Today we are fortunate to present the Rashad Ahmed (Office of the Comptroller of the Currency, U.S. Treasury Department). The views presented are those of the author and not necessarily those of the U.S. Department of the Treasury or any other organization to which the author is affiliated.

Is a Flattening U.S. Yield Curve Signaling a Recession? The predictive nature of the slope of the U.S. yield curve, also known as the term spread, is well documented by academia and practitioners.However, it is not clear whether non-US The yield curve helps predict U.S. economic activity.exist Ahmed (2022), I researched the problem and showed that foreign yield curves actually contain information about future U.S. recessions — beyond what is contained in U.S. yield curves. As with U.S. term spreads, as foreign term spreads narrow, the risk of a U.S. recession has risen significantly and real GDP growth has slowed. This means that not all U.S. yield curve inversions are alike: a flatter U.S. yield curve coincides with a flatter yield curve abroad, indicating a greater recession risk than an isolated U.S. yield curve.

Why can foreign yield curves predict U.S. economic activity? In their respective countries, foreign yield curves can lead to economic conditions that are ultimately “exported” to the U.S. through cross-border spillovers. Foreign yield curves may also reflect the global financial cycle, becoming a common factor affecting economic conditions in many countries, including the United States. Evidence supports both views.

Build term spreads

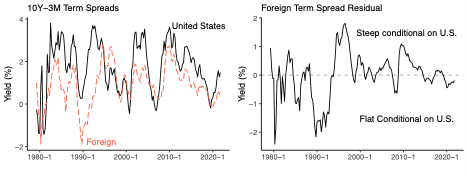

Using quarterly data from 1979-2021, the foreign term spread (FTS) was included along with the U.S. term spread in the G-7 member countries Canada, Germany, Japan and the United Kingdom on average 10-year minus 3-month term spreads ( USTS) regression on future U.S. recession risks and U.S. real GDP growth. The left panel of Figure 1 shows USTS and FTS. The two series are positively correlated (0.55, t-stat is 8.54), consistent with common factors driving global interest rates.

figure 1: U.S. and foreign 10-year 3-month spreads

While both USTS and FTS can be directly involved in regressions of future US economic activity to assess their informativeness as leading indicators, the significant correlation between the two variables makes it challenging to distinguish the contribution of each variable.I take a conservative approach by assigning to USTS any information shared between the USTS and the FTS about the future state of the US economy, by formally testing whether innovations in the FTS meet the irrelevant With USTS contains incremental forecast values. This entails recovering the FTS residuals uncorrelated with the USTS, estimated as the residuals of the regression of the FTS on the USTS. The right panel of Figure 1 plots the recovered FTS residuals. FTS residual values above zero can be interpreted as foreign term spreads with larger U.S. term spreads relative to historical standards, while values below zero indicate relatively flatness. Note that using FTS residuals directly in the analysis instead of FTS does not change the joint predictive power of FTS and USTS, but it does serve as a convenient and conservative tool to quantify the unique contribution of FTS. Also consider letting FTS go directly.

regression model

Estimate a standard probabilistic model to test whether the FTS and other indicators can predict whether a recession will occur anytime in the next 12 months. Indicators considered include the FTS and those previously shown to lead to recessions: USTS, the federal funds rate (FFR), S&P 500 stock returns, S&P 500 volatility, Brent crude oil price changes, and national financial conditions.

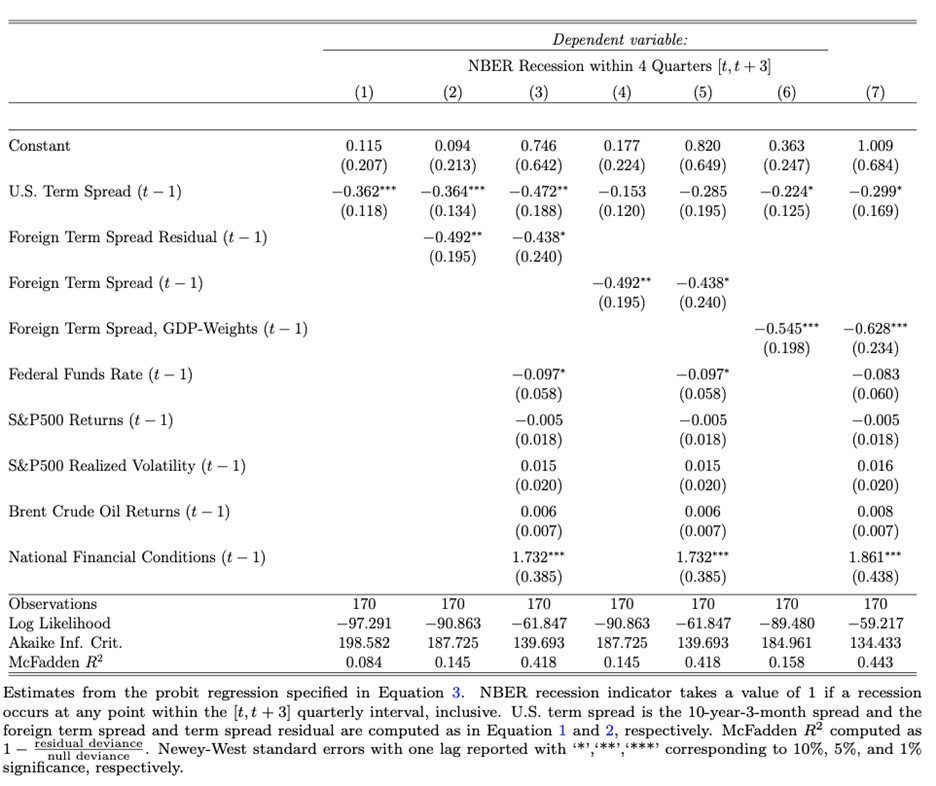

Table 1 reports estimates of alternative probabilistic regression specifications. A significantly negative coefficient for the USTS means that a steeper (flatter) U.S. yield curve is associated with a lower (higher) recession risk. The FTS residuals and the equivalent and GDP-weighted FTS were also found to be statistically significant predictors of recession in the United States, and their inclusion increased the McFadden R-squared from 8% to about 15%. As with the U.S. yield curve, a negative coefficient on the FTS or FTS residual means that the risk of a U.S. recession increases as foreign yield curves flatten.

Table 1: Probabilistic Regression for NBER Recession

Columns 4-7 of Table 1 show that the coefficients on the USTS drop significantly when the FTS goes directly in. This result suggests that U.S. and foreign yields are partly governed by underlying common factors such as the global financial cycle. However, after controlling for U.S. term spreads and other proxies of the global financial cycle (such as stock market volatility, U.S. financial conditions, and FFR), foreign term spreads remain an important predictor of U.S. recession risk. Also, assigning heavier weights to specific regions (eg, Europe), the coefficients of the GDP-weighted FTS are larger than those of the equal-weighted FTS. Both results suggest that common factors alone cannot explain the predictive nature of foreign yield curves. Thus, the predictive power of foreign yields appears to arise from common factors and cross-border spillovers.

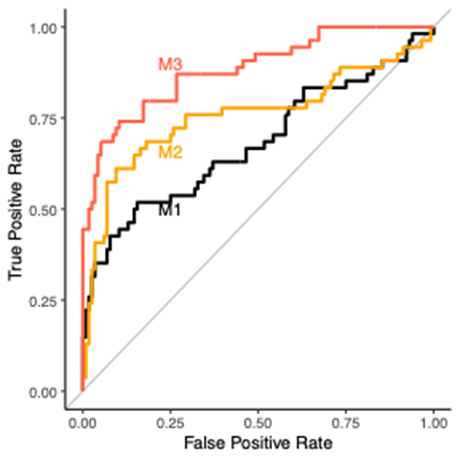

figure 2: ROC curve

Model performance

To compare model performance, Figure 2 shows the receiver operating characteristic (ROC) curves for the first three models in Table 1: the univariate USTS model (M1), the model with USTS and FTS residuals (M2), and the model with USTS, FTS residuals and additional metrics (M3). Compared to M1, the true positive rate of M2 was significantly higher when the false positive rate was 15-50%, and the false positive rate was lower when the true positive rate was 40-75%. Unsurprisingly, M3 dominates M1 and M2.

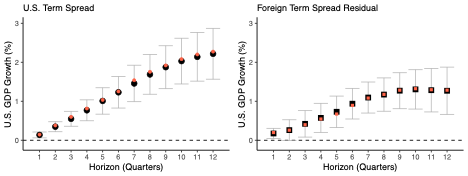

Unlike recession forecasts, foreign yield curves can be used to forecast real U.S. GDP growth over the next three years. The larger points in Figure 3 refer to the 1979-2019 (pre-COVID) point estimates, and the smaller points to the 1979-2021 estimates. The chart on the left shows that a 1 percentage point increase in the US term spread is associated with a 0.77% acceleration in real GDP growth in 4 quarters and a 2.22% increase in 12 quarters.

image 3: Local forecast estimates of residuals of U.S. term spreads and foreign term spreads on U.S. real GDP growth

The graph on the right shows that a 1-percentage-point expansion of the FTS residuals is associated with a 0.57% faster U.S. growth rate in 4 quarters and a 1.27% faster growth rate in 12 quarters. Vertical error bars represent 95% confidence intervals, indicating a statistically significant relationship between these term spreads and future real U.S. GDP growth.

Recession forecast using data as of May 18th2022

Finally, I use the latest available indicator data and Model 5 in Table 1 to make a real-time forecast of a US recession over the next 12 months. The model implies a 60% probability of recession over the next 12 months (primarily Q3 2022 to Q2 2023). Notably, recession risk could be well above 60%. The 60% threshold used to classify recessions resulted in a false positive rate of 3.4% for the in-sample period 1979-2021. In other words, over the past 4 years, simulated recession probabilities that are at least this high have produced very few false positives.

Furthermore, the current yield curve in 2022 does not drive recession risk. In the model, a combination of recent stock market declines, heightened stock market volatility, and a sharp rise in oil prices accounted for one-third of the 60 percent chance of a recession. The most important factor contributing to the current recession risk is the oil price shock, which alone increases the probability of recession by 12.6 percentage points.

refer to

- Ahmed, Rashad. “Can Foreign Yield Curves Predict a U.S. Recession?” Available at SSRN 4097006 (2022).

This article is by Rashad Ahmed.