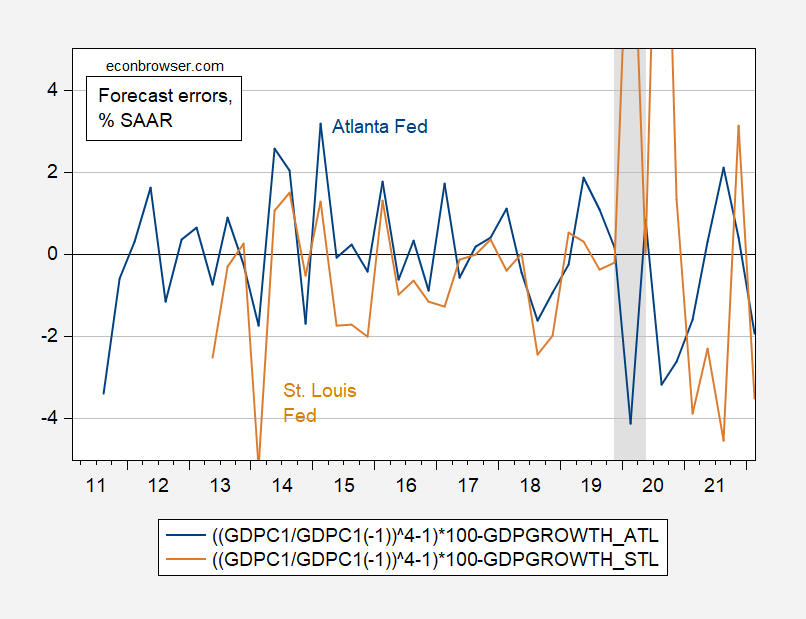

Reader Steven Kopits seems to think that the Atlanta Fed’s GDPNow is the only relevant nowcast. There are actually quite a few, from consulting firms (for example, a former macroeconomic advisor to IHS Markit) to tracking GDP at Goldman Sachs, Deutsche Bank, etc. However, for illustrative purposes, here is an easy comparison to make (since the data is in FRED) for nowcasting before the advance release.

Excluding the four quarters associated with the outbreak of the pandemic (Q1, Q2, Q3), the average error for a common sample of 33 observations for GDPNow and St. Louis is 0.12 and -0.82 ppts (SAAR), respectively. The RMSFEs were 1.4 and 1.8 percentage points, respectively. In other words, GDPNow is slightly undervalued, while the St. Louis Index is slightly overvalued. Adjusting for bias means GDPNow’s implied second-quarter growth rate was -1.7 percentage points, and the St. Louis Fed was +3.2 percentage points.

Note that I used the final revised growth rate in the calculation, not the advance growth rate (because otherwise I would have to calculate all the advance growth rates in the ALFRED spreadsheet), so thought this was a quick and dirty analysis. There is also a more fundamental question of whether pre-pandemic data are useful in this comparison of predictive power (which is why I used data from the past three years in an earlier post) postal).