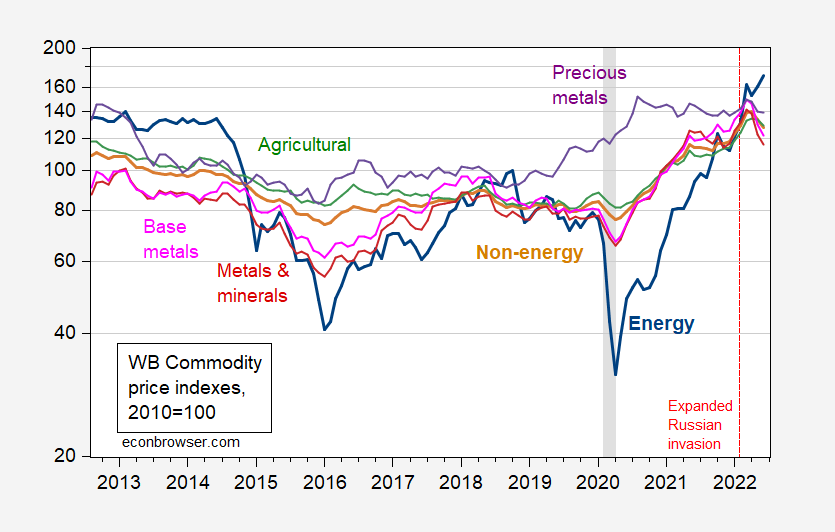

Commodity price indices have fallen through June, with the exception of energy. Front-month futures prices point to further easing of upward pressure on commodity prices, including energy.

figure 1: Commodity price indices for energy (bold blue), non-energy (bold tan), agriculture (green), metals and minerals (red), base metals (pink), precious metals (purple), 2010 All=100 , all on a logarithmic scale. The last observation was in June. The NBER uses shades of grey to define the peak and trough dates of the recession. resource: World Bank Accessed July 24, 2022 and NBER.

Note that by June, all indices are down from their March/April peaks, saving energy (these are averages of daily data). As these charts show (both from Macrotrends), front-month futures show a downtrend for July.

Crude Oil – Brent

Natural Gas – Henry Center

wheat

corn

soybean

wood

platinum

palladium

Clearly, some futures prices do not follow these patterns; for example, natural gas in Europe:

Natural Gas – TTF Dutch (non-log scale)

Of course, it depends on market expectations, such as Russia’s actions on European gas supplies, the impact of sanctions on Russia’s oil exports, and what will happen to China’s energy demand and/or production in the face of a blockade.