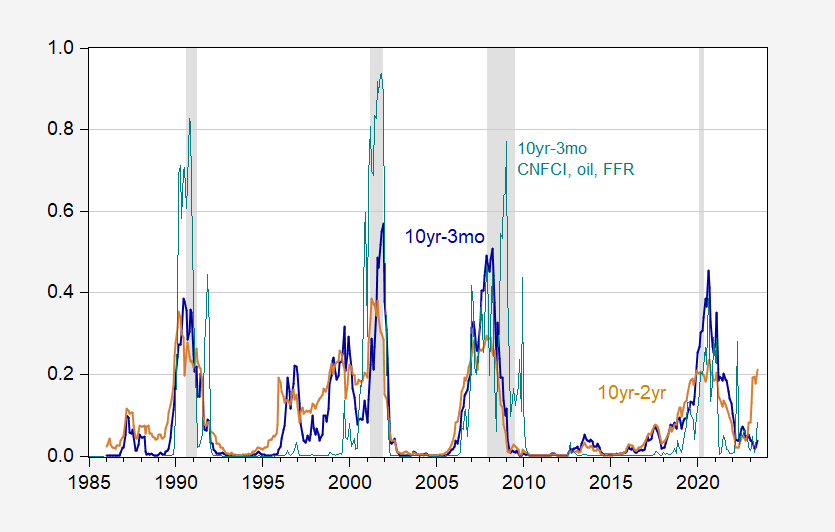

Probability of 10yr-3mo and 10yr-2yr spreads:

figure 1: Recession probability for specified month, using 10-3 month spread (blue), using 10-2 year spread (brown), and 10-3 month spread plus fed funds rate, Chicago Financial Conditions Index, 12-month oil price Variation (turquoise). NBER-defined recession dates are shaded from peak to trough in gray. Source: Treasury via FRED, NBER, author’s calculations.

The probabilities of the 10-to-March and 10- to 2-year spreads in June 2023 are 3.8% and 21.2%, respectively. If you extend the 10-year to March with the Chicago Financial Conditions Index, the federal funds rate, and the 12-month oil price change, the probability is 8.4%.Note that this specification is similar to Ahmed (2022)except for excluding foreign spreads and stock market variables (McFadden R2 of 0.51 versus 0.28 unaugmented).

I’m sure alternative term spread models that include other variables could lead to higher implied recession probabilities, but the plain vanilla model currently does not lead to higher than 22% in the 12 month range (10 to 10 years) 2 years) (26% in the 18-month range in 2023M12).