Some people do this; some don’t.Revise Paper by me, Itohiro, with Robert Macaulay. From the summary:

Will the central bank rebalance its currency share? The answer is important, because the dollar’s dominant role in large official reserve holdings means that extensive rebalancing requires the central bank to buy (sell) depreciated (appreciated) dollars in order to stabilize its value against other major currencies. We hypothesize that more reserve holdings lead to more systematic investment by the central bank and make rebalancing in the face of exchange rate changes the norm. We use two polar case studies to illustrate this choice: The United States has obviously not rebalanced its small foreign exchange reserves; Switzerland has indeed rebalanced its huge reserves, so changes in exchange rates will not affect its currency distribution. Our hypothesis is partially supported by the global aggregated data. They reject non-rebalancing and complete rebalancing, and point out that emerging market economies are the source of the overall result. We also used panel data to test the rebalancing, and found that our sample economies performed in an intermediate manner again on average, and were partially but not completely rebalanced. However, when the observation is weighted by the size of the reserve, the panel analysis found a complete rebalance. The various control variables and splits of the panel samples will not change the thrust of these findings. The central bank rebalanced its foreign exchange reserves extensively but not uniformly.

The most substantial innovation is the use of panel data to observe how various central banks and government agencies that hold foreign exchange reserves manage the composition of reserves.This is a unique data set that represents the Ito and Macaulay (2020), Discussing This post (Expanded from 58 countries to 74 countries, 1999-2018 to 1998-2020).

Third, a panel analysis of more than 70 economies also found that the central bank has generally rebalanced partly. When separately analyzing developed markets and emerging markets, there is no significant difference in their behavior.

Fourth, when we weight the group observations by the size of the reserve, the result is a complete rebalance. From this perspective, the Swiss approach is more suitable for large reserve holders than the US approach. This finding is consistent with large reserve holders making reserve management more like private portfolio management.

Fifth, the rapidly growing reserves are related to a higher share of the dollar. We interpret this to reflect the U.S. dollar as the dominant (“carrier”) currency in the foreign exchange market: most central banks buy U.S. dollars and then diversify their investment in the target currency over a period of time. In contrast, there is little evidence that financial market volatility affects rebalancing.

In summary, the strong recommendation is to link the size of the reserve with rebalancing. In the case study, Switzerland has a lot of reserves and rebalance; the United States, moderate reserves, don’t rebalance.In the aggregated data, rebalancing seems to be more characteristic [Emerging Market Economies] Emerging market economies, some of which hold very large reserves. In panel data, when the observations are weighted by the size of reserves relative to GDP, rebalancing is the norm.

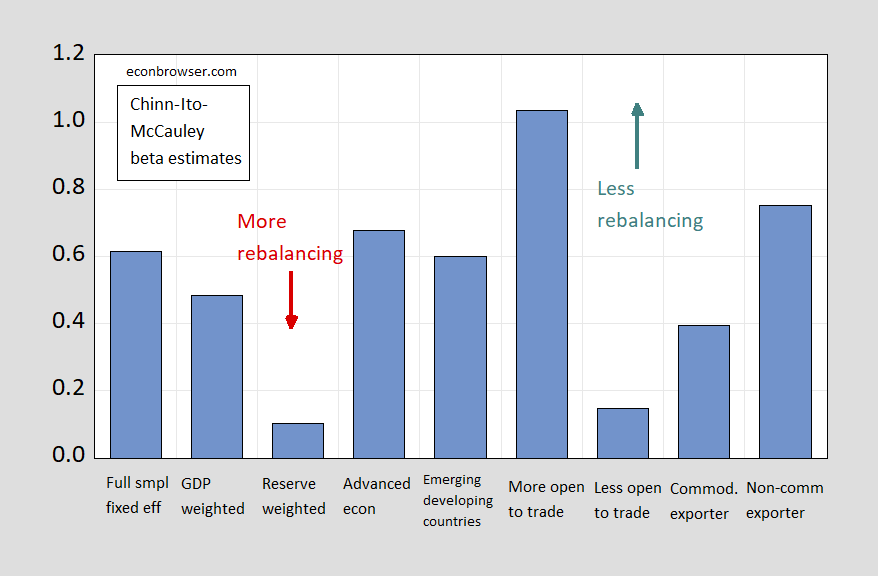

After stratifying the sample, we also find that closed-trade economies will rebalance, while open-trade economies will not; commodity exporting countries tend to be more inclined to rebalance than non-commodity exporting countries (the difference in the latter is not statistically significant ).

Some of these estimates are summarized in Figure 1 (a higher value means no rebalancing, a lower value means rebalancing).

figure 1: The regression coefficient of the change in the U.S. dollar share to the change in the valuation of the U.S. dollar share. source: Chin, Ito and Macaulay (2021), Table 4, 5.

What is the macroeconomic impact? If enough central banks with sufficient reserves make adjustments to changes in exchange rates, the value of dollar assets, such as bond yields and the dollar itself, may be affected. The back of the envelope calculation:

A 10% depreciation of the U.S. dollar may result in $15-200 billion in U.S. dollar purchases. The impact on foreign demand for U.S. Treasuries immediately followed.

The paper can also be used as NBER Working Paper Number 29190.