Today (April 18, 2024), the Australian Bureau of Statistics released the latest data – Australian workforce – March 2024, indicating that the labor market is weakening, with employment falling and the unemployment rate rising as more normal behavioral patterns return after the holiday disruption. The good news is that full-time employment continues to increase, offset by a decline in part-time work. The stronger full-time work result means the underemployment rate fell slightly. If the participation rate had not fallen, the rise in unemployment would have been much more severe. Declining employment and participation rates are signs of economic weakness. There is still 10.3% of the working-age population available and willing to work being wasted in one way or another – either unemployed or underemployed, and this proportion is increasing. While mainstream commentators claim Australia is not close to full employment, it is difficult to describe it as a “tight” labor market.

ABS March 2024 labor force (seasonally adjusted) estimates are summarized below:

- Employment decreased by 6,600 (0.0%) – full-time employment increased by 27,900 and part-time employment decreased by 34,500. Part-time jobs account for 30.6% of the total.

- The unemployment rate increased by 20,600 to 569,900.

- The official unemployment rate rose 0.1 percentage points to 3.7% (-0.4 percentage points).

- The participation rate fell 0.1 percentage points to 66.6%.

- The employment-to-population ratio fell by 0.2 percentage points to 64%.

- Total monthly working hours increased by 17.4 million hours (+0.9%).

- The underemployment rate fell by 0.1 percentage points to 6.5% (-13,700). There are a total of 958,300 underemployed workers. Total labor underutilization (unemployment rate plus underemployment) held steady at 10.3%. The total number of unemployed or underemployed workers was 1,528,100.

Released in ABS Media – Unemployment rate rose to 3.8% in March – ABS states:

The seasonally adjusted unemployment rate rose 0.1 percentage point to 3.8% in March…

The number of employed people fell by about 7,000, the number of unemployed people increased by 21,000, and the unemployment rate rose to 3.8%…

Following fewer than usual payrolls in December and January, more than usual payrolls in February and a slight decline in March. However, in March, job inflows have returned to more normal patterns.

Due to declining employment and slower population growth, the seasonally adjusted employment-to-population ratio fell by 0.2 percentage points to 64.0%, and the participation rate fell by 0.1 percentage points to 66.6%.

General conclusions:

1. The return to a more normal pattern after a break in behavior during the holidays indicates that the labor market is softening, with the number of employed people falling and the unemployment rate rising.

2. The good news is that full-time employment continues to increase, offset by a decline in part-time work.

3. The stronger full-time work outcome means a slight decline in the underemployment rate.

Employment decreased by 6,600 in March 2024 (0.0%)

1. The number of full-time employees increased by 27,900, while the number of part-time employees decreased by 34,500. Part-time jobs account for 30.6% of the total.

2. The employment-to-population ratio fell by 0.2 percentage points to 64% – a reliable indicator of a weakening situation.

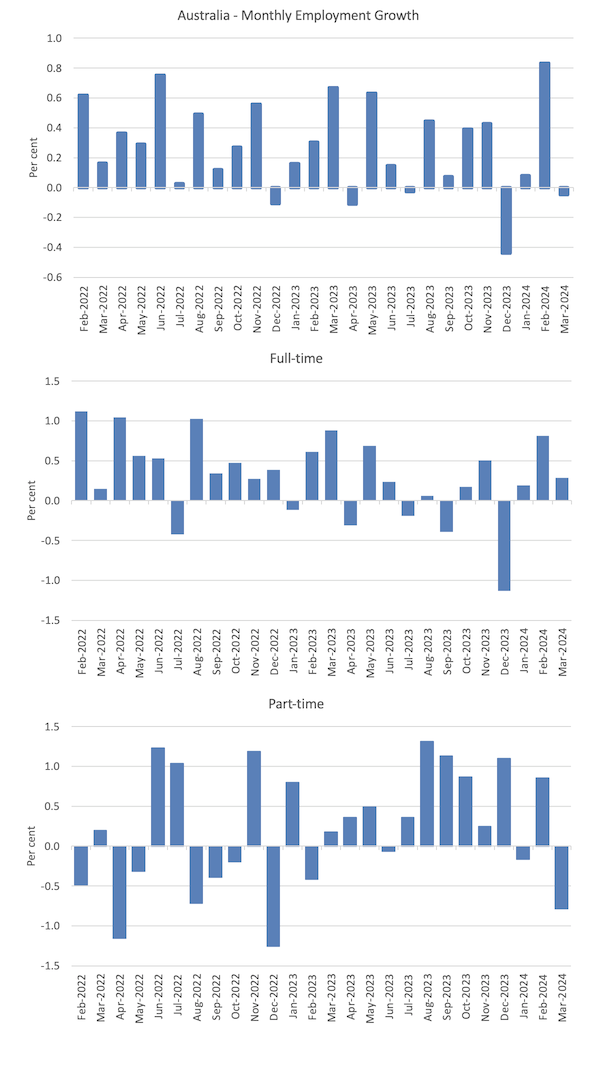

The chart below shows the month-over-month growth in total employment, full-time employment and part-time employment over the 24 months to March 2024, using seasonally adjusted data.

The following table provides an accounting summary Labor market performance over the past six months Provides a longer-term perspective, smoothing out month-to-month variations and better assessing trends.

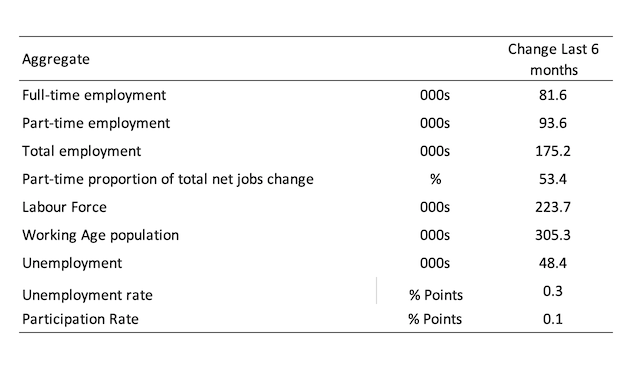

Given changes in labor estimates, it is sometimes useful to check labor force estimates Employment-to-population ratio (%) Because the underlying population estimate (the denominator) is less cyclical and easier to change than the labor force estimate. This is another measure of how robust economic activity is to the unemployment rate, which is sensitive to labor fluctuations.

The chart below shows the employment-to-population ratio since March 2008, the time of the global financial crisis.

The employment-to-population ratio remains stable, fluctuating slightly around current levels.

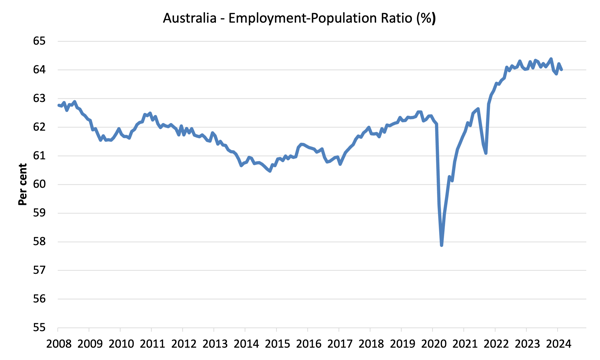

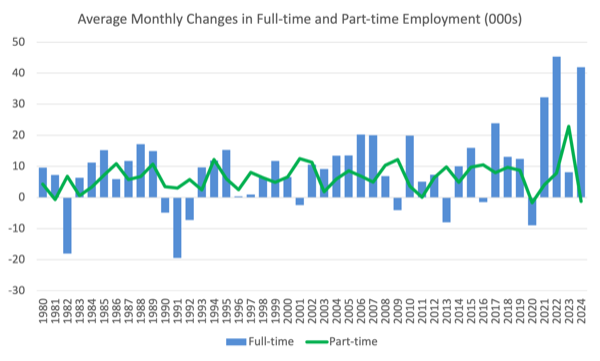

The chart below shows average monthly employment changes over the calendar years from 1980 to 2024.

1. The average employment change in 2020 was -10,600, rising to 36,300 in 2021 as lockdown eased.

2. In 2022, the average monthly change will be 44,700, and in 2023, the average monthly change will be 31,000.

3. From 2024 to now, the average monthly change is 40,800.

The chart below shows the average monthly change in full-time and part-time employment since 1980 (in thousands).

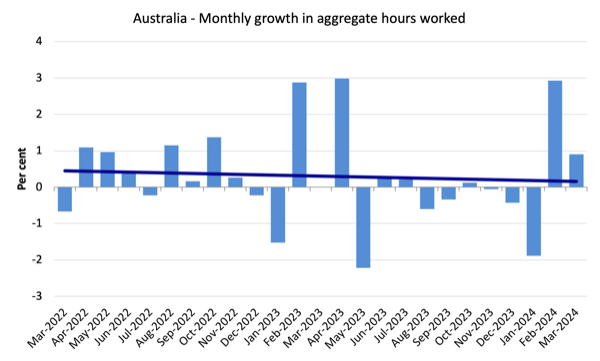

In March 2024, total monthly working hours increased by 17.4 million hours (+0.9%)

Hours worked increased despite a decline in overall employment, as full-time work increased but was unable to offset a decline in part-time work.

The chart below shows monthly growth (in percent) over the past 48 months (omitting the period of pandemic restrictions).

The dark linear line is a simple regression trend of monthly changes.

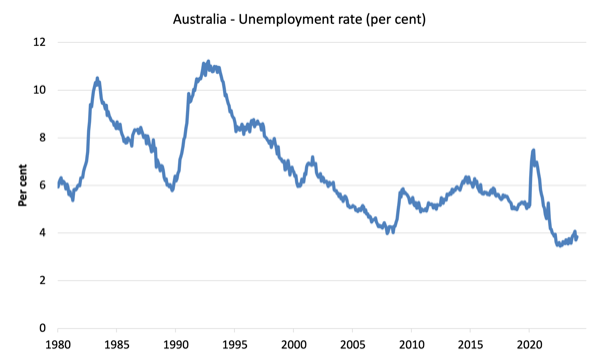

Unemployment rate increased by 20,600 to 569,900 in March 2024

Overall employment losses were partly offset by the impact of lower participation rates on unemployment.

Ore production outpaced the rise in participation rates, so the official unemployment rate fell sharply.

Declining employment and participation rates are signs of economic weakness.

The chart below shows the national unemployment rate from March 1980 to March 2024.

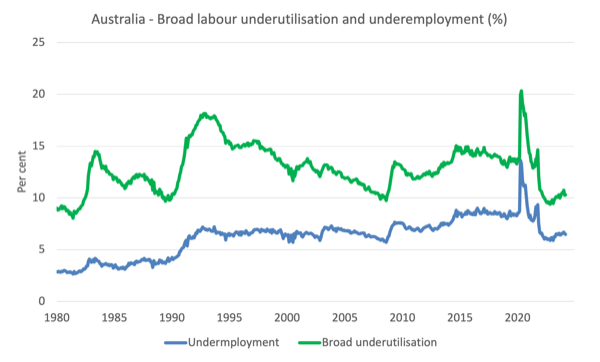

In March 2024, the overall labor utilization rate was stable at 10.3

1. The underemployment rate fell by 0.1 percentage points to 6.5% (-13,700).

2. There are a total of 958,300 underemployed workers.

3. The total labor underutilization rate (unemployment rate plus underemployment) remained stable at 10.3%.

4. The total number of unemployed or underemployed workers is 1.5281 million.

The fact that 10.3% of workers who are both available and willing to work are in some way out of work (unemployed or underemployed) has led economic commentators and policy officials to claim that Australia is close to full employment or that it is a nervous labor market.

The chart below plots Australia's seasonally adjusted underemployment rate between April 1980 and March 2024 (blue line) and the overall underutilization rate for the same period (green line).

The difference between the two lines is the unemployment rate.

Youth labor market improves in March 2024

The overall number of youth employment increased by 2,000, but the number of full-time employment increased by 12,900, while the number of part-time employment decreased by 12,800.

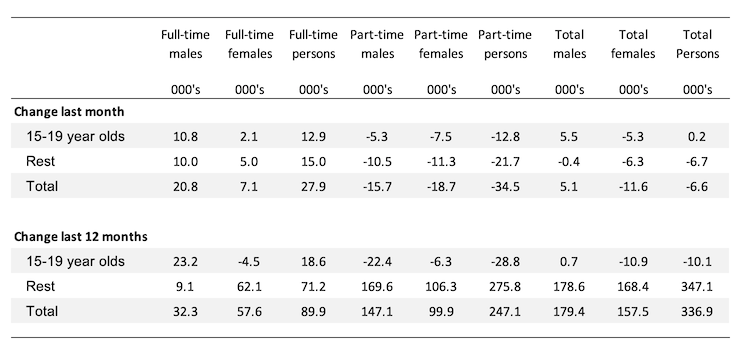

The table below shows the distribution of net job creation by full-time/part-time status and age/gender category (15-19 and other) last month and the last 12 months.

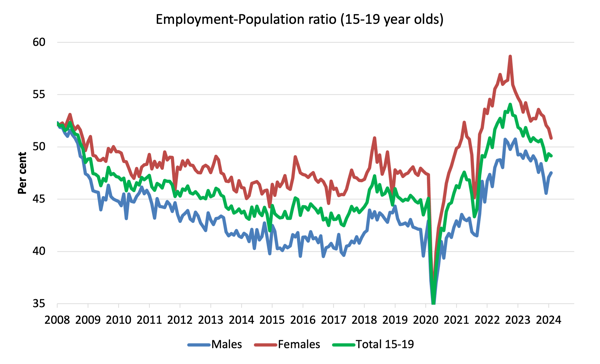

To put youth employment into a scale (relative to their size in the population), the chart below shows the employment-to-population ratio for men, women and the total population aged 15-19 since July 2008.

You can interpret this graph as describing changes in employment relative to the underlying population for each cohort.

Judging from recent developments:

1. The proportion of males increased by 0.4 percentage points from the previous month.

2. The proportion of women decreased by 0.9 percentage points quarterly.

3. The overall youth employment population decreased by 0.2 percentage points month-on-month.

In recent months, the situation of men has improved uniformly, while that of women has suffered.

However, since November 2022, employment opportunities for the growing teenage population have continued to deteriorate.

The Reserve Bank of Australia's deliberate desire to create unemployment in Australia may hurt this group of people more than anyone else.

As the population ages, this group is the workers of the future and we will rely on them to increase productivity.

Sabotaging their job opportunities at an age when they are about to gain skills and experience is smart policy (not!).

in conclusion

My standard monthly caveat: Given the way labor force surveys are constructed and administered, we always have to be cautious in interpreting monthly changes.

My overall rating is:

1. The return to a more normal pattern after a break in behavior during the holidays indicates that the labor market is softening, with the number of employed people falling and the unemployment rate rising.

2. The good news is that full-time employment continues to increase, offset by a decline in part-time work.

3. The stronger full-time work outcome means a slight decline in the underemployment rate.

4. If the participation rate had not fallen, the rise in unemployment would have been much more severe.

5. Declining employment and participation rates are signs of economic weakness.

6. There are still 10.3% of the working-age population available and willing to work being wasted in one way or another – unemployed or underemployed, and this proportion is increasing.

7. Although mainstream commentators claim that Australia is not close to full employment, it is difficult to describe it as a “tight” labor market.

That's enough for today!

(c) Copyright 2024 William Mitchell. all rights reserved.