Today, we are honored to introduce to you the Pavel Skrzypzynski, Economist at the National Bank of Poland. The views expressed in this article are those of the author and should not be attributed to the National Bank of Poland.

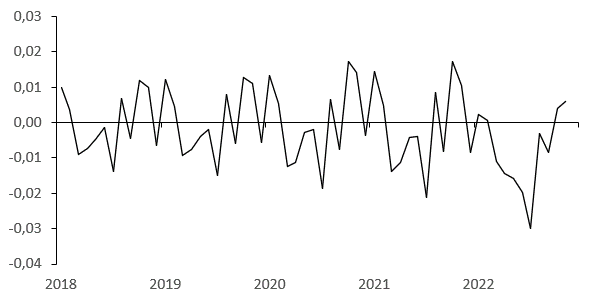

The BLS publishes “Employment Situation – December 2022” and “Job Vacancies and Labor Turnover – November 2022”, allowing us to update the job-worker gap and business cycle indicators based on it. As stated earlier, we assume that the level of job vacancies (T) at the end of the sample remains constant compared to previous observations (T-1), because the availability of JOLTS survey data lags the availability of household survey data by one month. This update also contains revisions to seasonally adjusted household survey data published in “Employment Situation – December 2022”. These revisions have little effect on the gap, so the business cycle indicator – 2018:01 – 2022:11 average gap revision is only -3,2k (-0.002 percentage points).

Figure 1. Job-Worker Gap Revisions (Percentage Points)

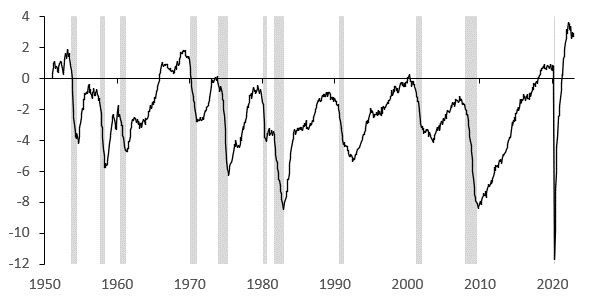

In December 2022, the gap between jobs and workers was 2.9% or 4.7 million, up 0.2 percentage points or 200,000 from November.

Figure 2. Job-to-Worker Gap (Percentage)

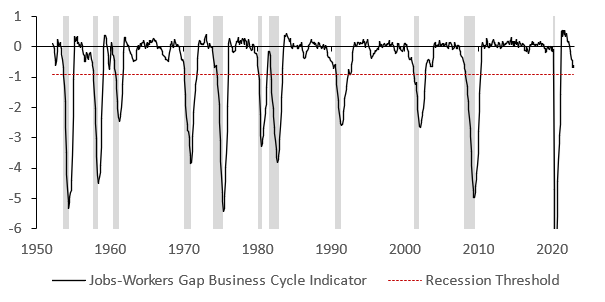

With these new data, the Employment-Worker Gap Business Cycle Indicator (JWGBCI) fell to -0.67 points in December from -0.63 points in November and remained above the recession threshold of -0.93 points. In October, the JWGBCI was also -0.67 points, as in December. Recall that this indicator uses smoothed gaps, i.e. we calculate the change in the three-month moving average of the employment-worker gap relative to the previous twelve-month maximum.

Figure 3. Job-Worker Gap Business Cycle Indicators (Percentages)

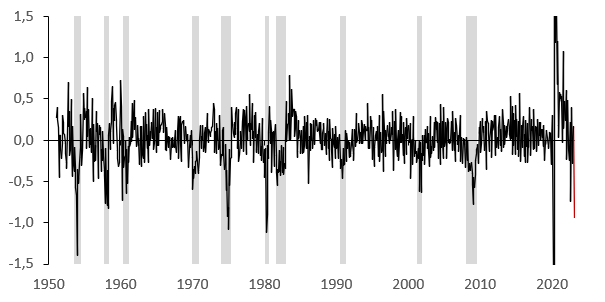

How much m/m change in the job-worker gap in January 2023 is needed to predict a recession? The job-to-worker gap (unsmoothed) needs to fall from 2.9% in December to 1.9%, or 1 percentage point, or 2 standard deviations of historical volatility. The graph below shows this change (marked in red) from a historical perspective. That seems unlikely as it would likely mean a sharp contraction in either employment or job vacancies or both as of January.

Figure 4. 1-Month Change in Job-Worker Gap (Percentage Points)

Conclusion: Recent gap readings and business cycle indicators are consistent with labor market resilience to a rapid tightening of monetary policy.

This article was written by Paweł Skrzypczyński.