Look at gas prices (and a few other things).

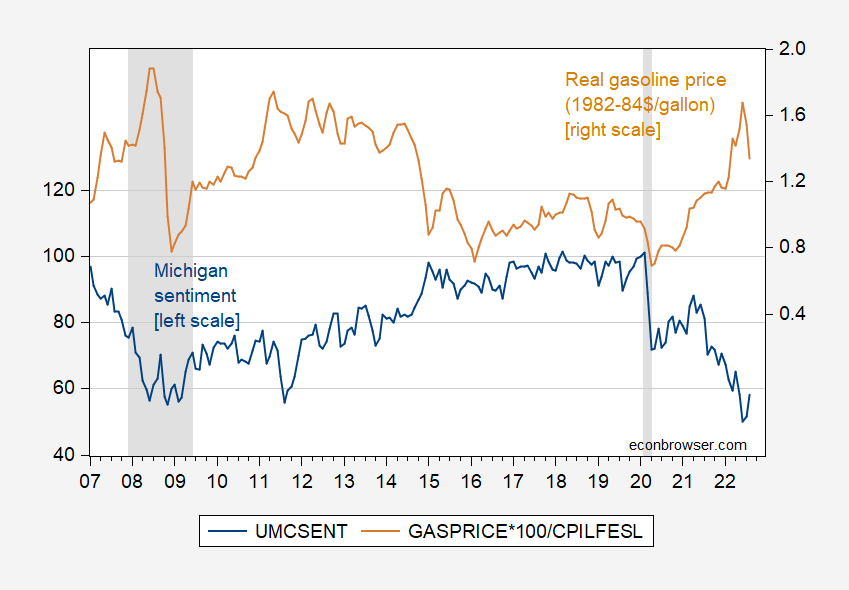

figure 1: University of Michigan consumer confidence index (blue, left scale) and real gasoline prices 1982-84 per gallon (tan, right scale). The NBER uses shades of grey to define the peak and trough dates of the recession. Monthly average weekly data on gasoline prices; Cleveland Fed August 2022 core CPI as of Sept. 4. Source: University of Michigan, BLS, EIA Calculations from FRED, Federal Reserve Bank of Cleveland, NBER, and authors.

During 2021M02-2022M08 (using the Cleveland Fed’s nowcast of core CPI for August), gasoline prices are believed to be a good predictor of household sentiment.

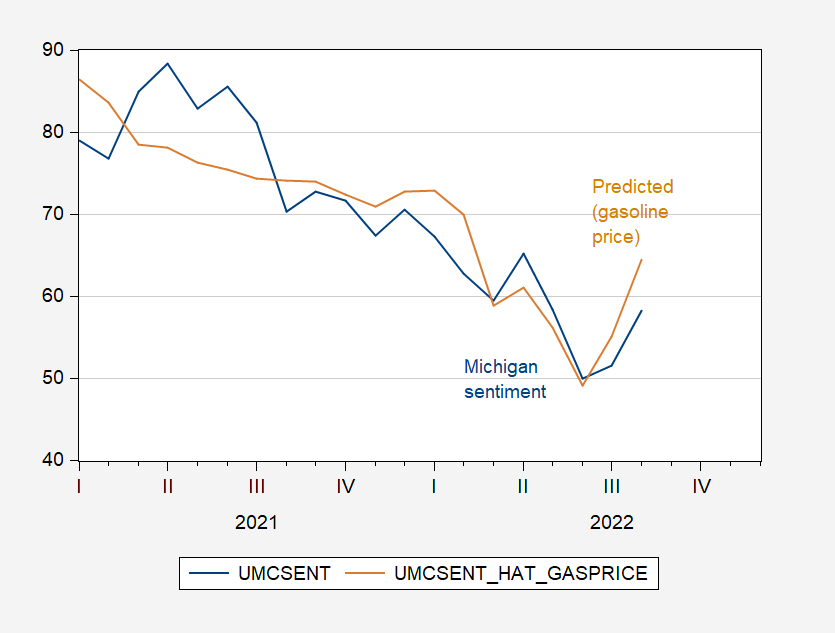

figure 2: University of Michigan Consumer Confidence Index (blue), 1982-84/gallon forecast using actual gasoline prices (tan). Monthly average weekly data on gasoline prices; Cleveland Fed August 2022 core CPI as of Sept. 4. Source: University of Michigan, BLS, EIA via FRED, Cleveland Fedand the authors’ calculations.

Adjusted R2 The regression coefficient of Michigan sentiment on real gasoline prices is 0.73 (so the correlation coefficient is about 0.86). One notable aspect is that sentiment has not rebounded as the model predicted (but the forecast is well within the plus/minus 2 standard error prediction interval).

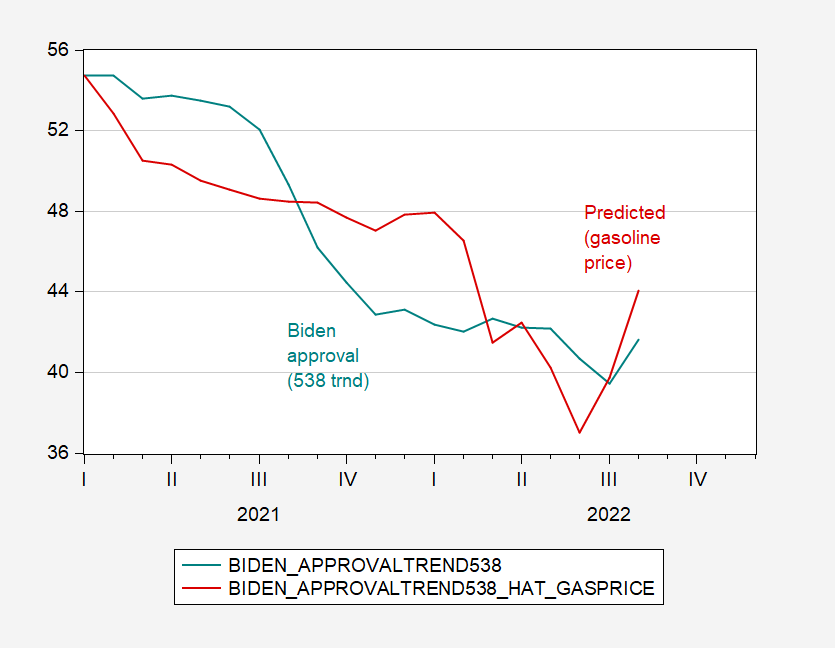

Interestingly, gas prices largely explain Biden’s approval ratings.

image 3: Biden’s approval rating among likely voters, starting at 538 (turquoise), using actual gasoline price forecasts of $1982-84 per gallon (tan). Approval ratings are monthly averages of daily values. Monthly average weekly data on gasoline prices; Cleveland Fed August 2022 core CPI as of Sept. 4. resource: five thirty eightBLS, EIA via FRED, Cleveland Fedand the authors’ calculations.

Adjusted R2 is 0.64, and the correlation coefficient between the two variables is about 0.81. For every $1 increase in gasoline prices in 2021, approval ratings will drop by 13 percentage points. Since the linearity of this relationship is not very attractive, take a look at the Biden-backed regression of logit, i.e. log(X/(1-X)) Where X is the support rate in decimal form. This won’t allow for negative or greater than 100% approval predictions, but it doesn’t happen to change the goodness-of-fit metric. Both specs suggest that the rebound is overrated.

So what’s the way of sentiment (and approval ratings)? From the February 2023 contract, gasoline futures prices are in backwardation (5% implied decline); by November 2024 (and beyond), oil prices are in backwardation.