Last week, personal income and consumption for May, and sales data for manufacturing and trade in April were released.

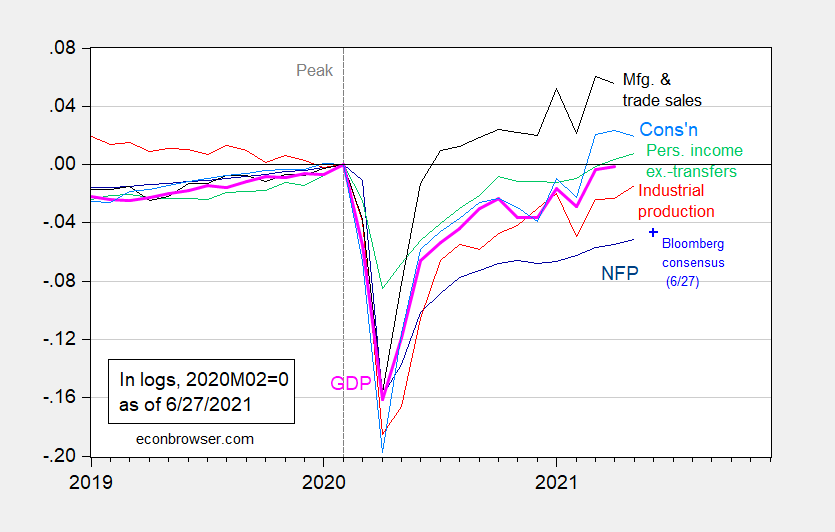

figure 1: The number of non-agricultural employment released in May (dark blue), as of June 27, Bloomberg agreed on the number of non-agricultural employment in June (light blue +), industrial production (red), excluding the 2012 Chapter 2 transfer Personal income (green), manufacturing and Ch.2012$ trade sales (black), Ch.2012$consumption (light blue) and Ch.2012$ monthly GDP (pink), all logarithms are normalized Turn into 2020M02=0. Source: BLS, Federal Reserve, BEA, calculated by FRED, IHS Markit (nee Macroeconomic Advisers) (released 6/1/2021), NBER and author.

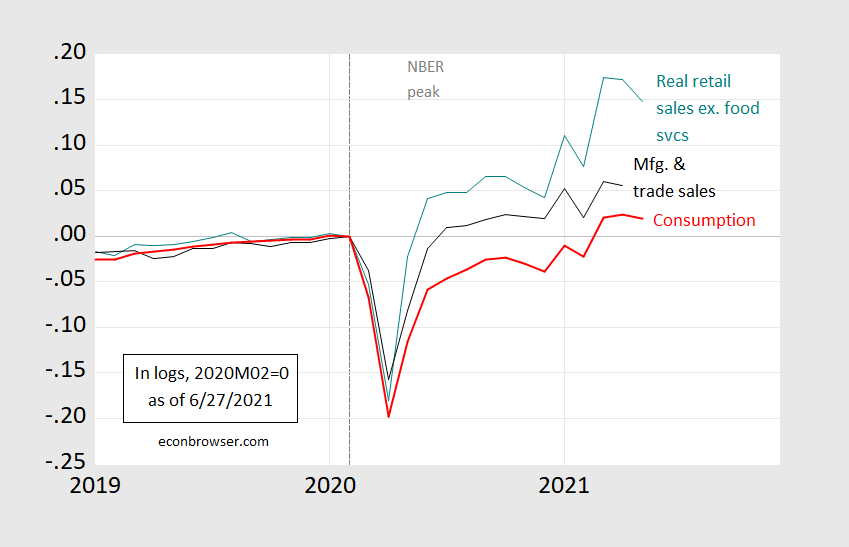

As suggested before retail sales.Food (discussed here postal), sales and consumption in the manufacturing and trading industries have both fallen, although in both cases are moderate. This is an updated version of the chart in this post.

figure 2: 1982-84 does not include food service retail sales (blue-green), 2012 manufacturing and trade sales (black), and 2012 consumption (red), all of which are logs, 2020M02=0. Retail sales (excluding food) are reduced using CPI-all. Source: Census, BEA, BLS, St. Louis Fed via FRED, and author’s calculations.

The consensus (Bloomberg) is that the number of non-agricultural employment released in June (July 2) continues to increase, reaching 675,000. Assuming that the level in May is not revised, employment will still be 4.7% below the peak level (in logarithm).

Nowcast for the second quarter: Atlanta GDPNow is 8.3% (6/25), New York Fed is 3.4% (6/25), IHS-Markit is 8.1% (6/25).