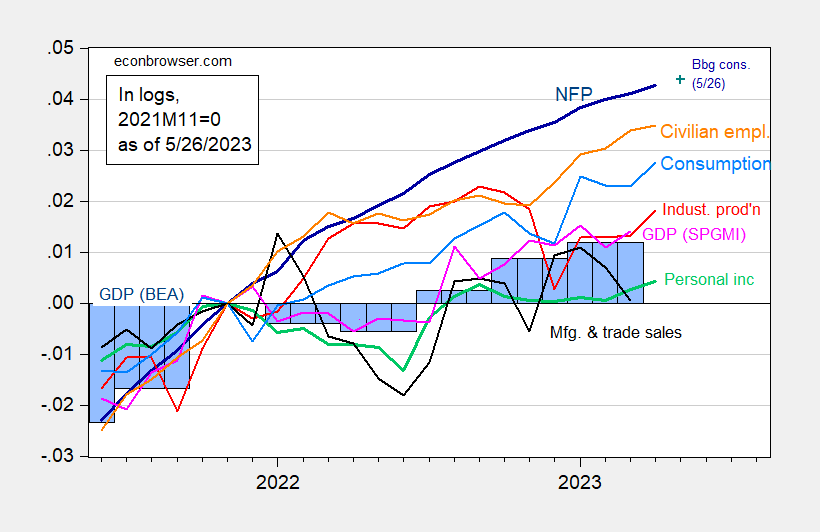

Monthly indicators such as employment, consumption, and personal income (net of transfers) all rose in April. But GDO and GDP+ show a decline in 2022Q4 and 2023Q1.

figure 1: Non-farm payrolls, NFP (dark blue), Bloomberg 5/26 consensus (blue+), civilian employment (orange), industrial production (red), China 2012 personal income excluding transfers (green), manufacturing and Trade Sales Ch.2012 USD (black), Ch.2012 USD Consumption (light blue) and Ch.2012 USD Monthly GDP (pink), GDP (blue bars), all log normalized to 2021M11=0. The Bloomberg consensus level is calculated by adding the forecast change to the previously unrevised level of available employment at the time of the forecast. Source: US Bureau of Labor Statistics, Federal Reserve, BEA 2023Q1 Second Edition via FRED, S&P Global/IHS Markit (nee Macroeconomic Consultant, IHS Markit) (5/1/2023 release) and the authors’ calculations.

Given the NBER Business Cycle Dating Committee’s emphasis on employment and personal income, one would be fairly confident that there will be no recession through April 2023, bearing in mind of course that all of these numbers are subject to revision over time. In particular, GDP will be revised multiple times, so an increase in the series will not be as decisive in ruling out a recession (as a decline in 2022Q1-Q2 would be).

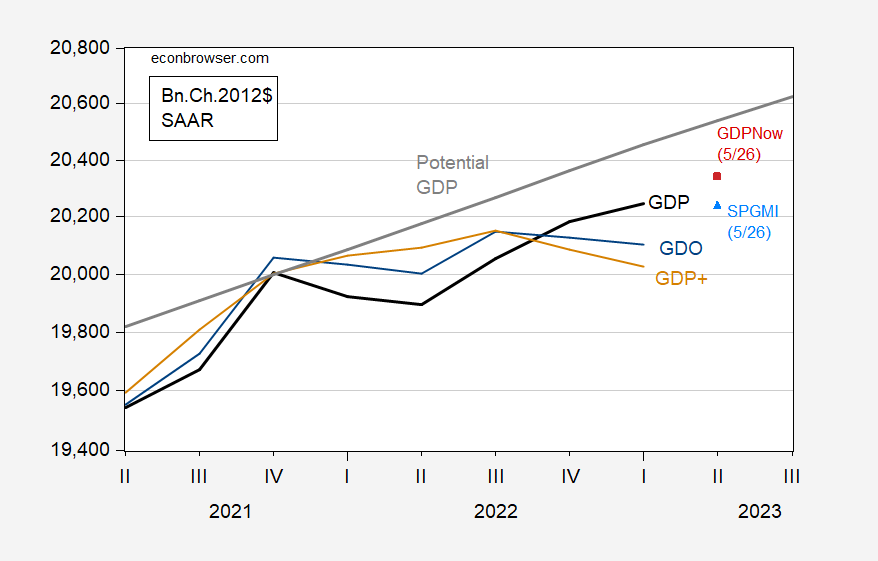

We know that reported GDP is not actually the best indicator of where GDP will eventually be revised. GDO and GDP+ are two series that are more likely to meet this condition. Here we see some disturbing signs.

figure 2: GDP (black), GDO (blue), GDP+, scaled to Q4 2019 (tan), potential GDP (gray line), GDPNow at 5/26 (red squares), SPGMI tracked at 5/26 (sky blue triangles), bn.Ch.2012 $ SAAR. Source: Bank of East Asia, Federal Reserve Bank of PhiladelphiaCBO (February 2023), Federal Reserve Bank of AtlantaS&P Global Market Insights and author’s calculations.

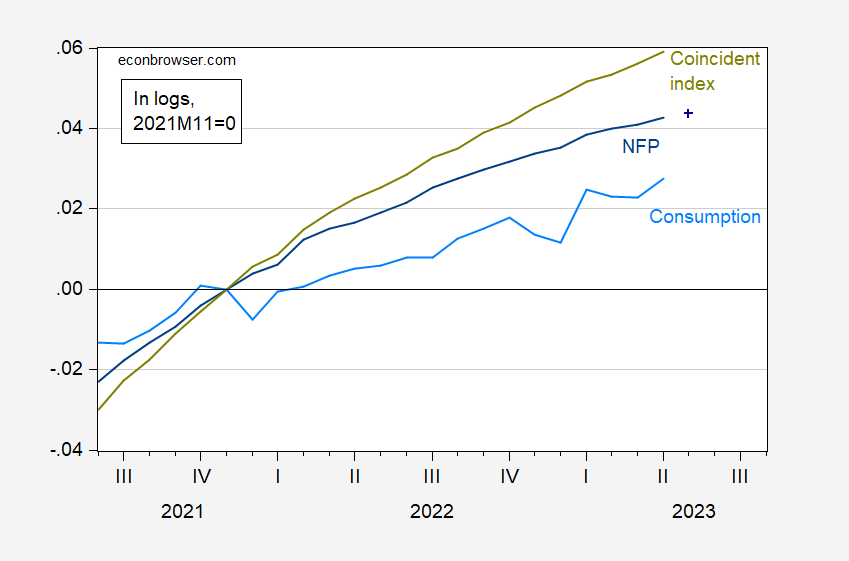

While GDP was revised up to 1.3% SAAR, GDO (the average of GDP and GDI) and GDP+ were -0.5% and -1.2% SAAR respectively.as Jason Furman It has been noted that the divergence between GDP and GDI is very large, highlighting the uncertainty we face in discerning trends in economic activity. This shows a difference in the bean counting exercise As he points out, if these are the only series we observe, we’ll look at GDO. But, again, we have a lot of evidence about the strength of the labor market. An aggregate indicator is the Philadelphia Fed Coincidence Index in the United States. In Figure 3, I show the coincident index compared to non-farm employment and consumption.

image 3: Coincidence index (yellow green), non-agricultural employment (blue), Bloomberg consensus 5/26 (blue +), consumption (sky blue), all logarithmic, 2021M11=0. Sources: Federal Reserve Bank of Philadelphia, Bloomberg, BLS, and BEA from FRED, and authors’ calculations.

The Coincident Index is largely based on labor market indicators and has continued to rise, even in the first half of 2022, when some observers believe a recession has already arrived. Consumption, largely supported by salaries and wage payments, has also grown sharply over the past year-and-a-half and unexpectedly rose in April.

So, in conclusion, uncertainty reigns!