With consumption (0.2% nominal vs. 0.4% consensus) and personal income released in May, we have the following snapshots of some of the key metrics the NBER BCDC followed.

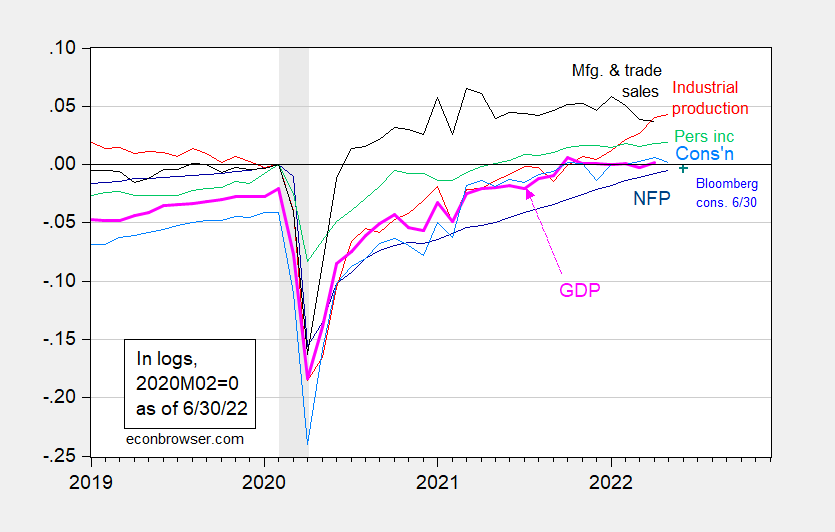

figure 1: Nonfarm payrolls (dark blue), Bloomberg consensus on NFP (blue+), industrial production (red), 2012 personal income excluding transfers (green), 2012 manufacturing and trade sales (black), Consumption is in Ch.2012$ (light blue) and monthly GDP in Ch.2012$ (pink) is normalized to 2020M02=0. NBER defines the decay date, peak to trough, shades of gray. Sources: BLS, Federal Reserve, BEA, via FRED, IHS Markit (nee Macroeconomic Advisers) (published June 1, 2022), NBER, and author’s calculations.

Three of the four indicators for which we have May data are still rising, while real consumption is falling. The 0.2% m/m drop in consumption was surprising, but not unprecedented; it fell by 1.4% m/m in December 2021. This is the breakdown of actual consumption, and the change in actual consumption.

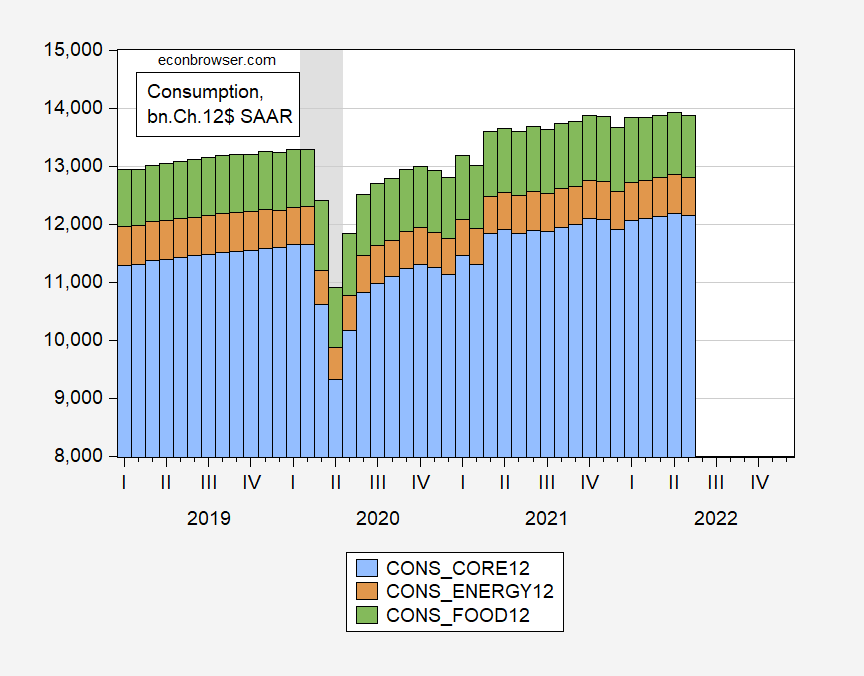

figure 2: Non-food non-fuel consumption (blue), energy commodity consumption (tan) and food consumption (green) in billions Ch.2012$ SAAR. Source: Bank of East Asia.

Here are the details on the changes in consumption:

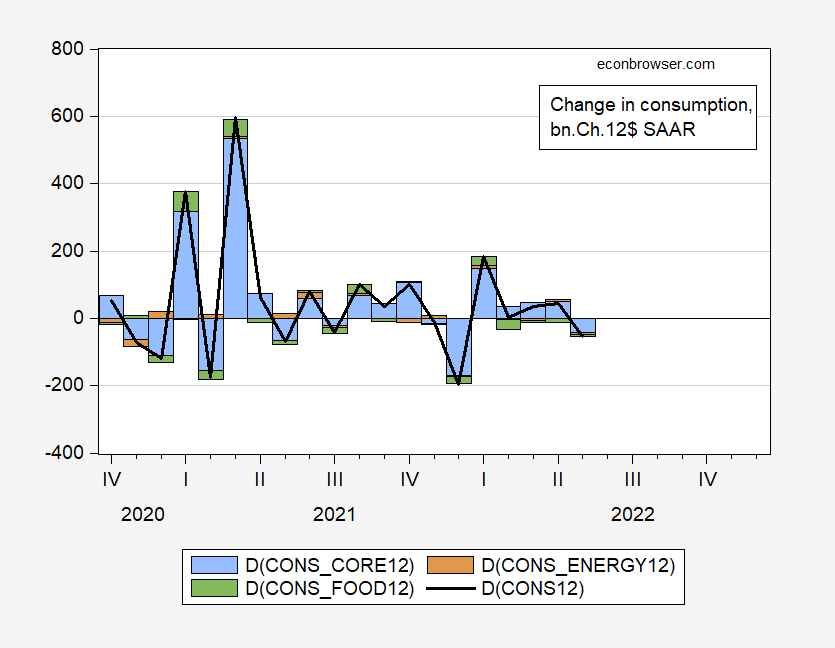

image 3: Changes in non-food non-fuel consumption (blue), energy commodity consumption (tan) and food consumption (green) in billions Ch. 2012 $ SAAR. Source: Bank of East Asia.

Consumption fell across all categories, although numerically, declines in core consumption accounted for most of the change (which makes sense as core consumption accounts for about 87% of the total).

In nominal terms, the share of non-core spending rose from 4% to 4.9% from the first quarter of 2021 to the first quarter of 2022, so higher energy and food prices are sure to squeeze core spending.

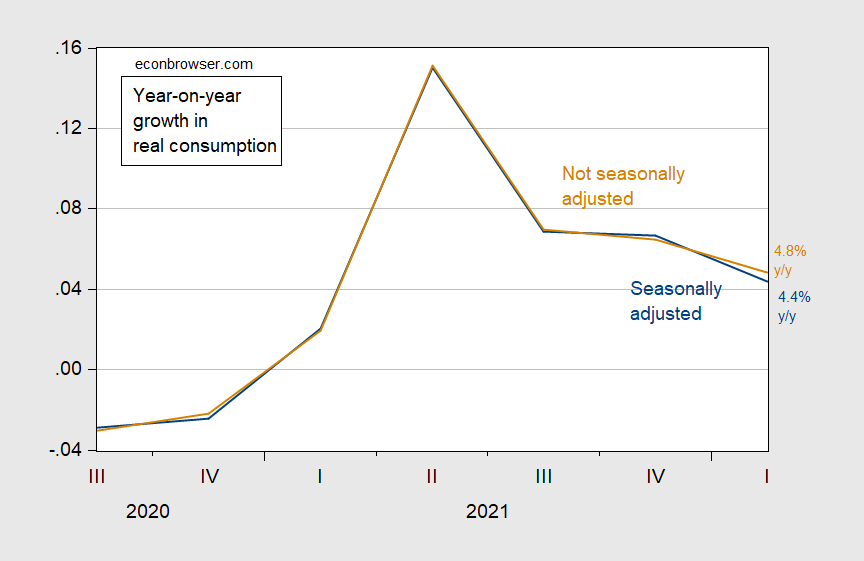

I think it will be interesting to see how the post-recession seasonal adjustment in 2020 affects our understanding of consumption growth. It turns out that the y/y change is different for the non-seasonally adjusted series and the (standard) seasonally adjusted series (which is usually not the case from 2014 to 2019):

Figure 4: Year-on-year growth in consumption (blue), not seasonally adjusted consumption (brown), calculated as log difference. Source: BEA, author calculations.

This suggests caution in interpreting high-frequency growth (seasonally adjusted annual growth of 3.5% versus 4.1% for real GDP).

appendix:

In the second quarter, GDPNow was -1.0%, IHS-Markit, -1.5%; Goldman Sachs +1.9%.