After last week’s financial turmoil, but before the CS/UBS trade, real interest rates and inflation breakevens fell, while risk and uncertainty indicators rose.

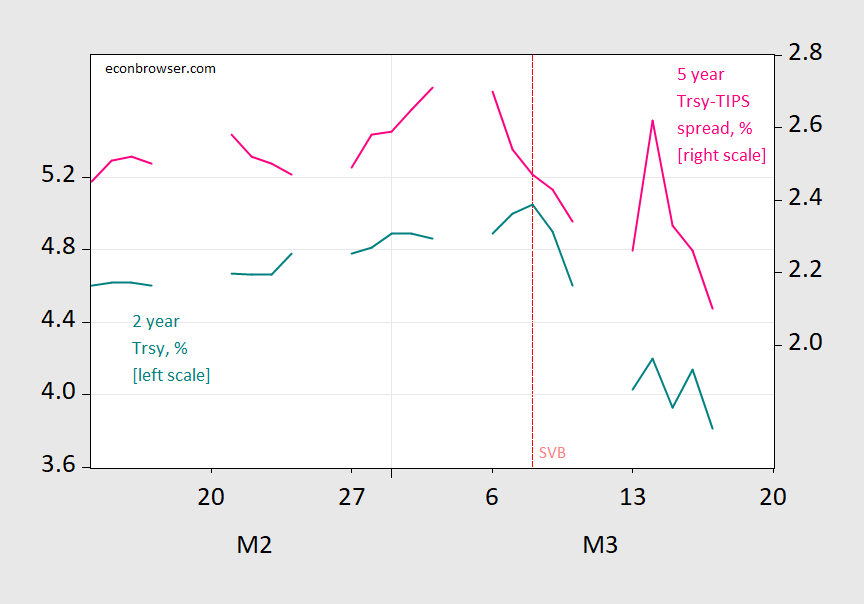

figure 1: Two-year Treasury yield (teal, left axis) and 5-year Treasury-TIPS breakeven (pink, right axis), both in %. Source: Treasury via FRED, and authors’ calculations.

Note that nominal Treasury yields have fallen with expected inflation (neglecting risk and liquidity premiums). Note that the five-year TIPS is down about half a percentage point since the SVB drama unfolded.

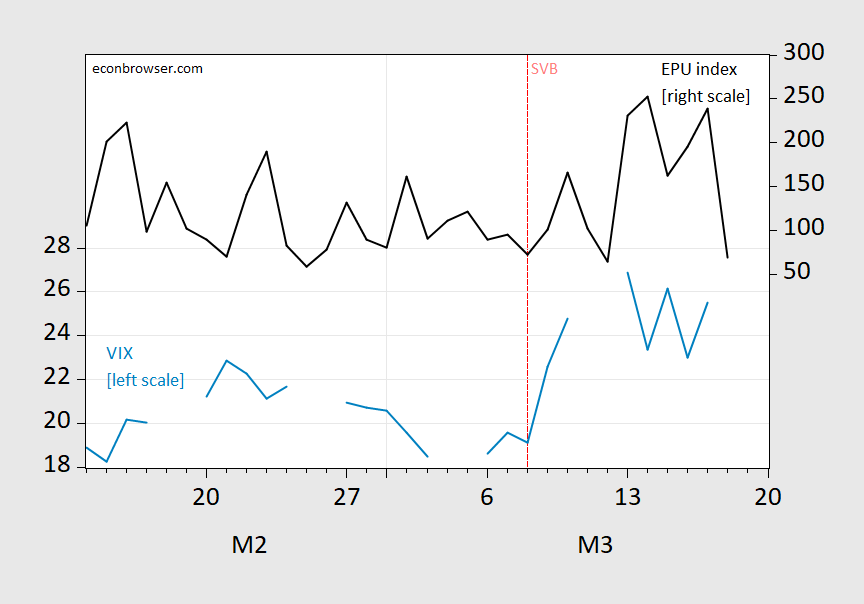

figure 2: VIX (sky blue, left scale) and economic policy index (black, right log scale). Source: CBOE via FRED, policyuncertainty.com.

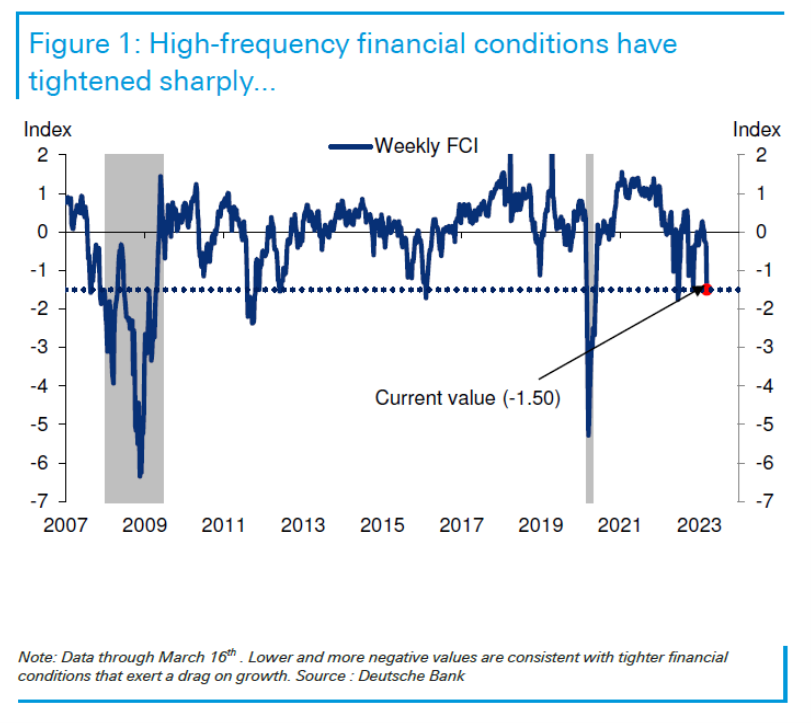

Financial conditions have tightened so much that markets have achieved what the Fed might have achieved by raising the funds rate. Data from DB, starting Friday, until the 16th.

source: DB, where’s the pressure? March 17, 2023.

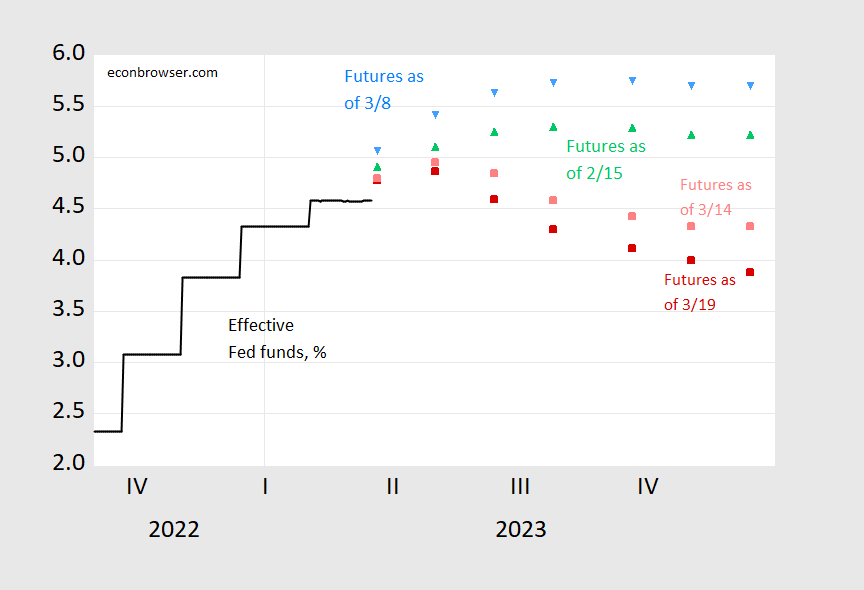

In fact, the market’s perceived path for fed funds has now been revised down.

image 3: Federal funds in effect (black) as of March 19th at 4:30CT (red squares), March 14th at 1:30CT (pink squares), March 8th (sky blue inverted triangle) and February 15th (green triangle) ), implied federal funds. Source: Federal Reserve via FRED, CME Group Fed Watch and author’s calculations.

The implied end-of-year fed funds rate is now 1.8 percentage points lower than it was 11 days ago…