Remark reader Indicates that it is worth revisiting the topic. consider:

If market information is efficient, corporate news events (such as earnings announcements) should be immediately reflected in stock prices. Now, actually checking stock price reactions to corporate events is also not as simple as it sounds. But Gene and his co-authors provided standard solutions to all empirical puzzles that still exist today. What followed was a large event-studies literature that enabled academic accounting to measure the impact of corporate events through associated stock price movements.

If market information is efficient, corporate news events (such as earnings announcements) should be immediately reflected in stock prices. Now, actually checking stock price reactions to corporate events is also not as simple as it sounds. But Gene and his co-authors provided standard solutions to all empirical puzzles that still exist today. What followed was a large event-studies literature that enabled academic accounting to measure the impact of corporate events through associated stock price movements.

Here is the discussion from Fama’s contribution. What is an event study?from Investment Encyclopedia:

Event study is an empirical analysis that examines the impact of significant catalyst events or contingencies on the value of securities, such as shares of companies.

now consider these note to respond this post:

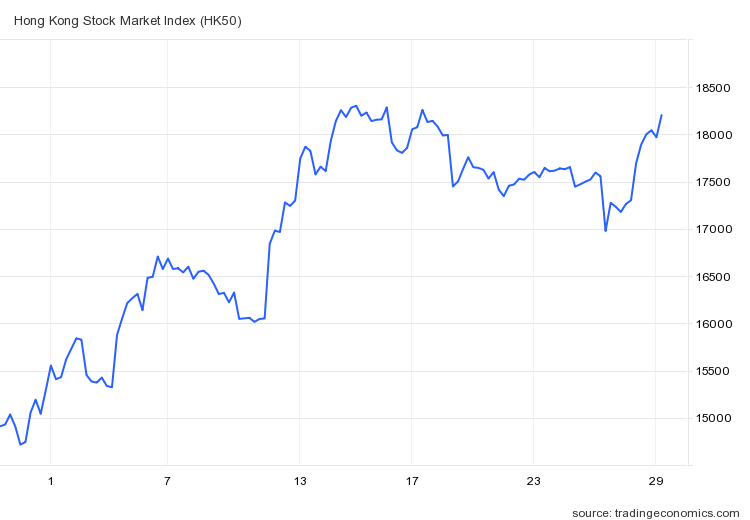

no update? The Shanghai Composite, USD/CNY and Hong Kong indices all recovered from the relatively modest losses of November 27th (eg only ~-2% for the Shanghai index and ~-3.8% for the Hong Kong index).

It is also important to note that Menzie’s carefully selected data sample amplifies the shock value of recent (temporary) losses. Looking at the same data set from just a month ago will show that this week’s decline is nothing more than a reversion to recent levels.

Beware of the alarm bells ringing by economists.

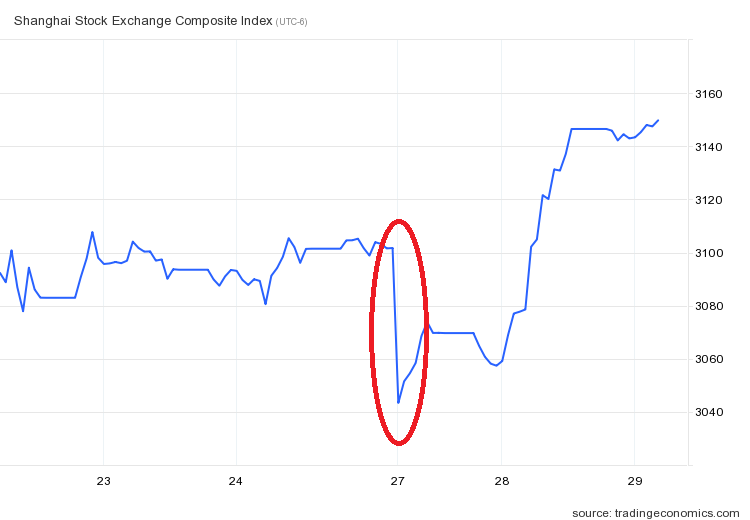

Here is an updated chart of the Shanghai Composite Index:

figure 1: Shanghai Stock Exchange 30 Index.

The events that I followed in my November 27th post are circled in red as the focus of my attention. The focus is on the outbreak of widespread protests as “news”, as detailed in the following week:

figure 2: Red circles indicate responses to protests.

For an example of an application of the “news” concept to efficient markets, see this positionTon.

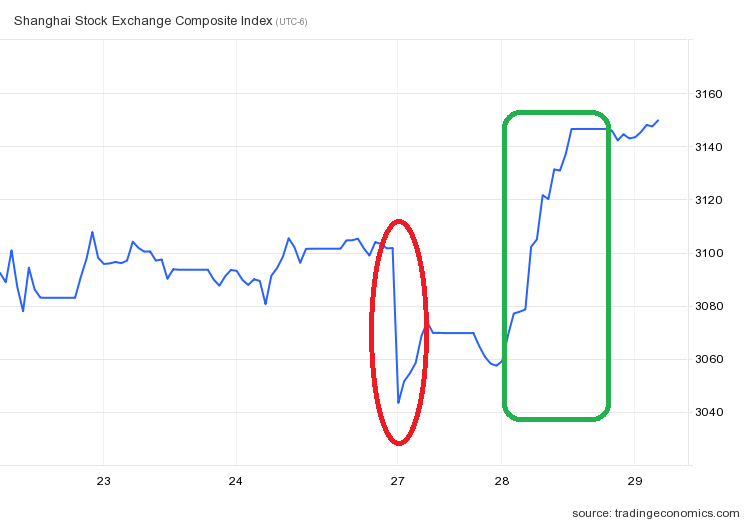

Readers focus on recovering lost ground on Tuesday (local time). However, nothing happened on Tuesday.Instead, as in wall street journal:

Hong Kong’s benchmark Hang Seng rose 5.2% to close higher on Tuesday after China’s national health authority downplayed the risk of an Omicron variant of the coronavirus and said it would increase vaccinations for the elderly.

The move shows that the government is still refining its approach to dealing with Covid-19, one of the top concerns of global investors. China’s strict Covid-19 policies have recently sparked protests across the country, which were partly to blame for Monday’s decline in Hong Kong and U.S. markets.

Strategists said Tuesday’s rally was also helped by China’s securities regulator easing restrictions on real estate companies raising equity financing in the domestic market, a source of funding they have been denied for years. Chinese developer Longfor was one of the best performers, rising more than 11 percent in Hong Kong.

…

China’s CSI 300 index rose 3.1% on Tuesday, while the Shanghai Composite rose 2.3%.

As shown in the green rectangle in the figure below:

image 3: Green rectangles indicate government support for policy measures in the real estate sector to increase vaccinations for the elderly.

In other words, not all other factors were held constant on Tuesday.

I don’t think I need to explain the concept, but apparently I do. here is an early application of the concept of “news” (again related to China, but this time with hogs)