Today we are honored to have a guest writer joseph joyceProfessor of Economics and M. Margaret Ball Professor of International Relations at Wellesley College.

Current account data are scrutinized for signs of potential or actual fluctuations. If the foreign capital that sustains the deficit suddenly outflows, as happened to Mexico in 2014-15, the deficit that seems reasonable under current conditions may have to shrink.International Monetary Fund's External Sector Reporting Policy 2023For example, list countries whose external conditions are weaker than ideal. The 2023 report includes Argentina, Belgium, Canada, France, Italy, South Africa, Turkey and the United States.

Regulations on how to deal with the current account deficit point out that the trade balance needs to be adjusted through spending switching and/or spending reduction measures to adjust the savings-investment imbalance.Recently published papers Kolerus, “What factors influence current account adjustments during recessions?”, 2021, Bergin, Kim, and Pyun, “Fear of Appreciation and Current Account Adjustments,” 2023, provide an analysis of this issue. But a closer look at current account deficits reveals that not all deficits have the same components. The current account includes the trade balance, net primary account (mainly investment income) and secondary income balance (including personal transfers). The respective positions of the latter two accounts may complicate policy prescriptions.

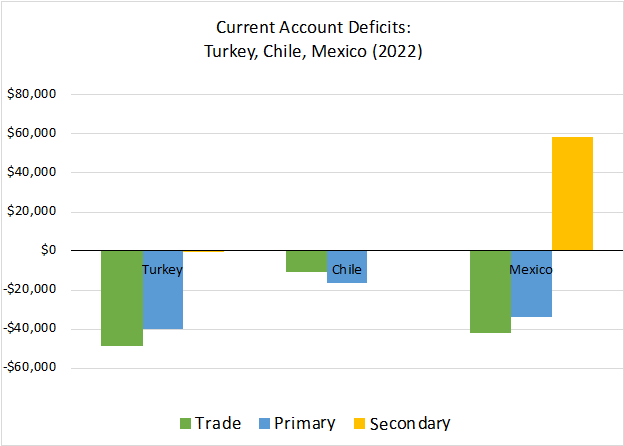

To illustrate this point, consider the current account deficits of three emerging market economies: Turkey, Chile, and Mexico, all of which have current account deficits. Türkiye's deficit in 2022 will be US$48.751 billion. The main source of this deficit is the trade balance, with a deficit of US$39.812 billion. A relatively small primary income balance deficit of $8.565 billion also contributed to the current account deficit, while the secondary income balance was negligible.Articles about turkey current account It is rightly pointed out that the trade deficit is a major factor.

Chile's current account deficit in 2022 will be US$27.102 billion. But the largest component is not the trade deficit of $11.016 billion, but the primary account deficit of $16.52 billion. This figure in turn reflects a deficit of $13,267 in direct investment income from FDI inflows. The $434 million secondary revenue surplus was too small to have a significant impact. Any changes based on exchange rate depreciation need to bear in mind whether and how the underlying balance changes.

The final example to consider is Mexico, which has a current account deficit of $18,046 in 2022. Its trade deficit is as high as US$42.292 billion, and its primary revenue deficit is as high as US$33,831. How did Mexico achieve a significant reduction in its current account deficit? The answer, of course, is the positive secondary income balance of $58.077 billion. The latter shows the contribution of individual transfers of Mexican overseas workers. Its situation is not unique. Egypt's current account has a similar configuration.

Can the primary or secondary accounts be adjusted to reduce the current account deficit? Let’s start with the structure of the three countries mentioned above, which includes trade and main account deficits and some remittance inflows. Will the main account response to a depreciation enhance or dampen the trade account response? The immediate impact on income earned from foreign currency assets should be to strengthen trade account growth, while foreign currency denominated liabilities will offset it. Persistent deficits that need to be financed will increase the state's indebtedness and thereby exacerbate the revenue deficit.

Empirical analysis Alberola, Estrada, and Viani, “Global Imbalances from an Equities Perspective” (2020), showing that for debtor countries, the trade balance contributes to the rebalancing of the current account, thus offsetting the deterioration caused by the income pipeline. For debtor economies, the trade balance pipeline offsets the impact of the worsening income balance. Colacelli, Gautam and Rebillad, Japan's Foreign Assets and Liabilities: Implications for External Accounts (2021) Study the case of Japan and report that the response of the income balance to changes in the real exchange rate is smaller than the response of the trade balance. They also report that the main external rebalancing response occurs through the trade balance, but that this response is dampened by debtor country income responses. Behar and Hassan, “Current Account Balance: External Adjustment Channel or Vulnerability Amplifier? (2022), defined income balance as including primary and secondary accounts, and found that income balance does not play an important role in stabilizing the current account. The results of all three papers suggest that assessments of the measures required to deal with current account crises should include possible deteriorations in the income balance.

Although government transfers sometimes dominate, personal remittances are the main factor in secondary net income. For many emerging markets, these inflows partially offset deficits in trade balances and international investment income. Can they be used to mitigate the impact of the crisis? Much depends on the savings-investment balance that contributes to the deficit. Should overseas funds be used for savings or consumption? If the latter is the case, are the goods imported or domestically produced? Additionally, multiple studies have shown that capital inflows can lead to exchange rate appreciation, a phenomenon known as the Dutch disease (Acosta, Ratti, and Mandelman, “Remittances and the Dutch Disease.” (Year 2009), Ratti, Mandelman, and Acosta, “Remittances, Exchange Rate Regimes, and the Dutch Disease.” (2012).

Relatively few studies have investigated the link between remittances and the current account. Bugamelli and Paterno, “Do worker remittances reduce the likelihood of current account reversals?”“ (2009), The evidence suggests that, in terms of gross domestic product, larger remittances reduce the likelihood of a large current account adjustment due to a decline in international reserves. Hassan and Holmes, “Do remittances contribute to a sustainable current account?” (2016) The study finds that larger remittances cause the current account to adjust more quickly in response to shocks. Lartey, “The Impact of Remittances on the Current Account of Developing and Emerging Economies (2019)On the other hand, evidence of positive contemporary effects but lagged negative effects was found.

Other changes may affect the balance of income between the parties. For example, a contraction in national income may reduce the profits and revenue deficits of multinational corporations, while immigrants living abroad may increase the amount of money they remit to their home countries. On the other hand, a global recession reduces returns on all income, and immigrants may lose some or all of their income in the host country.

The impact of international factor income therefore deserves more attention, especially as primary and secondary income balances become a more important component of the current account. The trade balance will continue to be the main focus, but investment income and remittances may worsen or mitigate current account imbalances. Policies to correct the crisis by reversing the trade balance deficit need to take these other imbalances into account.

The author of this article is joseph joyce.