Assume that unadjusted nominal real yields are a good indicator of inflation expectations (see yesterday’s post Why probably not), it’s interesting to see how market-based inflation expectations have changed in the recent past (before today’s ECB decision):

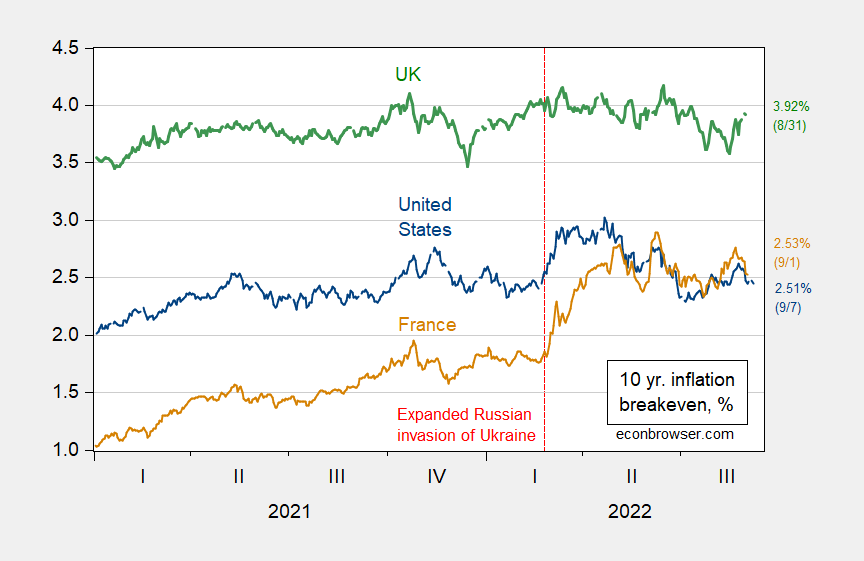

figure 1: Ten-year inflation breakeven points for the US (blue), UK (green), and France (tan), all expressed as a percentage. The US is based on the constant-maturity Treasury-TIPS spread, the UK is based on the Treasury-gilt spread, and France is based on the spread between government bonds (mat. 5/36) and indices (mat 3/36). Source: Treasury via FRED, Bank of Englandand treasureand the authors’ calculations.

Note that as the Russian invasion of Ukraine widened, the breakevens for both France and the US went up at the same time (thanks Putin!). The UK’s breakeven remains fairly stable. Although it shared a small peak in mid-June with the other two series. That’s not to say the UK’s breakeven remains the same. Go back to mid-2016 and you’ll see the jump there (so, there’s an unusual bump).

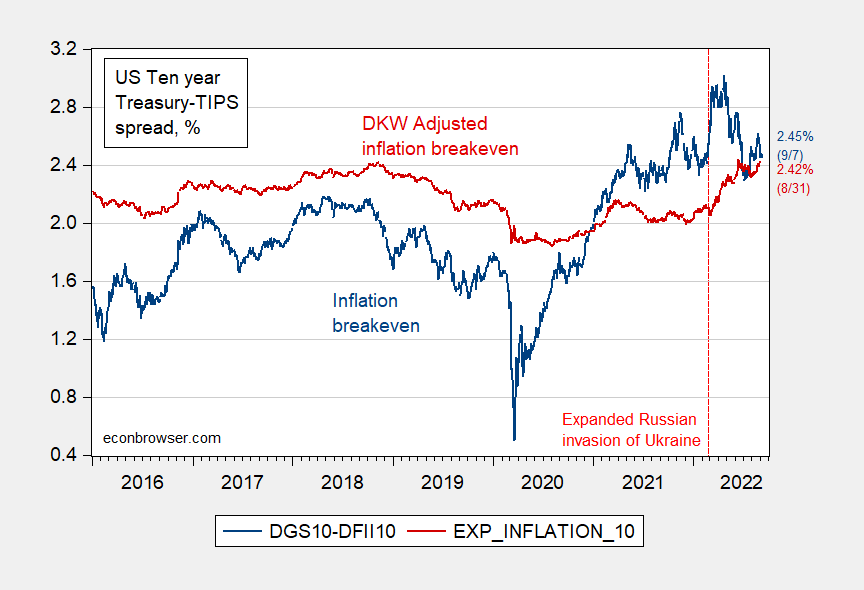

As I pointed out at the beginning, these are unadjusted (for inflation risk, liquidity premium), which can be important. After adjusting for the premium, US expected inflation has risen steadily since February 24.

figure 2: The five-year inflation breakeven is calculated as the five-year Treasury yield minus the five-year TIPS yield (blue), and the five-year breakeven is adjusted by the inflation risk premium and the liquidity premium per DKW (red), both in %. Source: FRB via FRED, Treasury, NBER, KWW Following D’amico, Kim and Wei (DKW) access 9/7, and author’s calculations.

There is no reason for the inflation risk premium and liquidity premium (and in France, default risk during the Eurozone crisis) to behave like the US. Hodar and Tristani (IJCB, 2018) Compare the inflation breakeven adjusted to 2014 spreads for the US and France. I’m sure there are live adjusted series somewhere in France and the UK, so any hints are welcome.