And now it’s time to give some credit where it’s due… what were the most successful teaser picks of 2023?

Each year, we spend a few minutes highlighting the worst idea from the investment newsletter world when we name our “Turkey of the Year” at Thanksgiving… but as the year comes to an end, we also want to pin down the best ideas of the past year, and maybe think a little bit about what made them the best performers.

It was an much better year than 2022, for sure, last year was all about oil and gas prices spiking following the invasion of Ukraine, and about the comedown from the wild COVID bubble in little growth stocks and SPACs that popped around the time the calendar turned from 2021 to 2022. In 2022, sometimes surviving was enough to make you look like a winner.

The runaway winner a year ago was the Argentine oil company YPF (YPF), teased right when oil prices were going bonkers with the Russian invasion of Ukraine — I thought that was a “it’s so cheap that it could go crazy” stock, but also one that merited some caution because it had been so cheap for so long, and for good reasons (it’s Argentina, and the company is majority controlled by the state, so the good reasons were mostly “the government”). And that performance has continued in the wake of Argentina’s surprising election, so the stock has doubled again since it topped the list a year ago…. and by any conventional metric you want to use, it’s still cheap. And still risky, for pretty much the same reasons that were clear in 2022.

Who’s on top of the pile this time around?

All of this data comes from our Teaser Tracking spreadsheets, which anyone can view, and we pulled the data on December 21 and ranked them by relative performance vs. the S&P 500 (so you don’t win just by being lucky and hitting the bottom of the broad market)… and our standard caveats apply: We don’t subscribe to these newsletters, this is based on the Thinkolator results for all the teasers we’ve investigated throughout the year (historically, the Thinkolator is right 99% of the time… but 99% and 100% are very different numbers). We also don’t know what an editor might have done with a stock after teasing it, whether they bought or sold since or said something different to their actual subscribers, we are left to assume they bought it on the day they were teasing it and held it forever.

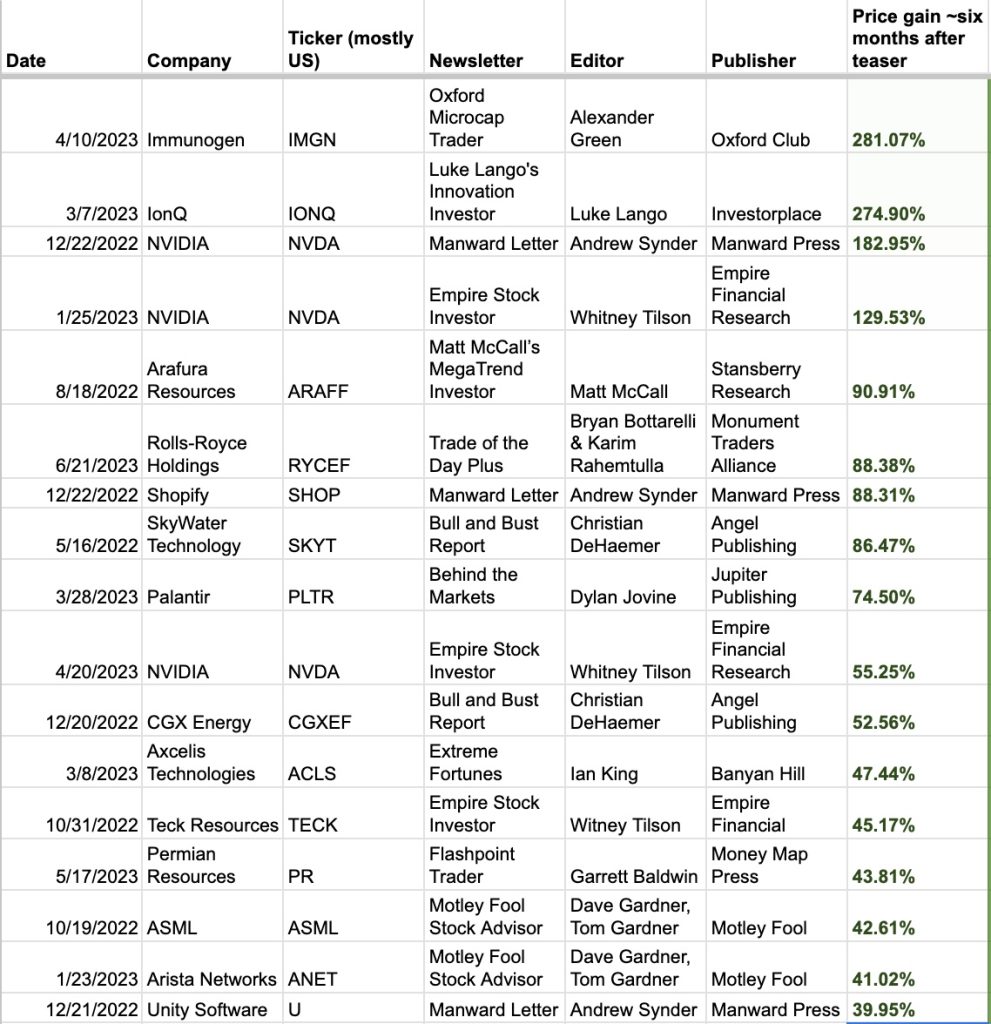

It’s also possible that by the end of the year on Friday, the rankings will be slightly different… but here are the top twenty teaser stocks of the past year (the date links to the original teaser solution article):

(And yes, as we do with the Turkey of the Year, we go back a bit to make sure that we give a stock time to percolate… so any great picks made in the closing months of 2022 were eligible for the list, as well, we really go back 14 months or so to try to avoid disadvantaging picks that happen be made in the Fall each year).

What stands out as interesting from this list?

There are several repeats — both Shopify (SHOP) and NVIDIA (NVDA) make the top twenty three different times, both were teased by Andy Snyder at Manward and Whitney Tilson at the (now defunct) Empire Financial, and both of them teased NVDA and SHOP in the same multi-stock pitches (Snyder was teasing them as “Metaverse” plays, just a couple months before the AI enthusiasm really took off — Tilson as “Everything On Demand” picks in January and then “A.I.” picks in April, around that theme started to really heat up). And in a repeat from last year, Rolls-Royce is again on the list — that pitch has been around for a long time, Karim Rahemtulla has been running similar ads since March of 2022 (and the stock has now gone up quite a bit since then).

And down near the bottom of the list we see one oil stock that was picked by two different pundits, too, and made the list mostly thanks to a takeover — Earthstone Energy (then ESTE) was acquired by Permian Resources (PR), and PR has held up pretty well in the past few months, so those are still beating the market despite a tough year for oil stocks. And we should probably set off some fireworks or something, because this is the rare example of a predicted takeover offer actually coming through — Garrett Baldwin teased five different oil stocks back in May as takeover targets in the Permian Basin, and one of them actually was acquired, and at a price above where it was teased. And funny enough, he also teased Permian Resources as a takeover target in that same ad, and that did pretty well, too — only one of those five oil stocks is trailing the S&P 500 since May, so that’s pretty impressive. The other pundit to pick Earthstone was Marc Lichtenfeld, at around the same time, though he did so as part of a “commodities supercycle” pitch that teased some metals stocks that have done poorly, so the four stocks average out to almost even right now (Intrepid Potash (IPI) is also up pretty nicely, but Talon Metals (TLOFF) and DRDGold (DRD) drag down the results).

The far and away winner was a biotech stock, which has happened a few times — sometimes these stocks are almost like lottery tickets when investors are surprised by a big FDA approval or a successful clinical trial, and Alexander Green called a winner in Immunogen (IMGN) back in April, and that 600%+ gain stands head and shoulders above everything else. (As luck would have it one of the best picks was featured in one of my shortest articles… who knew?) That’s the only stock that kept NVIDIA from being the top teaser stock of the year.

And artificial intelligence (A.I.) was obviously a big driver of many of these stocks — it wasn’t Luke Lango’s primary reason for pitching IonQ (IONQ) the first time he teased that as an “Area 52” stock, back in March… but later in the year, IONQ definitely got the “quantum computing will enable the next leap forward for A.I. treatment, from Lango and others, and the stock delighted in the attention.

It wasn’t just market darling NVIDIA and IonQ, though, A.I. was probably a primary driver of most of the tech stocks that got a lift this year… and it was certainly behind the surge we saw from Palantir (PLTR), which Dylan Jovine touted for it’s “Living Software” and role in Ukraine, for the briefly-adored penny stock VERSES AI (VRSSF) pitched by Alex Reid (and also by Tobin Smith earlier in the year, at a price so much higher it almost qualified for the Turkey of the Year award last month).

And A.I. was also the theme for the tease of drug discovery stock Absci (ABSI), which has been relentlessly pitched by Alexander Green… and it’s partly luck that one of his teases hit our inbox when the stock was around $1.60 back in September and October, so that has shown a good gain with the stock spiking higher in the latest rally (he also teased it at over $2.50 a year ago as his “#1 Stock for 2023”, the latest variation of those ad presentations calls it his “#1 Investment for 2024,” so he’s apparently still on board, though the ads have never gotten updated much and it’s been called a “$3 stock” all year). ABSI was part of a five-stock microcap pitch from Alex Green back in December of 2022, I should note for some context, and the other four — Farfetch (FTCH), Amyris (AMRS), Zevia (ZVIA) and Wheels Up (UP) — have all done terribly… such is life with microcaps, I guess.

And with more speculative stuff like warrants — Nomi Prins has taken the reins of what used to be the Casey newsletter which focuses on warrants, and has pitched a bunch of different warrant investments over the past couple years… one of them ended up “winning” the Turkey of the Year this year, that was Lion Electric (LEV/WS), but another is also on this top-20 list in BigBear.ai (BBAI/WS) — the stock is essentially unchanged since she touted it in late August, but, helped by a huge spike after she recommended it, the warrants are still up pretty nicely (from about 25 cents to the 42-cent range at the moment). Still strikes me as silly leverage for a stock that would have to go up 500% or more before the warrants come into play, and her pitch was awfully misleading in calling this warrant a “26-cent microcap AI stock”, but math is math, and it’s on the list.

There are a few oddballs in the list that weren’t just riding along with the AI craze, too — Porter Stansberry made me grouchy with his pitch of Dream Finders Homes (DFH) back in the Spring, and it has worked out exceptionally well… and the Motley Fool’s microcap Canadian lending tech company Propel hits the list as well, sort of a North-of-the-border version of Upstart Holdings (UPST), I guess, so in truth that’s yet another pick that’s AI-fueled. That is also the most recent winner on this list, it was teased about six weeks ago… but it was also part of a multi-stock AI pitch for Motley Fool Canada, which included Docebo (DCBO) and Alphabet (GOOG, GOOGL), and those two larger companies have pretty much just tracked the S&P 500 during that time period.

What’s the impact of the calendar on these picks? Well, we do also track these stocks 10 days, one month, six months and one year after they were teased… so if we want to be a bit more scientific, and go back further (I don’t usually do this, but I’ve got spreadsheets on the brain), then the top picks six months from their recommendation/teaser date over the past year and a half or so, would give us a somewhat different list. Here’s what the top of that “six-months after it was picked” list would looks like, you can see that a few picks soared nicely, mostly because of a quick-moving trend, but didn’t stay among the leaders long enough to make our list — like SkyWater (SKYT) when uranium stocks were soaring, or CGX Energy (CGXEF) before Venezuela started talking about taking over Guyana and its offshore oil fields:

Not so say six months is the right timeframe — we also track these stocks over shorter and longer periods, out to three years… I won’t overwhelm you with yet more lists, but you can dig into those teaser tracking sheets from the past 16 years and see what you find. Let us know if there are any surprises (including bad ones — some of the data might be off if we missed a stock split or a bankruptcy from some many-moons-ago picks).

And finally, dear friends, we always want to think about the big picture — did the investment newsletter teaser pitches help or hurt during the past year, on average?

“reveal” emails? If not,

just click here…

Teaser stocks are almost always below average, as a group — if you bought every stock on the day it was teased, you would have done worse than if you had bought the S&P 500 on those days — but sometimes it’s pretty close. Typically, over the past 15 years, we’ve seen that less than a third of the teased stocks beat the market, more than half do worse than the market, and there’s a big chunk in the middle that is pretty close.

This year? Well, the pundits all said it was a good year for stock-pickers — and it really was! The average teased stock went up about 8.3%, and if you had instead bought the S&P 500 on those same days your return would have averaged 10.6%… so the teaser stocks only did about 2.3 percentage points worse than the proverbial “monkeys throwing darts,” which is better than we’ve often seen.

We’ve covered 218 teaser picks so far in 2023, and 100 of them are beating the S&P 500… which is pretty good, and better yet, 50 of them are outperforming the S&P 500 by more than 10%, and 27 of them by more than 25%. About half a dozen stocks have doubled this year out of 218, which is also more than usual… even if it’s a little depressing that there are only six “doubles”, since that tends to be the minimum kind of gains these newsletter teaser ads promise. Only about forty of these teaser picks have lost more than a third of their value, relative to the S&P 500, and — drum roll please — NONE have gone bankrupt! We often have one or two 100% losses from a bankruptcy or fraud of some kind, but not this year. Yet, at least. (It is likely that the Farfetch (FTCH) shares picked last December by Alex Green will probably go to zero, as the operating business is sold to Coupang and the press release says that “Upon consummation of the Sale, Farfetch Limited expects that holders of its Class A and B ordinary shares and its convertible notes will not recover any of their outstanding investments in Farfetch. Farfetch Limited is also expected to be delisted from the NYSE and to be liquidated”…. but it’s the season of miracles, and that hasn’t happened yet).

Whew. What a year.

Enjoy the break, everyone, Stock Gumshoe will be closed until January 2, and we wish you a very happy week and a Happy New Year. Thanks for joining us on these adventures in teaser-revealing and teaser-tracking as we try to help investors think for themselves, and please feel free to chime in below if you think any of the best pundit picks of the past year deserve some more attention — or if you think we missed somebody.

Disclosure: Of the companies mentioned above, I own shares of and/or options on Alphabet, NVIDIA, Shopify, Unity Software, Dream Finders Homes,