Sterling fell sharply last week. But even as currency values return to pre-mini-budget levels, the pound has been on a downward trend for the past six years after adjusting for inflation.

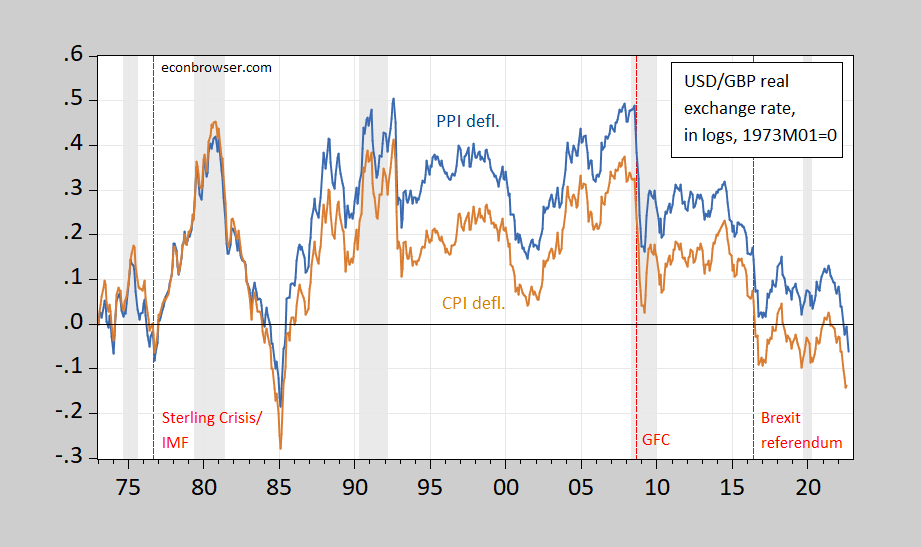

Figure 1: 1973 M01=0 PPI depreciation Real GBP/USD exchange rate (blue) and CPI depreciation (tan), both in log. A downward movement indicates a depreciation of the pound. The September value of PPI is assumed to continue to decline at the pace of August. Bloomberg consensus on UK CPI; Cleveland Fed nowcast on US CPI. ECRI defines the recession dates from peak to trough, shaded in grey. Source: Calculated by FRED, BLS, ONS and authors.

One way to look at the events of September is that it was the third sustained negative terms of trade shock for the pound in the past 15 years, the first being the global financial crisis and the second being Brexit. The downward trend in PPI tightening real rates is more pronounced (in my opinion) because they reflect a deterioration in the terms of trade for ostensibly tradable commodities.

How a formal statistical test relates to this assertion. Using the ADF test (6% for the unit root test), the PPI reduction rate rejects unit root nulls at 13% msl. This means that the purchasing power parity of traded goods/PPI is not very obvious. The Bai-Perron recursive structure break test identified breaks in 1987, 2000, and 2015. The 2015 disruption came close to the Brexit referendum.

For more discussion on PPP etc, see this.