persistence of inflation), it is not surprising to see the stock index fall.