Term spreads rose slightly, yields (nominal and real) fell, and risk indicators rose.

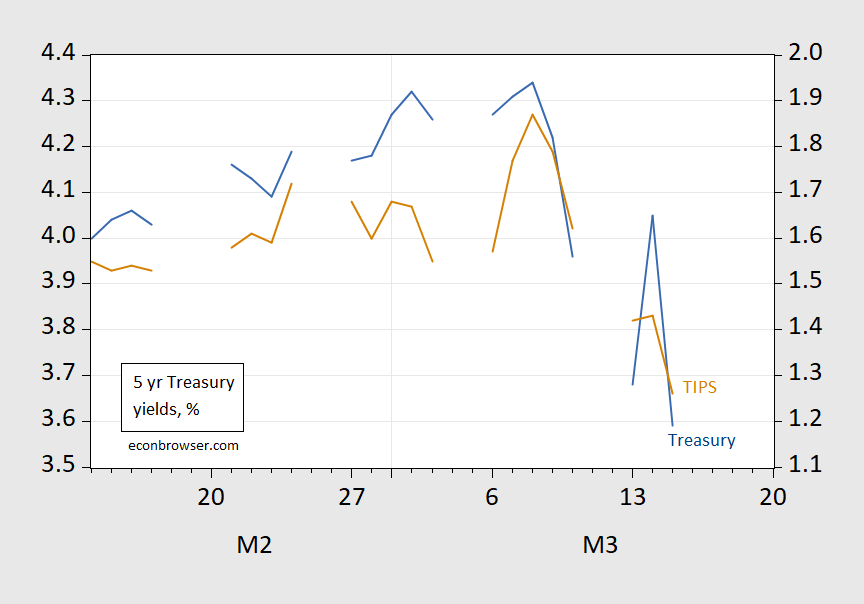

A nominal interest rate has fallen; so has a real interest rate, suggesting that most of the change is an expected change in future economic activity.

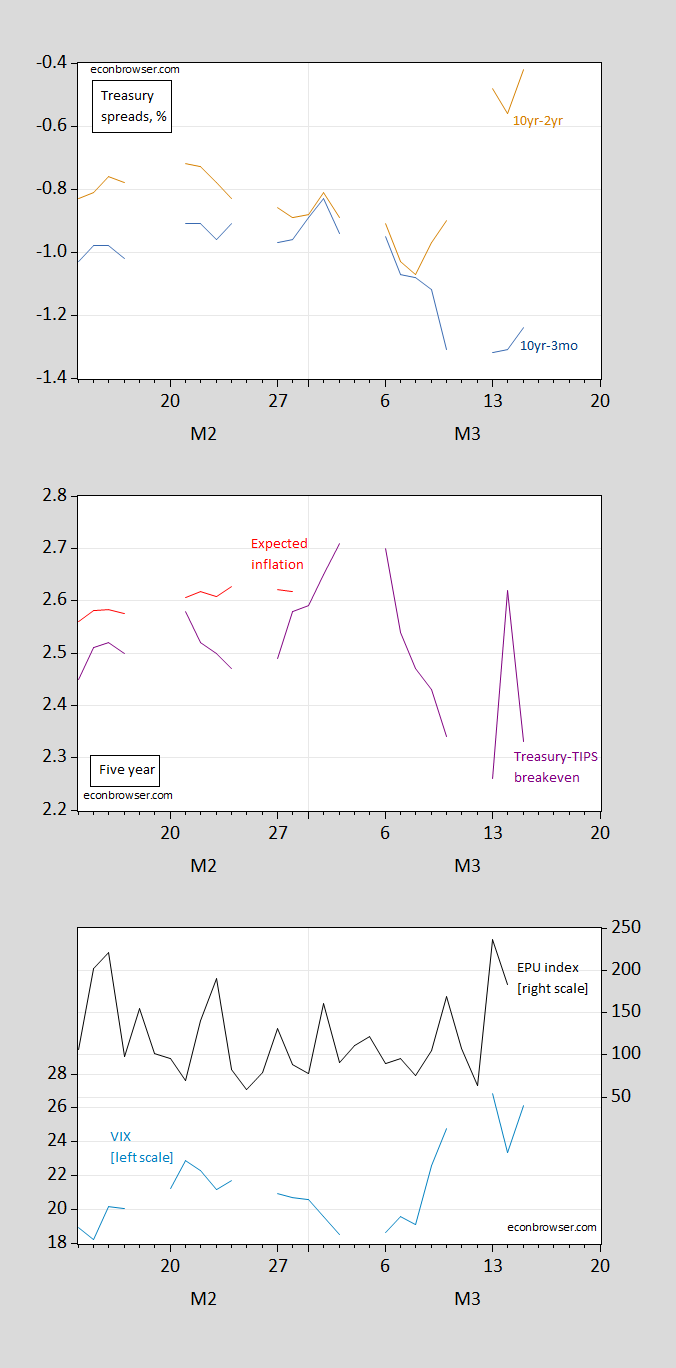

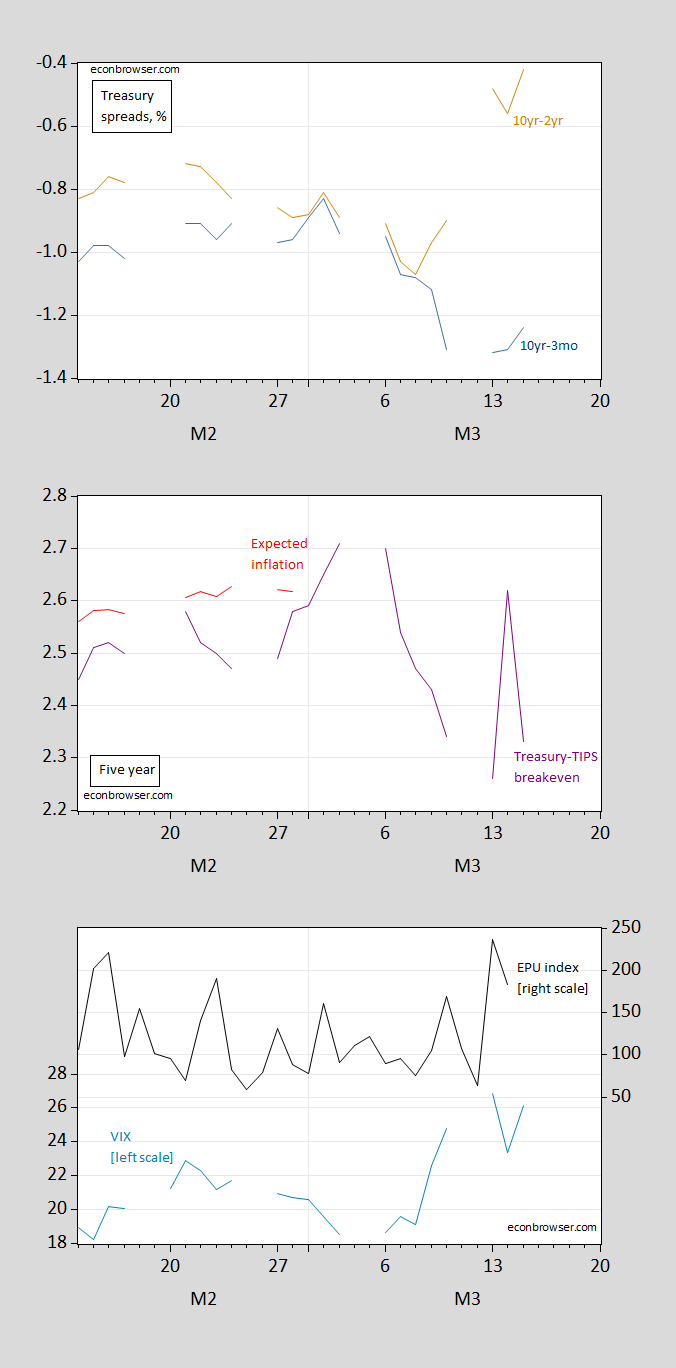

figure 1: Top: 10-3M Treasury spread (blue), 10-2Y spread (tan), both in %; Middle: 5-Year Treasury-TIPS spread (purple), 5-year Period spreads adjusted for liquidity and risk premiums (red); bottom panels: VIX (sky blue, left scale), EPU (black, right scale). Source: Treasury via FRED, kilowatt Follow D’amico, Kim and Wei (DKW), CBOE via FRED, policyuncertainty.com.

Five-year yields fell 46 basis points today, while two-year yields fell 27 basis points. Actual or nominal effect? These are the corresponding 5-year nominal and real interest rates.

figure 2: Five-Year Treasury Yield (blue), TIPS (tan), all in %. Source: Treasury via FRED.

Last week, nominal 5-year rates fell by 75 basis points, while TIPS yields fell by 61 basis points.This suggests a real recession – which, of course, could be driven by the outlook for the real economy or expectations of Fed policy tightening (see Previous post on the implied path of the federal funds rate).