Here are some indicators of the weekly frequency of the real economy. Bloomberg Note that GDPNow (3/16) combined with a median SEP growth rate of 0.4% in 2023 implies negative GDP growth for three quarters starting in Q2. The latest figures below relate to the end of the first quarter.

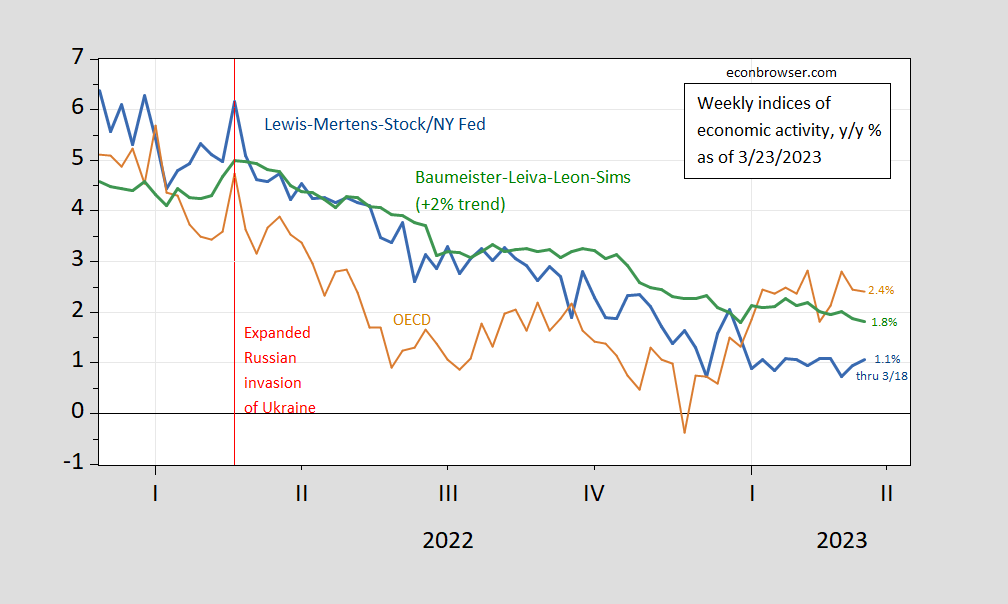

figure 1: Lewis-Mertens-Stock weekly economic index (blue), OECD weekly tracker (tan), Baumeister-Leiva-Leon-Sims US weekly economic conditions index plus 2% trend (green).Source: New York Fed via fred, OECD, WECIand the authors’ calculations.

For the week ended March 18, 2018, the Weekly Tracker continued to post strong gains, outpacing the WEI (1.1%) and WECI+2% (1.8%). A WEI reading of 1.1% for the week ended March 18 could be interpreted as a 1.1% year-over-year increase if the 1.1% reading persisted throughout the quarter. Baumeister et al. A reading of -0.02% is interpreted as a growth rate of -0.02% above the long-term trend growth rate. US GDP growth averaged around 2% over the 2000-19 period, so this translates to 1.8% annual growth through 3/18. The weekly OECD tracker reading of 2.4% can be interpreted as a year-on-year growth rate of 2.4% as of March 18.

Recall that WEI relies on correlations of ten series available at weekly frequencies (e.g., unemployment claims, fuel sales, retail sales), while WECI relies on a mixed-frequency dynamic factor model. The Weekly Tracker — at 2.4 percent — is a “big data” approach that uses Google Trends and machine learning to track GDP. As such, it does not itself depend on actual economic indicators.