Juan E. Castañeda (Director) and Tim Congdon (Chairman) International Monetary Institute At Buckingham University Write today:

When the M3 circulation velocity is 1.04, the equilibrium nominal national income is approximately $29,000b.

…If nominal GDP needs to grow by 30% in 18 months to two years, and if real output growth cannot exceed 8% during this period, then the remaining adjustment must be at the price level. The continued prosperity from now to the fourth quarter of 2022, in which real output increases by 8% and price levels increases by 20%, will actually lead to a 30% increase in nominal GDP

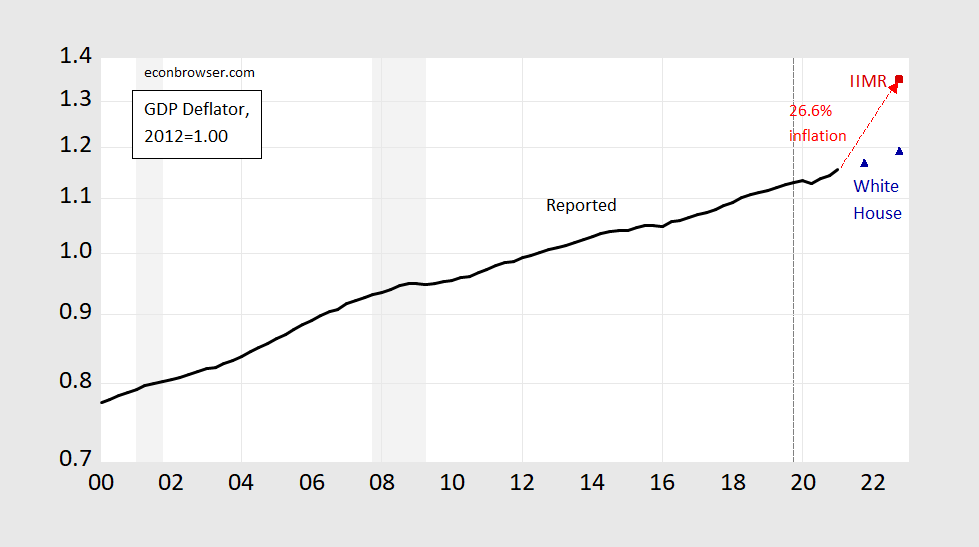

Using the calculations implicit in their research, I came up with the following GDP deflator chart (assuming an actual growth rate of 7% by the end of 2022).

figure 1: US GDP price deflator (black), IIMR implied deflator as of the fourth quarter of 2022 (red square), White House fiscal year 22 forecast implied deflator (blue triangle), all logarithmic scales for 2012 are Is 1. The IIMR calculation of the price level assumes an increase of 7%. The NBER-defined recession date is indicated by the gray-shaded dashed line in the NBER peak date in the fourth quarter of 2019. Source: BEA, 2021Q1 2nd release, IIMR (June 14, 2021), White House (May 2021), NBER and author’s calculations.

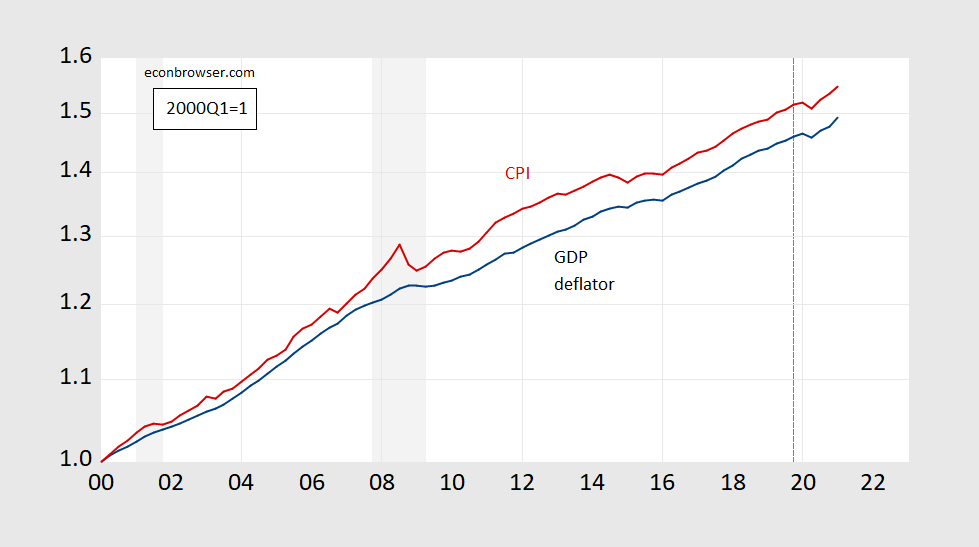

As the author pointed out, this method essentially uses quantitative theory, MV=PY. use Meter3 for money(Meter), think Volt (Speed) is the average regression, obtaining PY (Nominal GDP), then assume Yes It cannot rise more than a certain amount (7% or 8%, depending on the position in the text). Meter3 Is a broader measure than currency Meter2 (Data after 2006 comes from Shadowstats). If my calculation is correct, it means that the GDP deflator will grow at a rate of 26.6% (annual rate) by the fourth quarter of 2022. During the period from 2000 to the first quarter of 2021, the CPI growth rate was about 31% faster than the GDP deflator, so this indicates that the CPI inflation rate in the next 1.5 to 2 years is about 34.5%. (Figure 2 shows the evolution of the two series).

figure 2: The GDP deflator (blue) and CPI-all (red) are both 2000Q1=1, on a logarithmic scale. The NBER-defined recession date is indicated by a gray shaded dashed line during the NBER peak period in the fourth quarter of 2019. Source: BEA 2021Q1 Second Edition, BLS, all calculated from FRED, NBER and the author.

Time will tell whether quantitative theory or some other methods (such as the Phillips curve) are more accurate.I discuss the past forecast record of quantity theory In this article.

Addendum, 4:30 PM Pacific Time, June 15th:

How reliable is the forecast of 290 million GDP? A key part of Castañeda-Congdon’s argument is: (1) nominal GDP is determined by the amount of broad money assuming a speed value, and (2) speed is predictable and the mean is regressed. On (2), the standard unit root test results (ADF, DF-ERS) applicable to the available M3 speed measurement (1959-2006) show that people cannot reject the unit root zero at the conventional level, and can usually reject the trend stability The zero value (KPSS) is at the 5% level.

In other words, a key assumption in the calculation of Castañeda-Congdon is problematic.