reader john h.* quotes politician

EU officials have attacked Joe Biden over sky-high gas prices, arms sales and trade as Vladimir Putin’s war threatens to undermine Western unity.

…“The fact is, if you look at it dispassionately, the country that stands to gain the most from this war is the United States, because they sell more gas at a higher price, and because they sell more weapons,” said a senior officials told POLITICO. “

While this quote is quoted verbatim from Politico, it’s not clear to me that gas prices are sky-high in the European context. Below is data for US natural gas futures (blue line) and Dutch TFF futures (green line).

figure 1: US natural gas USD/MMbtu (blue, left scale) and TTF natural gas EUR/MWh (green, right axis). Source: Tradingeconomics.com, accessed November 29, 2022.

Prices are quoted in different units (Eur/MWh for TTF, USD/MMbtu for the US), so direct comparisons are not possible. TTF prices are still seen to be much lower than they were earlier in the year (though much higher than two years ago).

What about liquefied natural gas? Here, as I pointed out, the market is segmented due to transport capacity and ability to convert from liquid to gaseous form. EIA Notes for the week ended November 16, 2016:

The trend of international natural gas futures prices in this reporting week was mixed. The weekly average futures price for East Asia liquefied natural gas (LNG) cargoes fell 85 cents to a weekly average of $27.06 per million British thermal units, Bloomberg Finance reported, while natural gas for delivery at East Asia’s Title Transfer Facility (TTF) Futures prices The Netherlands, Europe’s most liquid natural gas market, rose by an average of 15 cents to $34.10/MMBtu on a weekly basis.

Is this expected (as opposed to is this a “good” or “fair” outcome)?I’d say yes, given what we know about the market (see this postal). Quotes in the post are from Loreiro et al. (2022):

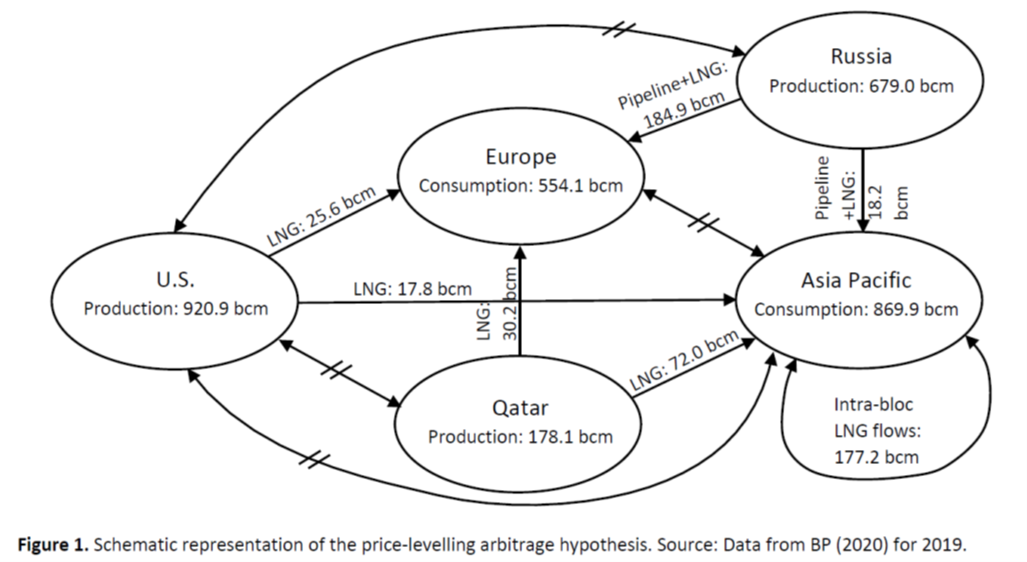

…[T]His research conducts a growth convergence test and cluster analysis on a panel of four established natural gas price benchmarks and two emerging benchmarks extended to the pre-Covid-19 period. The most important finding is that no gas price convergence was found outside of Europe. This occurs despite partial convergence events identified in the literature, reproduced and explained here. Importantly, the results strongly disagree with the hypothesis of increasing LNG flows as a price-balancing arbitrage mechanism.

Once you look at the relative flows from a few years ago, you can see why price equilibrium is unlikely.

resource: Loreiro et al. (2022)

* In case you’re wondering, yes, that’s JohnH who couldn’t be located Real Median Income Data located in what ONS data reportingand Ukraine suspected of Kherson action.

![“high altitude [natural] Natural Gas Prices…” | Economy Browser “high altitude [natural] Natural Gas Prices…” | Economy Browser](http://econbrowser.com/wp-content/uploads/2022/11/ttf_ngeu_compare_29nov22.png)