Answer: Not much.This is critical for assessing suitability Conditional Inflation forecasts, especially those related to 2022.

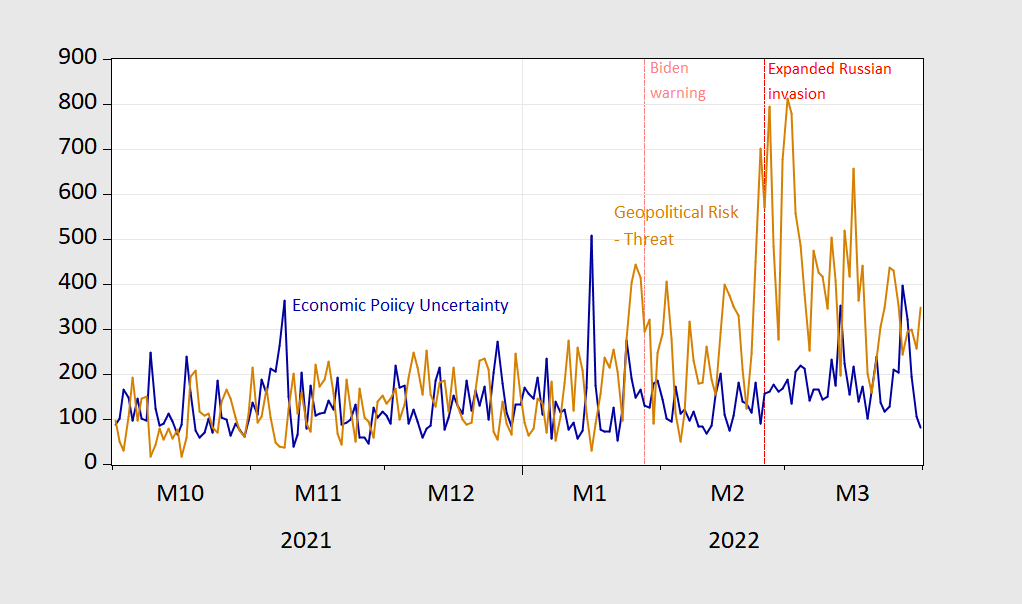

Text analytics and market indicators. The first is the geopolitical risk indicator and the economic policy index:

figure 1: US Economic Policy Uncertainty (EPU) Index (blue) and Geopolitical Risk (GPR) Index (tan).Sources: Baker, Bloom and Davis, via FRED, and Ground Penetrating Radar Indexaccessed 18 October 2022.

Mind you, the U.S. EPU — the focus of the U.S., of course, didn’t signal much movement before Biden’s warning to European leaders, and not just before Russia’s “special military operation.” As word spread that US intelligence agencies had issued a warning to Western intelligence agencies, the GPR index did rise and spiked in the days leading up to the actual intrusion.

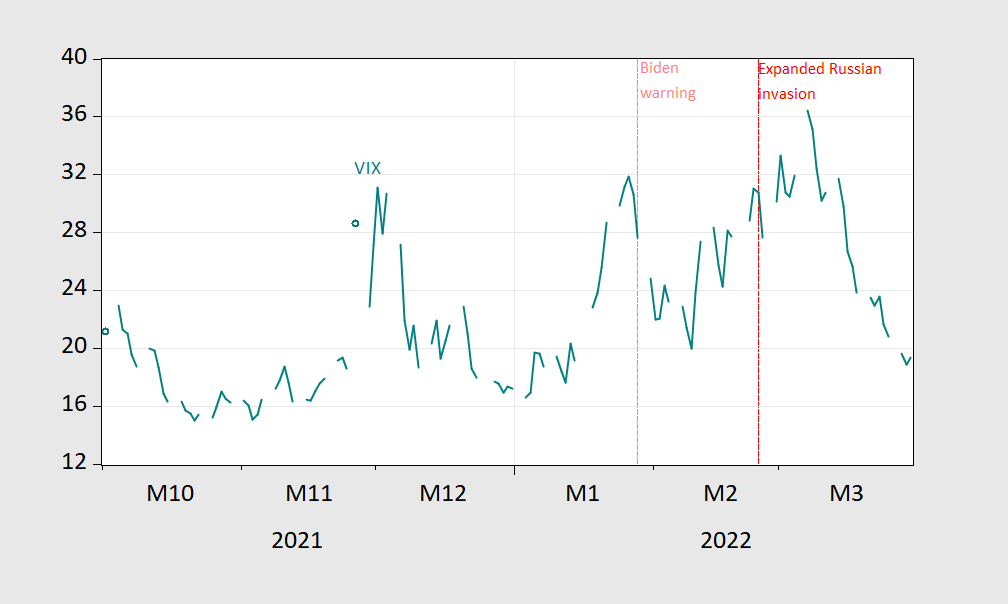

What about market indicators? The VIX surged when shares fell in early December, then surged (as U.S. intelligence warnings spread). But by the fall of 2021, U.S. financial markets did not see a high risk of Russian aggression affecting the stock market.

figure 2: VIX closing price (turquoise). Source: CBOE via FRED.

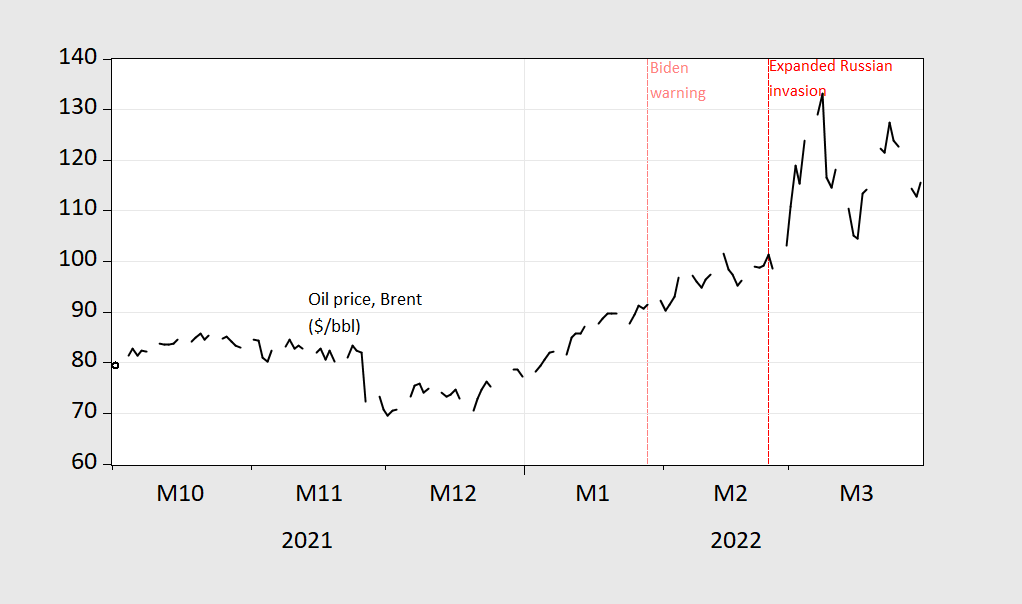

We know that any Russian aggression will have a positive effect on energy prices, including oil and gas. Does the spot market (remember, as a storable commodity, oil and gas should reflect current and expected future conditions) reflect the expected Russian actions?

Here’s Brent and Dutch TTF (natural gas):

image 3: Oil price (Brent), USD/barrel (black). Source: EIA, FRED.

Figure 4: Gas EU (Dutch TTF), Eur/MWh (blue), October 2021 to October 2022 [NOTE different time scale]. Source: Tradingeconomics.com, accessed 18 October 2022.

While both prices saw spikes, note that gas prices in the EU market remained stable until the start of the special military operation.

Oil prices rose through November, but Futures prices show backwardation.

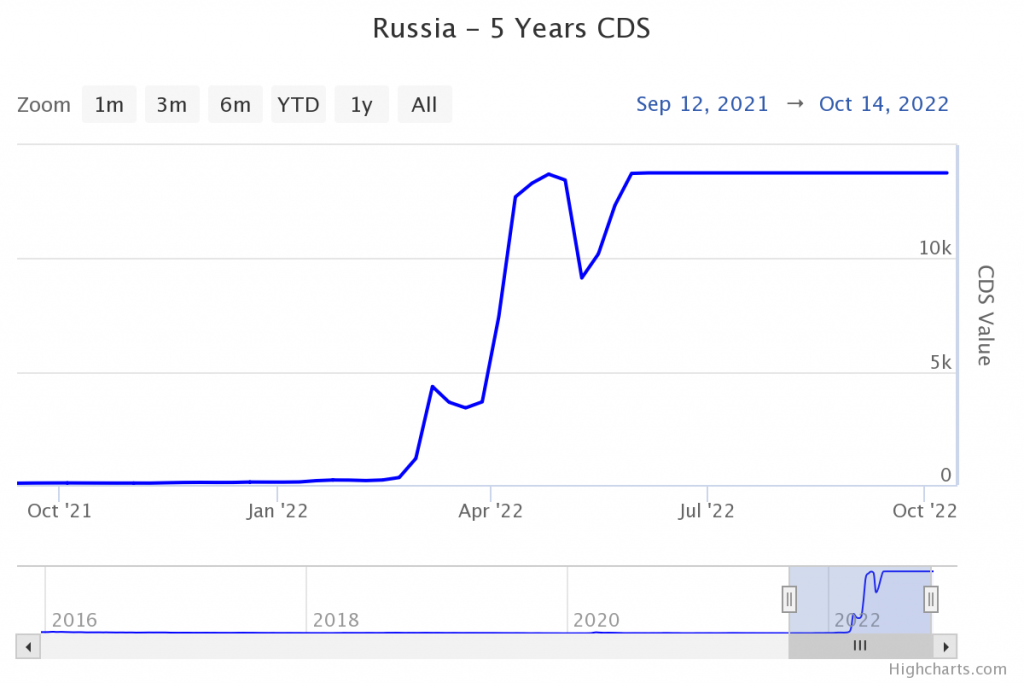

Finally, assuming that Russia’s expanded war on Ukraine will spur sanctions and increase the risk of sovereign default, we would expect the value of CDS to rise in advance. The value did not rise until special military operations began.

Figure 5: Russian sovereign debt CDS value. resource: The world of government bondsaccessed 18 October 2022.

The current value implies a 100% probability of default using a 40% recovery rate.

Without knowing what the counterfactual price would be without Russia’s special military action, it is impossible to infer the market’s assigned probabilities to the actual realized outcome. However, the high likelihood does not appear to be market-related (similarly by text analysis).

If one considers that inflation outcomes depend largely on the trajectory of energy prices, then inflation projections must be judged on whether proxies think Russia is likely to expand its aggression. If forecasters, including those in policymaking, see a higher likelihood of increased Russian aggression, inflation forecasts are likely to be higher (and growth forecasts correspondingly lower).

In other words, when evaluating the inflation forecast record, keep in mind the difference between conditional and unconditional forecasts.