Is the world going to hell in a handbasket? I get essentially that question all the time, particularly as the newsletters who are more prone to fearmongering ads begin to pepper our inboxes with panic about debt and social collapse and government overreach and, well, whatever things happen to be scaring the people who are the core market for investment newsletters (generally, affluent folks, 50-60 or older, who are thinking about or in retirement), and that seems to have been picking up a little bit of late.

Do I know what’s going to happen in the next year? Of course not. Nobody does. All I know is that the panic-spurring promos that bring up these feelings are not public service announcements… they’re designed to extract money from you. We should assume that they are no more focused on your well being than the guy who’s trying to sell you a ShamWow in a late night infomercial.

I haven’t dug into the most recent ones of those yet, but the themes tend to be pretty much the same — and I do end up writing a longer piece in response to fearmongering and panic every year or two, it seems, so I thought I’d at least re-share some thoughts from one of my favorite pieces along those lines, from back in 2017 when the immediate panic trigger was different than COVID (the fear was more China-based and debt-based back then), a piece I called Inevitable Collapse and the Story of Progress — here’s a little excerpt:

“The economy today is in far better shape than the economy of 1979 or 1980, but the debt level in almost every corner of the world is also far more frightening — at that time, we were really just about to begin the biggest deficit spending party since World War II, as President Reagan urged military spending as stimulus… today, we’ve just about climbed out of a long period of massive deficit increases following the financial crisis and, if President Trump’s priories are followed, we’re on the cusp of again ramping up governmental borrowing. And yet the world has steadily, for more than 30 years, lowered the cost of debt.

“This consistent arc of progress ends someday, we have to believe. There will be a reckoning, perhaps because the world is built on debt that can’t continue forever… just as people believed it was based on an unsustainable and irrational level of debt in 1980.

“But note that word: “Believe.”

“We don’t know anything, but we feel like it must end… we feel like things aren’t logical and so therefore they must change, that we must be just around the corner from a huge correction because the world does not match what we think makes sense.

“That way leads to madness, I’m afraid. None of us are going to do well by betting on the future direction of the world or the timing of giant macro events — that is the ultimate hubris, that those of us who can’t remember where we left our glasses are somehow the only ones who can see the logical future for an incredibly complex and interconnected global economic system with clarity… that we can predict, even within a vast margin of error of a few years, the logical end of this bull market, or this economic expansion, or this currency’s dominance, or this modern way of life.

“If you’re reading my words here you’re probably an individual investor, and building up a nest egg to support yourself or your family or create or sustain some financial security in the future is your job.

“Don’t confuse that by building a story.

“Don’t bet on your ability to predict the future.

“Use your brain for the things that it’s probably much better at doing — don’t overheat your neurons building a mental map of the world and where it’s going, you’re dealing with an overwhelmingly complex system and you’re almost certainly going to be wrong. Instead, choose and invest in sensible companies whose business you can understand, and that you have reason to believe are well-managed and generating profits and seem to be in markets where growth in those profits is a decent expectation.

“And for God’s sake, invest in humility — I like to call this ‘diversifying away from myself’… whenever I feel certain about what’s likely to happen to the market or the economy, or, frankly, even for a particular stock or speculation, I try to step back and take solace in putting some of my investable assets effectively out of the reach of what will sometimes, despite my best efforts, be dumb and emotional forecasting… mostly by putting it in reasonable, low-cost and diversified funds that will keep up with, or hopefully beat by a little bit, the historically excellent long-term performance of large corporations.

“Picking stocks is fun, and it can be profitable and successful, even for small individual investors… but we have to be very aware of our limitations, and of the fact that we are very likely to work against our best interests when we start to feel good or bad about a stock or politician or a day or a month or a quarter, and especially when we start to be certain that we can see the future. The evidence is pretty overwhelming that investors who move in and out of investments on the shifting winds of sentiment lose.”

Some of the stuff being touted these days is very similar, as I noted last week, to the stuff Porter Stansberry trumpeted in his extremely heavily promoted “End of America” presentation back in 2011, with a lot of the focus now on inflation (as some of it was then, too, following the huge surge of stimulus spending following the financial crisis) — pundits push us to buy farmland and gold and silver, find tax-free hideaways in the Caribbean, buy only the best trophy companies if you invest, and stock up on guns and safes and silver coins and whiskey because the world is about to come to an end and you need to be ready to fight off or bribe the hordes of barbarians at your front gate (OK, that’s a paraphrase).

Some of those kinds of decisions or investments suggested back then would have worked out fine, or at least not cost much, some have been disastrous, but even the ones that might a little silly in retrospect were all sorely tempting at the time, when the ideas were sold just right, by skilled marketers, to people who were feeling bruised by the financial crisis. And the result is that the more you feared and the more you hid because of that kind of worry about the “End of America,” the more likely you were to see your portfolio disappoint.

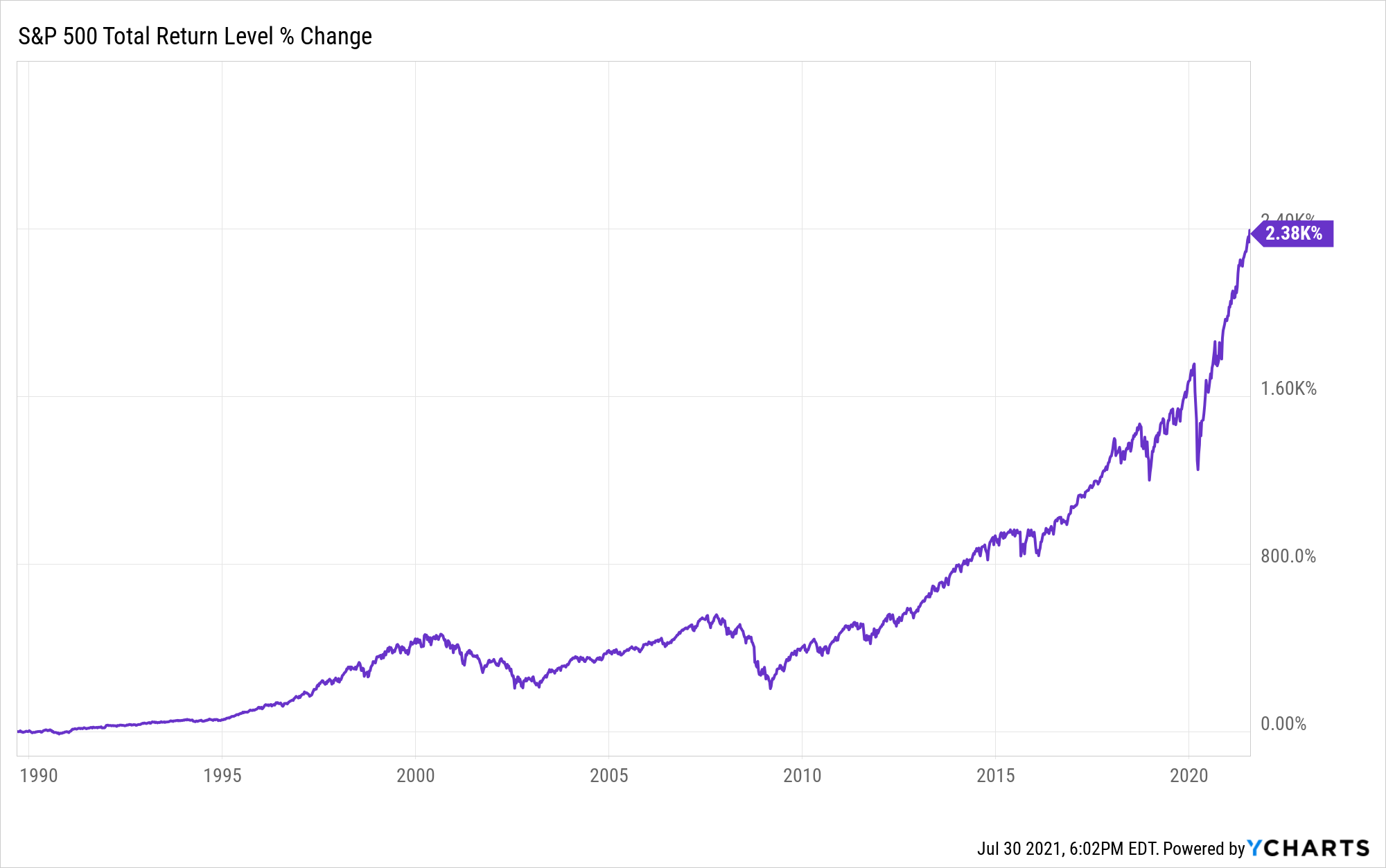

Just by putting your money in an S&P 500 index fund ten years ago, when that panic was being stoked so well and was hitting a population that was still very worried, after the 2008 financial crisis, and really ready to listen, you would have spent the past ten years quietly quadrupling your money. Real estate would have returned about 150%, gold about 7%, some stocks hit and some missed, but betting on the broad market and the continuing push of global capitalism and progress was still, despite obvious fears, the smart bet. As it usually is, and probably still is today, even though yes, valuations are near extremes.

That doesn’t mean we’re going to see 300% returns over the next decade — if we do, it will probably be because of inflation, which would mean that gains in purchasing power would be much lower than that. The market is generally expensive now by most measures, and it was generally inexpensive a decade ago (though it didn’t feel like it at the time), and the price you pay matters. It’s OK to be cautious and disciplined with buying — the biggest driver of future returns is the valuation you accept when you buy, so when you pay an above average price you should expect that the next decade will bring you a below average return relative to history.

But being cautious doesn’t mean hiding in a walled compound and waiting with a shotgun on your lap, it just means thinking about prices, and doing your best to wait for the right pitch before you swing your money around and invest heavily. The relatively low expected returns from these valuations are just the average, and it’s just math — and even math doesn’t know the future. When we lean back in our rocking chairs in 2040 and look back at the 2020s, the odds are pretty good that whatever big, scary thing happens next will be different from what you’re imagining it might be today… and will also end up being a blip on the long-term chart… kind of like the big drops in the broader market in 2000 and 2008 look way less scary back there on the left side of the chart than they felt at the time.

OK, fine, I should also share the pessimistic “what if America’s time is really over and we panic and close off the country to immigration and entrepreneurship and future change and we’ve all been living in a bubble for years and it’s gonna end in brutal stagnation for decades” picture — that would be essentially the “next Japan” argument. Japan is still a fine place to live, so maybe don’t panic, but it has been a terrible place to invest for 25 years. Here’s what the Japanese stock market has looked like next to the US for the past 25 years, following the peak in the late 1980s and 1990s when we were sure that Japan was taking over the world, in case you want a little context for worrying — I also shifted the chart to log scale, which gives more weight to each year’s change:

Just as a fun little point of interest, by the way, I should also point out that betting against “End of America” ideas doesn’t mean you’ll be right, either — despite our fascination with short answers, binary outcomes, and simple, linear narratives (being a “winner” or a “loser”), the world rarely works so cleanly as that. David Gardner at the Motley Fool had a response to Stansberry’s “End of America” video with his own bet ten years ago, which happened to be Corning (GLW) because of its history of quiet innovation and leadership in some hot areas… and that stock, too, trailed the market badly over the past decade.

Investing isn’t a world in which you’re right or wrong, it’s a world in which each of us will turn out to be both right and wrong 100 times a year. And that is just as true of famous pundits as it is of you and I and Joe Investor in the street. That’s not easy for most of us to manage, emotionally, and that’s the biggest reason that some investors are a lot better than others — they’re not smarter, they’re not better at tuning up their crystal balls, they don’t have a magical chart or program that makes things work all the time, they’re just better at playing the long-term odds and not overreacting to the fear or greed impulses caused by clickbait headlines and social media. Which is harder today than it has ever been, given our split-second attention spans and tendency toward polarization in all things. Investing doesn’t reward certainty, there’s never a perfect stock in a perfect position with a perfect valuation… it’s mostly about playing the odds, knowing what risks you’re taking and thinking about whether the likely rewards are worth that risk, and avoiding emotional overreaction.

Fortunes will probably continue to be made by those who can ignore the extremes, keep plodding along, and live with a general sense of optimism about the world and its possibilities. And yes, that means plodding along through those future crashes, too, because those will come — so you do have to know yourself. If you’re calling for that fourth drink at the casino and betting with money that you know you’ll need for rent next year (or next month), then good luck to you, but you’re taking a lot more risk than I’d be comfortable with. If you’re only investing with a long view, and won’t be needing that money for at least 3-5 years, then stay optimistic. It won’t work all the time, but it has certainly worked over time.

In the meantime, of course, we’ll all fret about inflation and interest rates, if only because those are the two easy and numerical inputs that we can add to our spreadsheets and radically change our valuation view about the broader stock market or a particular company. Those inflation fears are moderating a little bit this week, but we still won’t know, of course, whether real inflation sticks and builds on itself, or moderates once we’re out of the stimulus/recovery cycle.

For now, a lot of companies are making a ton more money than they did last year — and earnings growth is the kind of “inflation” that we as investors always like to see… though that, too, is exaggerated because of the one-time impact of last year’s shutdowns. Expectations were pretty sky-high for this quarter, since this is the best year-over-year earnings quarter we’ll probably ever see for many relatively mature companies. We habitually compare year-over-year quarters to assess progress and growth, and memory is short, some of us might not recall that the quarter we’re comparing to now, Q2 of 2020, was the quarter when the global economy was all but shut down and almost every company (except maybe Zoom and a few e-commerce players) reported awful results, which means a return to anything approximating “normal” will look like wild year-over-year growth for a lot of companies.

Some companies are emphasizing this point by also highlighting their Q2 2019 numbers, just for context, but a lot of them aren’t — so it probably behooves us to seek that data out, just to keep our heads straight. This earnings season that we’re smack-dab in the middle of is likely to include eye-popping numbers for pretty much everybody, but in most cases we should think about these growth numbers as really more fairly representing two or more years of growth, not just one.

And, of course, the way stock prices react to earnings updates and other news is not often driven by the quality of the reported numbers… it’s driven by the level of surprise in those earnings releases and conference calls, the extent to which quarterly numbers and, usually to a greater degree, future forecasts are much better or worse than analysts had been anticipating.

But with that blathery preamble out of the way, shall we check out some of those companies who reported? Earnings season really got going in a big way this week for the Real Money Portfolio, so I’ve got a bunch of updates for you…

*****

Brown & Brown (BRO) reported a strong “beat” quarter, with earnings coming in 20% better than expected, and with surprising strength in top-line revenues, too, which bodes well for everybody in the business. Revenue and earnings have not been steady and predictable every year for Brown & Brown, partly because of a never-ending series of acquisitions as they’ve continued to build their insurance brokerage, but the long-term performance has certainly been excellent, with earnings per share compounding at 13% a year over the past decade and recently accelerating as margins have improved a bit with scale and as the “hard market” in insurance has brought some nice top-line growth (a “hard market” for insurance just means that insurers are being more careful about risk and demanding higher prices, which trickles through to brokers because their primary revenue source is commissions, which are a percentage of those rising prices). My assessment has been that the strength of that business, particularly with a hard market, has been underestimated a bit, with analysts predicting only 10% earnings growth going forward, but these aren’t huge distinctions (10% and 13%, if steady enough, are both high enough to deserve some premium price).

Still, even with great family-controlled management and a long tradition of reasonable capital allocation (roughly a quarter of free cash flow has gone to dividends and buybacks, keeping the share count flat-to-shrinking and giving shareholders a small yield, with the rest split between improving the business, with new systems and technology upgrades and the like, and growing the business by acquiring more companies), we want to maintain some price discipline. I raised my “buy under” price to $53 last week, and noted that I thought BRO was set up to beat their fairly conservative guidance over the next few quarters, and then they did so quite spectacularly this week — so does that change the thinking further?

Well, it did drive the share price to new all-time highs, with organic revenue growth of 14.7% for the quarter and 12% for the first six months of 2021 (that’s not counting new acquisitions, or any bonuses from insurers for good underwriting profit-share or high volume) — and organic revenue is the most impressive aspect of the business, since they can always buy more revenue by acquiring more companies, but total revenue, including new companies acquired, is growing even faster, at 21% this quarter. The company is continuing to grow nicely, despite their pretty large size, and they are continuing to grow more efficient, with diluted net income per share growing at 40% for the first six months of this year (44% for the quarter).

Some of the future growth will be out of their control, we can’t really know what the insurance market will be like in a few years, whether it will stay rationally “hard” or will soften for currently unforeseen reasons (usually it goes in cycles — catastrophes and losses build up, or the portfolio investment returns for insurance companies fall because of low interest rates, and insurance companies raise rates to keep the business rational… and then a period of fewer claims comes, or they get good investment returns and shift from thinking about underwriting to thinking about growth, and new companies come into the business with lots of cash to splash around, and they push to just grow their business to boost the size of their investment portfolio, so then everyone has to compete for customers by competing more aggressive on price, and the market softens… until the next run of hurricanes or hailstorms or fires crushes some of the less careful companies and scares away some of the fast money).

But we do know, at least, that Brown & Brown and all the other agents and brokers should have a steadier path than the actual insurers, because they’re not taking those risks and insuring those losses, at heart they’re basically just commissioned salespeople. That’s the other major risk, of course, that the whole business model is being gradually disrupted, with direct sales and technology beginning to supplant agents and brokers, but that’s been happening since GEICO really started growing 40 years ago, and yet every small town still has a few meaningful insurance agents who are mainstays of the chamber of commerce and sponsor local little league teams, and it does not seem, at least as of now, that the brokerage business is in a precipitous decline because of those disruptive forces. That kind of accelerating pressure to disrupt the business and get rid of middlemen like Brown & Brown is probably the largest long-term risk, but it’s also true that BRO is quite aware of that risk and investing in technology and diversification to help ameliorate it — probably, at least in part, because it is still genuinely a family business, run by another generation of Browns and with very meaningful insider ownership and “skin in the game,” motivation to make sure that the company doesn’t fall into an extinction trap.

I’ve only owned BRO shares for a little over a year, but it feels a little bit like an old friend already. I’ve further ramped up my “buy under” price a little bit to reflect what I think can be continued strength going forward… more on that in a minute, as I compare them to one of their near-peers…

*****

Arthur J. Gallagher (AJG), a very similar business to Brown & Brown (more international, a little more variety in their advisory businesses), has had a slightly tougher run of late. AJG missed out on the little benefit they were expecting from the AON/WLTW merger, since that merger was scrapped in the face of antitrust objection from the government and they don’t get to buy those WLTW businesses which were planned for offloading as part of the deal. That means we have to lower our “reasonable buy” price back to roughly where it was before that little bit of cheap growth was penciled in (they were planning to buy some businesses that the merger would force WLTW to sell, at a valuation well below AJG’s current price/sales or price/earnings valuations, which should have provided a boost). Before the earnings call, I had bumped my “buy” price back down to $137… so what did we learn on the call?

Well, AJG is growing significantly more slowly than Brown & Brown — they think organic growth will pick up in the second half of the year, largely because of their HR and employee benefit advisory businesses recovering more slowly than the rest of the company, but for the last quarter they posted 17% revenue growth and 8.6% organic growth (up quite a bit from 3.2% last year, but still way short of BRO’s nearly 15% organic growth last quarter). AJG has suffered somewhat from the strength of the dollar, since they have more overseas business, but a look at their latest numbers is a good reminder of why I have a general preference, all else being equal, for BRO over AJG… the stocks have very similar performance over the past five years, thanks to very similar earnings growth, but BRO has provided much stronger growth in the top line on revenue per share (partly because AJG has increased the share count by 16%, while BRO has kept the share count almost flat — something large insider owners tend to care a lot more about), and that should build a stronger base over the long run:

I’m reluctant to make meaningful portfolio shifts based on my changing feelings following a quarter, but my growing inclination is to give up on the two-company experiment I’ve had in these traditional brokerage companies over the past year or so, and focus on the one that I like a lot more, with much stronger founding family ownership, and that is also a little bit less expensive and growing faster at the moment, so I’m going to put some of that shift into motion now. I’m re-assessing my “max buy” price for both companies given the adjustments to analyst forecasts, putting BRO near $55 and AJG at about $135, and today I did begin to shift over part of my AJG stake to BRO.

I’m not in a rush to sell out of AJG entirely, it’s not as though the company is suddenly “broken” or bad, but although AJG and BRO are largely operating in the same space, with the same tailwinds from rising insurance rates, reopening economic activity, and rising complexity in the commercial insurance space, I have more long-term confidence in BRO, and their business is growing better and more profitably… so watching the two over the past year is providing some reinforcement that whenever the two are similarly valued, BRO is my preferred choice. I effectively moved about a third of my AJG position over to BRO today, and will likely continue to shift AJG out of the portfolio unless something changes my mind.

*****

Much more tumultuous and risky, and with a far sexier growth profile, is the upstart insurance agency franchise builder Goosehead Insurance (GSHD), which also reported this week — and they issued pretty tepid revenue guidance, pretty much in line with what analysts were already expecting, so the shares dropped 10% or so. GSHD is a very volatile stock, I’ve bought in both the $80s and the $120s and have owned it for less than a year.

So what’s going on? Well, they did include a preview of their new Digital Agent Platform on the call, which is one of their growth levers — they’re hoping to build an agent-driven online platform that can tie in the best price quotes from more than 100 carriers, essentially offering the level of convenience and online-driven transactions that some people prefer and which is a major driver for Insurtech platforms like Kin or Lemonade, but doing so with an agent in the background and available to answer questions and customize coverage. That might end up being a big deal in a few years, even as it could be a dance between that and their traditional in-person agent force (and as they have to talk some underwriters into allowing this direct price comparison), and they have to carefully integrate their local and franchised agents to make it work, but for now it’s a future possibility that hasn’t even launched. The potential for what it could be if they’re really able to transparently quote multiple insurance carriers, without their finger on the scale and without just serving as a lead-generation platform for selling customer data, is pretty impressive, many of us would like to have access to an easy way to get genuine quotes fast and conveniently, and some agent expertise on what kind of coverage we might need… but we’ll have to see how that gets implemented and what customers and agents think.

As for the story for investors, CEO Mark Jones summed it up pretty well — here’s a little excerpt from the call transcript:

“Before discussing the quarter, I would like to spend a minute on a critical element of our competitive moat, our vast accumulated experience. We are a client-focused tech-enabled Company. Note the order of priority, clients first, technology second as an enabler. You will see this on vivid display when we demo our Digital Agent Platform. There is nothing like it on the market. It is simple and comprehensive and importantly informed by artificial intelligence, leveraging millions of actual quotes by our professional agents. There is no shortcut to gaining and being able to leverage that experience. It can’t be replicated by newcomers to the industry.

“I strongly encourage interested people to try as many competitive shopping offerings as they’re willing to endure, and see what is actually available, then try our digital platform. You will be amazed.

“I’d also like to say a word about margins. Our business model has a very long tail. The biggest growth investments we made this year won’t begin to start showing up significantly in our revenue until 2024 and thereafter. We’ve modeled out our business and quantified the trade-offs between growth and margin. Because there is so much growth already embedded in our business, with a lot of effort, we could slow our growth down to 10% to 12% annually in 4 or 5 years, which would likely yield EBITDA margins in the low to mid-40s, sounds pretty appealing.

“However, absolute profit dollars are maximized by keeping our pedal to the metal on growth with the margins we currently produce. While EBITDA margins in our current model may be lower, they are earned on a much larger base of business producing more profits. In addition, it is critical to our competitive position that we maximize our conquest of the land grab in the market at this time and continue to build our competitive moat. Thus, we optimize both our economics and strategic sustainability by continuing to pursue the growth strategy we have been and making the investments necessary to do so.”

The underlying numbers driving the business are still quite spectacular — they grew their number of corporate agents 43% in the past year, including opening some new offices to continue to build their scale outside of their home market in Texas, the total franchise count grew 59%, and the number of operating franchises (it takes a while to build them up to begin operations) grew 47%.

And since they’re still in such “pedal to the metal” mode when it comes to national expansion and onboarding new franchisees and recruiting more corporate agents, most of those agents aren’t generating any real revenue yet — 63% of the total franchise base is either in its first year or not even completely on-boarded yet. It takes at least two or three years for those new agents to become contributors to the business, as they build up their client base and make sales, and the beauty of the business model is that long tail of revenue growth Jones alluded to — franchises build up gradually, ceding a 20% share of commissions on first-year sales to Goosehead, and that little slice of the commission builds up slowly as they bring on more clients… but the agent is optimized to work almost exclusively on sales and building the customer base, not on administrative work on claims or renewals. Customers get both their local agent and full national Goosehead agent support, online and through their centralized customer service operations, and have now gotten up to an 89% retention rate as those customers renew their policies, and Goosehead starts to really benefit once they renew — Goosehead gets 50% of the commission on renewal policies.

Those two lags, the lag for new franchise agents to become productive, and the lag for that productivity to lead to much higher margins on renewal policies, are why Jones says that the investments they make this year will really begin to pay off in three or four years… we’re not buying the Goosehead that exists today, we’re buying the real opportunity they have to accelerate revenue growth over time, with the huge bolus of new agents brought on over the past two years the first driver, but with the company also clearly continuing that investment as they continue to expand and bring on new agents, and to push, we expect, that new digital platform.

What is generally important to me as an investor is not whether Goosehead’s revenue in a quarter is 5% above or below what an analyst modeled, it’s whether that building foundation of new agents and national expansion continues to be solid, and whether customers continue to love the Goosehead experience (their net promoter score remains around 90, great for anyone but very high for an insurance company) — keep customers happy and keep adding new agents and training them well, with building corporate support in new regions of the country to help build market share, and simple math takes care of dramatic future compounding revenue growth from that base. The only real downside to the strategy is that the base takes time and money to build.

The positive news for the short-term thinker is that they’re likely to spend less next year — the rollout of their new digital platform this year is fairly expensive, as is the opening of a bunch of regional offices to support the rollout of more franchises, and that’s likely to tail off in 2022 and offer a little boost to margins, but that’s not why I’m buying Goosehead — I’m buying because they’re expanding like crazy, building on the proof of their established success in Texas, and the combination of new states, new agents, and the maturation of the hundreds of new agents brought on over the past few years is building the foundation of something that could be dramatically larger in a decade.

There’s a lot of competition in this space, of course, from both Insurtech names like Kin and Lemonade and Root who are trying to go national and willing to lose a lot of money, and from traditional agents and big agency networks like Brown & Brown or A.J. Gallagher (which I also own, of course), or big national players like State Farm and Progressive who advertise very heavily, but I think Goosehead has found their niche in empowering a new wave of independent agents, including a new generation of entrepreneurial young agents coming out of college, and incentivizing them to sell policies and find new customers, improving the independent agent business and service level instead of “disrupting” the business by getting rid of the agent. And they’re still very small, with no sigh that they’re going to have trouble growing that pipeline. At least not yet.

When I’m worried about it failing, I do remind myself that the model has been proven out to some degree in their home market in Texas, where they do have meaningful market share in homeowners insurance (approaching 10%), and that’s encouraging as a kind of “proof” that the business can work and scale well. That’s no guarantee, but we’ll see how it goes. You can’t comfortably give them a $4 billion valuation based on the 2021 income statement, not with revenue likely to be about $150 million for the year… but you can if you look at the snowball effect of that huge growth in agents, and the revenue each successful new franchise agent will be bringing in, at much higher margin, in three or four years (during which, of course, they’ll continue spending heavily to expand further into new markets, and bring in new waves of new franchises).

Analysts are likely to get a lot of this wrong, since they really only want to look out a year or two in making their guesses, and it’s likely to be very choppy in any given quarter, with part of this quarter’s fall in margins, which spooked investors and brought a 10% drop in the share price, coming mostly just because contingent commissions were lower than a year ago and because they didn’t spend as much on travel and other overhead/selling costs during COVID (continent commissions are effectively a share of underwriting profits — you get a set commission on the sale of a policy, but then a bonus if you sell a bunch of policies that show an underwriting profit, and that’s largely dependent on stuff like whether a hurricane hits Texas or Florida in a given year), but I consider that an opportunity.

If we’re willing to buy the somewhat predictable expansion of the business over the next five years, just from continuing the mathematical progression and without assuming huge breakthrough growth in any given year, we can buy what should become a great and vastly larger platform today and just wait for those big numbers (~50% growth in agents, near-90% customer retention) to compound. To some degree it’s like a technology story, you have to take account of the fact that they’re spending heavily for growth that won’t come for several years — though there’s some comfort in the fact that they’re profitable today, the growth three years from now is somewhat predictable just from the franchise base they’ve already built, and they aren’t bleeding cash like a lot of technology growth stories.

They’re also paying a special dividend, as they did in each of the past two years — that’s not what I’d do with a company in growth mode like GSHD, but they’ve paid a similar special dividend in past years, and that seems to be both a way to reward insiders a bit (though the largest shareholders, including the Jones family, are also regular sellers of their huge stake of shares), and a way to emphasize that this is modeled out as a cash-generating business that investors can count on. That dividend is $1.63 per share, payable in August (the ex div date should be early next week), and that exceeds the cash the company has generated over the past year, so there is some risk that they’re doubling down on this story and using debt to continue to generate shareholder returns and fuel growth — you can choose whether you think they’re overdoing it, or whether that just represents management’s confidence that they will continue to snowball the business into something much larger. I’m betting on the latter.

As I’ve mentioned in past pieces, I’m almost maxed out on how much I’m willing to risk in Goosehead shares, given that it’s a small company and that it’s also quite reliant on new home sales to spur growth (the time you’re most likely to try a new insurer is when you’re buying a new home, people often don’t bother shopping around when they already have a policy that they can just renew), but my portfolio has grown, too, so I did microdose just a wee bit more into the portfolio this week when the stock dropped on earnings… mostly because I’m reminded that this is still a stock most folks haven’t heard of, it’s very small, with only about a thousand franchises currently operating and less than a million policies in force (by way of comparison, there are about 35,000 independent insurance agencies in the US, and State Farm has about 19,000 non-employee agents and services 83 million policies — the market is vast). I’m curious to see how their online sales platform does when that gets launched, particularly because they’re hoping to use it primarily for referrals (letting their customers refer friends, but also letting existing partners like mortgage companies and real estate folks instantly connect a customer with a Goosehead quote and agent), and they can’t afford anything like the heavy national marketing of State Farm and Progressive, so they really do need social marketing and referrals to keep building.

This kind of company is very prone to selloffs on short-term bad news, since the valuation is rich based on the current income statement and a lot of investors don’t want to look forward to what’s building four years from now, so perhaps we’ll also get opportunities to buy at substantially lower prices if sentiment shifts.

*****

And as long as I’ve already put some of you to sleep with my musings on insurance agencies, how about the actual underwriters? We haven’t heard yet from Markel (MKL), that’s been pushed off to next week, but Kinsale Capital (KNSL) did come out with their latest quarterly update. Kinsale is a new and small position for me, I bought in April after researching it for a Motley Fool teaser pitch, and in some ways it is a next-generation take on what Markel was in the beginning (insuring genuinely odd and specialized things, which insurers call the “excess and surplus lines” market), and they’re growing quickly and profitably, with a very high combined ratio because of their cost management and the differentiated risks they take as underwriters.

Combined ratio is just a way to give a shorthand number for the profitability of the underwriting, it’s the cost of claims and operating overhead divided by the incoming premiums — a large insurer would usually be very pleased with a combined ratio of 90-95% or even in higher in some cases, meaning they make at most a 5-10% profit on underwriting, but Kinsale for the first half of this year was at 79.5% (83.8% last year), so even without a big portfolio behind the business to generate investing returns they can post an unusually strong return on equity for an insurance company (18.2% so far this year). That lack of reliance on strong investing returns means their return on equity should also be much more consistent, assuming they can consistently underwrite well, and you can see that in a chart of their ROE versus Markel (MKL) — both have good recent numbers, but, because of investment returns and occasional catastrophes, MKL sometimes periodically posts a negative ROE for a quarter or two (Kinsale does get hit by catastrophe claims sometimes, including the third quarter last year when their combined ratio hit 97%, but they don’t really focus on traditional coverage for hurricanes, fire, etc., and have not historically been impacted as much by catastrophes).

The stock is priced for those high and consistent returns, of course, now that a bunch of investors have noticed it (I was not early on this one, to be clear), though there still isn’t all that much analyst attention and it’s still a pretty small company. The analysts this quarter were expecting $1.06 in earnings, and they came in well above that at $1.55, with revenue also 15% or so higher than anticipated, but that didn’t really cause the stock to move much on the earnings news.

The incoming fuel for growth for an insurance company is gross written premiums, the amount of policies they write, and that number is growing nicely, up 40% for the first half of the year, and they say that was driven by both more broker inquiries and rate increases for existing accounts. So the business continues to grow, they do not appear to be suffering from the erosion of margin that should theoretically come if they get to the point that they’re too large to focus on just the best risks in underwriting, and this has the possibility, with their increasingly consistent underwriting, of becoming what is a rarity for me: an insurance company that I’m willing to evaluate based on its ongoing operating earnings power, without giving much weight to the power and stability of its investment portfolio (they do have a portfolio, but it’s not particularly big and doesn’t currently drive results, and it’s not earning much because it’s in high-quality short-term bonds — though it might eventually matter more as rates rise, or as the portfolio compounds over a long period of time… right now, that portfolio is worth about $1.4 billion, which is very small for an insurer with a market cap of $4 billion — Markel, for example, with a market cap of about $16 billion, manages and profits from a portfolio of more than $20 billion of both corporate and policyholder funds).

This is what I said when I bought shares, in assessing the risk: I would assume that their high margins look like opportunity to their competitors, and if meaningful competition eats away at their business, and they stop being able to take market share and post amazing growth numbers, then the valuation quickly begins to look worrisome at 7X book value and 35X forward earnings. At the time, they had just come off of what was essentially a similar “beat” quarter, with very similar results, so the trajectory hasn’t really changed. I expect that Kinsale is still on track for roughly $100 million in underwriting profits this year, which would be double what they did last year.

There’s always risk in smaller and specialty insurance companies, to be sure, Kinsale’s competitor James River (JRVR) got clobbered earlier this year when they announced some surprising losses on part of their business, for example, and had to dramatically increase their reserves, which included doing a big stock offering, and the stock lost a quarter of its value instantly. We don’t get to see what actuarial assumptions an insurer is making (not that it would help in my case), and sometimes they screw up… and Kinsale (KNSL) is definitely a small company that trades at a really high premium valuation, so the risk of that next big problem they might have someday is higher, because a big blowup of any kind would bring down the multiple that investors are willing to pay.

But so far, I must say, I am building up a little confidence in their consistent underwriting performance and strategy, and I’m willing to stay on this ride. I expect earnings for the next couple quarters will likely come in a little above what is currently anticipated, if only because the first half of the year has been so surprisingly strong and analysts have been slow to raise their expectations, but clearly investors are not reacting to those earnings “beats” just yet, so I expect something like $4.50-5 in earnings per share is probably baked into the stock at this price. Which means we’re right in the area where Kinsale has mostly traded over the past three years, roughly 35-40X earnings. That’s risky, but I’d be willing to allocate a little bit more to that risk as we wait to see if they can really keep their near-20% ROE as they grow. I’d hold off on making big buys until we see a really ugly day, but I like the combination of their proven discipline in underwriting, their growing operating scale, and the rise in premiums (and pricing), and I did add a little bit to my position on Friday. If insurance companies do this well, then those positives compound on each other, you can throw on a little investment return from the growing portfolio as gravy, and sometimes 1+1+1=4.

(And yes, I should have dug more into little Trisura, which a reader wrote to me about at the same time I was buying Kinsale a few months back — that’s been a barn-burner for the past few months. Ah, well, we can’t own everything.)

*****

Enough about insurance for the moment…

Kambi (KAMBI.ST, KMBIF), our Swedish sportsbook operator, was driven up to a very high valuation over the winter, along with most of the other sports betting names, and I did take some profits back then… but I still like the steady growth and scalability of the company, and I’ve been keeping an eye out for when investors will finally panic about Kambi losing more of its business from DraftKings (DKNG, which is pulling its sportsbook technology in house) and drive the shares down.

That seems to be starting to happen this quarter, their revenue and earnings were strong, with big margins for the sports book (thanks especially to the Euro 2020 tournament, which had more betting than the 2018 World Cup), and they reported about $33 million in profit for the first half of the year, but the stock is still falling. I suspect that’s still because the DraftKings business is going away, the last two states for Kambi to handle DKNG sports bets are New York and Virginia, both of which will transition off Kambi by September, and that will still depress results a bit for the coming NFL season… but they do have deals to run sportsbooks for Penn National/Barstool and Churchill Downs in several newly-legal sports betting states, the overall marketplace is still growing fast, and that rising tide should continue to help make up for the loss of the DKNG business.

Kambi continues to be ambitious, seeing an opportunity to cement their global leadership among sportsbooks and triple their revenue over the next five years, with increasing margins (since operating the sportsbook technology is essentially an easily scaled software business), and I’m sure there will be bumps along the way, but I’ll keep holding — and I still think the $40 neighborhood represents a pretty reasonable value.

I last set a “buy under” opinion of $42 for Kambi, which is roughly 25X what I think they’ll earn both this year and next year, roughly $1.75/share (a fairly low bar, even with the loss of DraftKings — the first six months of 2021 hit $1.06 in EPS, more than all of 2020 thanks to the reduced sports schedule in Spring 2020), with earnings flattening out for a year or so before they grow again. The last close in Stockholm was around $43, so we’re close to that level now (the OTC shares at KMBIF are often meaningfully off of the “fair” price, mostly because they don’t have much trading volume, so don’t trust those KMBIF quotes) — but sentiment-driven trading for gambling stocks can change quickly, and the stock could also easily fall another 20% if there’s another wave of Draft Kings panic from folks who haven’t been paying attention. I’m not in a rush to add, but I still like Kambi as a quiet leader, and we’re getting close to reasonable prices again. And, of course, if they ever apply for a US listing, they will likely earn a substantially higher multiple — they don’t talk about that, but I imagine it’s at least been discussed in board meetings.

*****

Investors were pretty clearly expecting stronger 3M (MMM) earnings in the second quarter than the analysts were, because the company “beat” estimates pretty handily, with revenues a few percent higher than expected and earnings more than 10% above expectations for the quarter and, probably more importantly, a 5% bump up in the forecast for the year (expected earnings per share are now in the range of $9.70-10.10)… and yet the stock did not react. Mostly because the guidance for the full year was actually just catching up with what analysts had already estimated (MMM’s guidance was previously at $9.20-9.70, but analysts didn’t believe them and already had a $9.85 average estimate).

And that’s OK. There’s also some chatter from the company about rising input costs, and that’s part of the inflation challenge many industrial companies are seeing… if inflation becomes a more dramatic issue in the coming quarters that could certainly hurt earnings, but they should be able, over time, to rise prices to meet those costs. I’ve been holding out for the share price to dip again to the ~$175 neighborhood, just because 3M is a fairly slow grower and has tended to be quite dividend-driven in the past but has raised the dividend very, very tepidly in the past couple years (it is one of the stocks that is most firmly cemented in the “dividend aristocrats” lists, with a history of raising the dividend every year for more than six decades). That’s the price I’d really like to see, as I like the 3.5% dividend level for MMM… but with the company on a pretty solid path of recovery here, in my view, I can also use their earnings and cash flow to justify a somewhat higher price, as the company has outgrown the dividend growth over the past year.

With $10 in earnings per share we have a pretty easy math problem, so you can make an earnings-based price call if you like — they’re likely to grow earnings at about 8% a year, and pay a 3% dividend, so if you add those together it’s quite likely that over longer periods of time MMM will be pretty firmly in the “return about 10% a year” camp… you get the 3% dividend, and, all else being equal (it never is, to be clear), the share price should grow in concert with the earnings. I think that the decades of innovation at 3M are worth holding, and I’d still prefer to make major additions during times of distress (PFAS lawsuits, missed quarters, etc.), but my max-buy price can now trickle up to $200 and I’m willing to nibble a little bit at these prices.

There’s no point in buying 3M if you’re a short-term trader, but if you own it for a long time the compounding of that above-average dividend is very likely to provide results that are at least satisfactory and maybe, as they find new avenues of growth in their labs, a bit better than average. If they can keep up that fairly steady pace of growth through whatever tribulations the future brings, that 3% dividend, reinvested and compounded, in combination with a 3% annual dividend growth and share price increases of 5-8% a year, can turn one $200 share into $1,350 in 20 years (or $1,100 if you take your dividends in cash). I need a little more of that kind of potential stability in my portfolio, and most such companies are more richly valued than MMM today, so I did microdose a little post-earnings in the $199 neighborhood, but, to be clear, that’s a fairly boring call. These are the kinds of stocks that are only really fun to buy when they’re in the midst of an overreaction collapse, as MMM was in much of 2018 and 2019, and you can feel like a smartypants contrarian.

*****

Medical Properties Trust (MPW) has been fairly quiet of late, perhaps somewhat subdued by renewed attention from some short sellers who are skeptical of their reliance on private hospital group Steward Health. Their quarter came in pretty much exactly as expected, with hospitals getting stronger as COVID fades (thanks in part to government grants) and easily covering their lease payments, and with MPW’s “normalized FFO” of 43 cents/share easily supporting the ongoing dividend (currently 28 cents/quarter, grows very slowly).

They have grown the business considerably in the past year or two, and that has continued recently with more acquisitions (including four hospitals in Los Angeles announced this week, as well as the larger portfolio of behavioral health hospitals they bought in the UK last month, and a similar deal for Springstone behavioral health facilities in the US), and, yes, they further deepened their relationship with Steward, buying five South Florida acute care hospitals that Steward will operate. Their current US acquisitions in the pipeline are high-yield deals in the context of the current real estate market, they were done at cap rates of 8.7%, which means they’re presumably taking some meaningful risks (particularly with Steward, as has been well-covered, since Steward carries a lot of debt), though to a large degree we count on the large portfolio (446 properties, 51 different operators globally) will provide enough diversification to offset some of that risk.

They also noted on the conference call that they consider their share price relatively undervalued (that’s what everyone says, to be clear), so they’re trying to avoid big equity offerings at current prices to fuel growth, and that one possibility will be harvesting some of the embedded value of existing deals to bring in joint venture partners for some of their portfolio (which would also have the bonus effect, they hint, of bringing down the concentration risk in the portfolio, making them a little less dependent on their few largest tenants — and, specifically, lowering their exposure to Steward over time).

On balance, I still think we’re being adequately compensated for Medical Properties Trust’s risk profile. They expect normalized funds from operations of at least $1.72 per share (1.72-1.76 is their guidance range) this year, and actual net income of $1.14-1.18, and they’ve essentially already pre-promised that their current growth and ‘capital recycling’ plans, including some sales and some joint ventures, almost guarantee that number will rise in the next few months.

Normally we assess the ability of REITs to pay and grow dividends based on their funds from operations, since most REITs pay out substantially more than their net income (largely because depreciation is such a big deal for these properties), so it’s a bit encouraging that the current annual dividend of $1.12 is actually also supported by likely net income — with the likely cash flow providing a big cushion. Nothing to change my mind in this quarter, MPW is cheaper than other healthcare REITs because it has a concentrated customer base at the top, that connection to Steward carries some risk, and that’s why it has an above-average yield. I’m willing to take those risks for a 5%+ yield fueled by an increasingly diversified property base, and I think the odds are very good that this continues to work out well as a long-term compounder in my portfolio, but I am not fooling myself that this is without risk.

No real changes to my thinking this quarter, I still buying with a 5%+ yield will work out over time (that’s roughly $22), though I did find their continued talk about joint ventures to de-risk the Steward exposure and probably increase their FFO numbers for later this year to be at least a little reassuring.

*****

American Tower (AMT) reported strong earnings, as usual, and it remains the adjusted funds from operations (AFFO) that most people pay attention to (since that’s what fuels their ability to pay a growing dividend). That number was up by 18.7% in the quarter, to about $1.1 billion, which means it grew a little more slowly than revenue (which was up 20% to $2.3 billion), but they’re still passing a lot of their lease revenue straight down to the bottom “cash flow” line.

Carriers are still investing for 5G coverage, and for more mobile traffic in general, and that big acquisition of Telxius towers in Europe earlier this year could be a meaningful growth driver for a long time as they re-lease and share those towers with multiple carriers. They kept up the ~15% dividend growth over last year, and the big appeal of AMT is still that their payout ratio remains quite low, only about half of that AFFO for the quarter went to pay the dividend ($578 million). Some of that’s because of the nature of the “adjustments,” but their competitors adjust their numbers as well and have similar accounting, and Crown Castle pays out a much higher percentage of their AFFO as its dividend.

If there’s a caution flag, it’s that AMT is again relatively expensive (a marginally better value than CCI at the moment, thanks to the growth rate, but still expensive), and they are guiding for that AFFO per share to grow at only about 12% this year (and that’s new, higher guidance than they had given before). The guidance is about $4.3 billion in consolidated AFFO and about $2.45 billion in net income, so that means the shares are at about 30X current year AFFO and about 50X net income. I’d still rather hold out for a valuation about 20% below those levels for any meaningful buying, since I’m counting on dividend growth to drive most of my return, but it is certainly a strong and well-positioned company that might surprise us with growth over the next five years.

*****

Alphabet (GOOG) blew the earnings estimates out of the water again, as pretty much everyone figured they would after seeing the huge numbers from all the other ad-related businesses over the last week or two… but even with expectations hugely amplified, and even with everyone positive about the stock, the results were still dramatically better than pretty much anyone dreamed. Earnings came in at $27.26 per share, 40% higher than estimated, and the top-line revenue was 10% above the forecast, too, all of which is pretty ludicrous for one of the biggest companies in the world.

Alphabet remains within a whisper of all-time highs, but the share price didn’t really move in reaction to this quarterly update… so obviously expectations were high, which means that probably anything less than a ludicrous “beat” of the estimates would probably have caused the shares to sell off a bit.

Some tidbits to emphasize the hugeness of this quarter: Ad sales on Google’s platforms grew by 70%, and sales of ad space on YouTube grew even faster, by 84%, as overall revenue grew by 62% over last year. And yes, while that’s hugely impressive for such a large company, we should also remember that this is the best “comp” they’ll ever have, and probably the best quarter of GDP growth that the US economy will ever have, since the comparable quarter last year was when COVID hit the ad business hard, with major travel and other advertisers pulling their budgets.

Alphabet’s Q2 revenues last year were actually a hair lower than the comparable quarter in 2019, so we should really think of this as a two-year growth number, not one year, so the pace they’re really on is more like 35%/year. Still absurdly phenomenal, but not 62%. Similarly, the diluted earnings per share number in Q2 of 2019 was $9.50, last year was $10.13, and this crazy growth quarter brought $27.26. Look at that as two-year growth, and it’s about 190%, so let’s call it maybe 90-100% on an annual basis, not the year-over-year 170% growth.

I know, that’s splitting hairs and Alphabet isn’t really valued as a company with 100% earnings growth, anyway, but even with a great company that’s extremely well positioned we want to try to have a little discipline. Nothing goes straight up forever without suffering from some ups and downs from shifting investor sentiment, but I must admit that in the context of the current market, Alphabet stock is still pretty attractive, even at all-time highs — their hold on the advertising market doesn’t appear to be shrinking in any real way, both the ad market overall and their revenues are clearly booming at the moment, and they’re growing gradually more efficient… and the stock price is not just benefitting from multiple expansion, it’s really following the operating performance, over the past three years revenue per share for GOOG is up 48%, earnings per share is up 141%, and the share price is up 118%.

I’m pretty much out of superlatives when it comes to Alphabet, they keep beating and then re-beating the best I think they can do, and I keep just holding on. YouTube by itself now has quarterly revenue that’s just about on par with Netflix (NFLX), which is a $230 billion company — and both YouTube and Google overall are growing faster than Netflix. Sometimes those things that a company does which seem a little profligate and silly as they try to take advantage of a new market turn out to be extraordinary — I can’t think of two better acquisitions I’ve ever heard of than Facebook buying Instagram for $1 billion in 2012, or Google buying YouTube for $1.6 billion in 2006. I’m guessing that Google’s acquisition of DoubleClick back in 2008 was also a great deal, and fairly pivotal for their advertising growth (they paid $3.1 billion for the company), but they don’t really break out the value of that platform and it’s long since been integrated with lots of other ad systems at Google, so it doesn’t stand out nearly as much as YouTube.

With growth like that, my personal assessment that 30X forward earnings is a justifiable valuation for Alphabet seems even a bit quaint now — if Alphabet were a smaller company, investors would be climbing all over themselves to pay well over 50X earnings for a company that’s on pace for nearly 100% earnings growth, even before taking account of all their other possible businesses (Waymo, Google Cloud, as-yet-unclear “other bets” ventures that might start to generate cash flow someday instead of consume it) or their huge net cash position. There will be ugly down days for GOOG at some point, I’m sure, the regulatory pressure will probably kick in and pressure the share price again someday (though breaking the company up would very likely be good for investors, not bad), or they’ll have a disappointing quarter after having raised expectations so high, but the stock is still the cheapest of the big tech names (other than Facebook, at least), and it’s hard to argue that it’s particularly expensive even at these new all-time highs. Now, with estimates rising to account for Alphabet’s strong performance so far this year, 30X 2021 earnings would now be $3,000 a share — and the current strength has not yet led analysts to boost their 2022 earnings estimates, which are very close to the current 2021 estimates ($102 per share, versus $100). The real risk is not Google falling apart at this point, I expect, or even losing meaningful market share to digital ad competitors… the most likely risk to their future earnings is another recession that cuts into advertising spending.

That big news for Google also further spiked the shares of other ad industry participants, The Trade Desk (TTD) jumped 5% after hours that day for no reason (though gave it all back in the subsequent few days), so I guess we’re going to continue to see investors chasing whatever the hot themes are.

If you feel itchy about just doing something, and don’t want to add to an Alphabet position, one option recently has been to just sell Alphabet C shares and buy A shares instead, assuming no commissions or taxes that can instantly cut your cost basis whenever the gap widens between the two share classes. I did that years ago, when the C shares were a couple percent cheaper than the A shares — which was at least mildly sensible, the A shares have a vote and the C shares do not (a vote is largely irrelevant for Google shareholders, to be fair, since the founders still have overwhelming voting control through their non-traded B shares, but still, if the voting or non-voting shares are going to trade at a premium you’d guess it would be the voting shares, no? That’s how it was a few years ago, but the situation in recent months has sometimes flipped). I expect the disparity that sometimes emerges recently, with C shares now taking the lead and trading at an unjustifiable premium to the A shares, is just investor sentiment — either they migrate to the original ticker (GOOG, which is the non-voting C shares), or they follow the trading volume, which is sometimes higher for GOOG than GOOGL (the regular voting A shares). The economic value of A and C shares should be essentially identical for individual shareholders, so I’d always buy whatever’s cheaper.

I’d only do this in a retirement or other tax-sheltered account, incidentally, since I’d rather not suck up the tax obligation of those capital gains before I have to, but whenever a gulf emerges between GOOGL and GOOG of more than ~1% (so, ~$25 or more), it’s likely to be worth the effort to me to swap out my shares to earn the difference. I didn’t notice this was happening last month and didn’t act on it, sadly, but I’ll keep an eye out for it the next time it rolls around (as I’m typing this, on Friday morning, the gap has shrunk from $100 a few weeks ago to about $10, so it’s still perhaps worth a trade to capture that $10 per share, but not super compelling).

Apple (AAPL) and Microsoft (MSFT) clobbered expectations, too, though I don’t own either these days so I don’t care so much — Apple is obviously a great company, with an incredible franchise, and it was a mistake for me to sell the stock when I did … so perhaps it’s sour grapes, but I still think Alphabet’s earnings growth potential is a lot more dramatic than Apple’s, and the valuation more easily justifiable. I don’t think I’ve ever owned Microsoft directly, and I stopped out of my final AAPL position because I was skeptical of growth last Fall, when the price was around $110, and it has since returned 35% or so — though I guess I can take some solace from the fact that AAPL’s return has pretty much just matched the S&P 500 since I sold, while Alphabet is now up 70% since then.

None of these blowout earnings beats were really a surprise to the market, however, we all know that these big tech companies are doing extremely well, analysts tend to be conservative, and we’ve bid up the prices to record levels… so despite really strong “beat” quarters, with fantastic and surprising growth numbers, all three of those stocks are actually down 1-2% on the week.

The fourth foundational tech company that we all watch, however, good ol’ Amazon, showed what happens when the results are actually a little disappointing…

*****

Amazon (AMZN) reported a quarter that was fantastic in any objective consideration, but we’re not objective — we’ve watched all those big tech stocks double (or more) in the last year and a half, and we have high expectations that there’s more to come. Amazon tripped on those expectations a little bit, after its three near-peers had held up their end of the bargain and met high expectations, and investors jumped away like a cat who got too close to a rocking chair.

So should that change our thinking at all?

Not really, expectations were high going into earnings, and Amazon got above my “comfortable buy” price ($3,450), and this is really just the kind of minor near-term expectations reset that Amazon has done pretty regularly over the years. It feels like this was just a reminder that Amazon is not an easy and instantly scalable business like Microsoft and Alphabet, and that they don’t have much interest in looking pretty for investors in any given quarter. They actually have to spend a lot of money to build out infrastructure and capacity, they’ve never shown any interest in rewarding shareholders by maximizing profits (they always choose growth investments over reported profits), and there are still parts of the physical and digital worlds yet to conquer (and to defend against the onrushing competition) for Jeff Bezos and his successor.

And maybe, if we’re being a little cynical, this is one of the all-too-familiar “management resets,” where a new CEO comes in (Andy Jassy, in this case, the longtime Amazon executive who stepped into Bezos’ CEO role on July 5), and immediately dials down the expectations a little bit, giving him a little breathing room with investors and a chance to offer those investors a positive surprise in his first few quarters, when the honeymoon fades away.

Amazon “beat” on earnings this quarter, as usual, with strong revenue growth as we all kept buying stuff online, and as Amazon Web Services (AWS) continued to grow nicely despite rising competition from Google Cloud and Microsoft Azure… but they also clearly pointed to the fact that customer behavior is changing for the first time in a year, and their Amazon Prime customers in the US and Europe were not ordering as voraciously in this quarter as they were during the COVID shutdowns.

That led Amazon to offer lower guidance for future revenue growth, pointing out the obvious, that although e-commerce is still going to grow, it’s probably not going to ever again grow as fast in one year as it did in 2020… which means the year-over-year comparable sales trends are not going to look so exciting for the next few quarters. Add that to the fact that Amazon’s spending ramped up dramatically last year to meet fulfillment needs, with new hires and new warehouses and new delivery fleets and new data center capacity, and that spending level will remain pretty persistent in a lot of areas and cut into margins, and investors seem to be mourning the end of the year of milk and honey a little bit.

Amazon is now on the verge of becoming a drag on the S&P 500, as the price has been pretty flat since the surge into October last year, but the underlying business is still growing strongly and has now grown enough to pretty easily justify the current price, even with growth expectations tapering off a little. My basic assumption with Amazon is that they are a globally dominant company with huge and perpetual competitive advantages thanks to their decades of investment in e-commerce and fulfillment and “captive” Prime members, and that hasn’t changed — if anything, their advantage has grown over the past year as they brought on the few US customers who hadn’t tried e-commerce. They also continue to have a meaningful “first mover” edge in cloud services, with AWS continuing to grow roughly as well as Azure and Google Cloud, despite its larger size. That means it’s still a company I’m biased to want to own.

We do want to keep some pricing discipline, however, and the rough valuation guideline that continues to make sense to me is paying a max of about 4X current-year sales. Revenue expectations have come down a whisker as a result of Amazon’s commentary on the call, but are still in the $480 billion neighborhood. 4X that would be $1.92 trillion, roughly $3,800, and we’re still below that, so I can still buy the stock if I really want to. I’ll keep $3,450 as my “comfortable buy” range, pretty close to 3.5X the expected revenue for the year, and I’m hoping we’ll see the shares dip below $3,000 the next time the market weakens a bit.

Analysts are generally still positive, though they’ve also been cutting their forecasts a little bit after earnings — so the average price target of $4,250, I expect, will drift down closer to $4,000 in the next week or two, but those prices don’t really mean much, anyway, and the consensus remains overwhelmingly positive (which, of course, is a negative if you want to stoke those contrarian worries — having NO “sell” or “underperform” ratings from analysts means there’s nowhere to go but down).

The relative flatness of the share price over the past nine months has let the valuation catch up a little, and, with the business continually improving as they bring on more Prime members, add new countries for major investment, and prioritize their higher-margin marketplace and AWS businesses over direct retailing, I think the stock price performance should, at a minimum, eventually reflect whatever the revenue growth looks like over the coming years. Even without Jeff Bezos in the CEO’s seat, I expect the future to still be very bright for Amazon, and Amazon and Alphabet still strike me as the tech leaders which are most reasonably valued, with the best growth potential, and are the most difficult for competitors to disrupt.

*****

Amazon’s “kind of” competitor, Shopify (SHOP), also reported this week… and the results were predictably excellent, of course, just like Amazon’s. They blew out their quarterly estimates, earning $2.24 per share when less than $1 was expected, Gross Merchandise Volume (the amount sold on SHOP stores, not their revenue) was up 40%, and that drove 48% growth in payments (SHOP Pay now processes 48%, almost half, of all sales on the Shopify platforms, which is incredible — and if you’ve ever bought from a Shopify store, you know that the experience, especially on mobile, is substantially better than the competition.)

And they’re continuing to double down on the “next Amazon” story, spending like crazy, or like a 10-years-ago Jeff Bezos, to keep growing their workforce and expanding their reach to new geographies, still aiming to effectively become the global operating system for retail… so they’re also raising yet more money, they filed to raise $10 billion at the same time that they reported earnings (if they do that all at once, it’s one of the biggest secondary offerings from any company in years).

That’s hard for me to get my head around, honestly, since this was just a little $7 billion company when I first bought shares (and that wasn’t so long ago, just four years), but Shopify is close to $200 billion now, grew up really fast over the past few years, and continues to be an amazing company. Their growth will almost certainly slow this year as well, though they weren’t as explicit about predicting that as Amazon was.

So what do I do? Well, as has been the case for me with Shopify for a long time, I’m still pretty hamstrung. Shopify is too great a company to ignore, too powerful a leader to sell, but too absurdly valued to buy. Maybe that’s just a personal hangup of mine as SHOP actually begins to report consistent profits and perhaps gets judged on that profitability instead of just on their revenue growth, but if we do ever reach a panic sell moment in the market and move away from “growth” stocks, SHOP would probably be near the top of the “sell” pile for a lot of people, thanks to that valuation of almost 50X trailing revenues.

I would also guess that their persistent “invest heavily” strategy will probably mean they’ll miss some more quarters along the way, or cause investors to freak out by talking about big increases in capital spending, just like has happened with Amazon so many times over the years, so if you love the story it’s possible there will be a meaningful drop at some point and a better buy price. Of course, sentiment will be terrible if that happens, and the headlines will be telling you to sell, so if that’s your strategy, to wait for a 30% drop, just make sure you tell your future self that plan. It’s a lot easier to say “I’ll buy it cheaper” than it is to place an order for a stock that just fell 30-40% and is being mocked by other investors.

Right now, SHOP is valued at about 250X likely 2021 earnings, and about 40X expected sales. Bless them for their amazing margins that make such a valuation at all palatable, but we should expect , too, that margins will fall as fulfillment and payments grow to become much larger businesses for them than their core e-commerce software subscriptions (particularly because they’re also giving small businesses a break recently).

To buy the stock now you really have to be a believer in the vision of becoming the core operating system for retail over the next decade. It’s possible, and I wouldn’t bet on anyone beating them to that finish line… but it does require some faith and imagination. I have enough faith to hold, mostly because I love the company Tobi Lutke has built, but not enough faith to buy more at 40X sales and a $200 billion market cap. My most optimistic self might be able to get talked into SHOP shares in the $950-1000 range these days (roughly 15X potential 2023 sales), though I have no idea whether or not we’ll see those prices again. I’m pretty proud of myself for just holding the shares I’ve kept frankly (I have sold a couple times over the years, and the temptation to sell 1,000%+ gainers is powerful), so I’ll have to leave it at that.

*****

Kennedy-Wilson (KW), our real estate asset management company, has one more quarter in which they can raise the dividend if they hope to establish the company as a reliable dividend-growth investment (there’s no clear indication that they care, frankly, but I find it interesting). They have raised the dividend at least once a year for a decade now, and most companies really want to be in that “dividend growth” basket, but the last time they raised the dividend was in the fourth quarter of 2019. That payment actually hit shareholders in the first week of 2020, so if they raise the dividend next quarter they can technically continue to claim a hike each calendar year… we’ll find out in about a week whether or not they care about that metric, their next quarterly dividend update should be part of their earnings release on August 4. Their quarterly results are essentially impossible to forecast accurately, nobody really knows when they’ll buy or sell properties and that has a huge impact in any given quarter — and this will be a pretty big quarter on that front, with some large recognized gains on the partial sale of some multifamily properties to a partner. That doesn’t mean they’ll issue lots of cash to shareholders, the typical pattern with KW is that they follow a value investing strategy, buying in not-yet-expensive areas, upgrading those offices or apartments and later selling partial stakes, often maintaining an ownership interest and getting management fees… and at the same time they’re selling in hot areas where pricing has gotten much higher, so new capital from whatever they sold in the second quarter in suburban Seattle or Tacoma, for example (they didn’t disclose where they were), may have already mostly been rolled into buying apartment complexes in Boise and Albuquerque and Bozeman. They are trying to steadily build a core portfolio of partially owned properties for the cash flow, including rents and management fees from their ownership partners, but they also trade in and out of properties with some regularity so it’s highly variable quarter to quarter.

They can absolutely afford to pay a higher dividend if they wish, they’ve been buying pretty large properties quite steadily (both some contrarian plays, like a London office building, and some more typical investments in large apartment complexes in smaller western U.S. cities), and the company is growing nicely on the asset management side as well, with the raising of more managed funds for investment (adding $700 million to their “global debt program” with an institutional investor from Europe). They have almost $400 million in net operating income from their stabilizied portfoilo of income-producing assets, mostly suburban apartment complexes and low-rise office buildings (with some more urban stuff, too, particularly in London and Dublin), and expect to grow that to almost $500 million in the next four or five years, based on their current project pipeline… and they will soon be closing in on $5 billion in fee-bearing assets under management, which should generate at least $50-100 million in annual fee income. They have a substantial amount of debt, not a surprise for a company that both trades and develops real estate projects, and a lot of depreciation, and it’s a wild guess whether the company will book $200 million or $500 million in adjusted net income in any given year (that’s generally been the range, over the past five years), but I see the value continuing to build.