Joseph E. Gagnon with Madi Sarsenbayev In Peterson International Economic Research all an interesting article Is the economist or the market better at forecasting? They wrote:

Previous posts (here and here) indicate that long-term bond yields and long-term inflation compensation derived from bond yields are not good predictors of future inflation. Another article showed that economic forecasters are better at predicting inflation than consumers, but neither group is particularly accurate. This article compares the accuracy of the bond market and economists’ forecasts in the short and long term. The study found that although the short-term inflation compensation of bond yields is slightly more accurate than economists’ forecasts, economists are actually better at long-term forecasts.

I have been using the 5-year break-even point to extrapolate expected inflation in several posts. I think the commonly used indicators (mean error, root mean square error) for evaluating the standard break-even point will be interesting and adjusted for inflation risk and liquidity premium. (Unfortunately, I don’t have an economist to compare five-year forecasts).

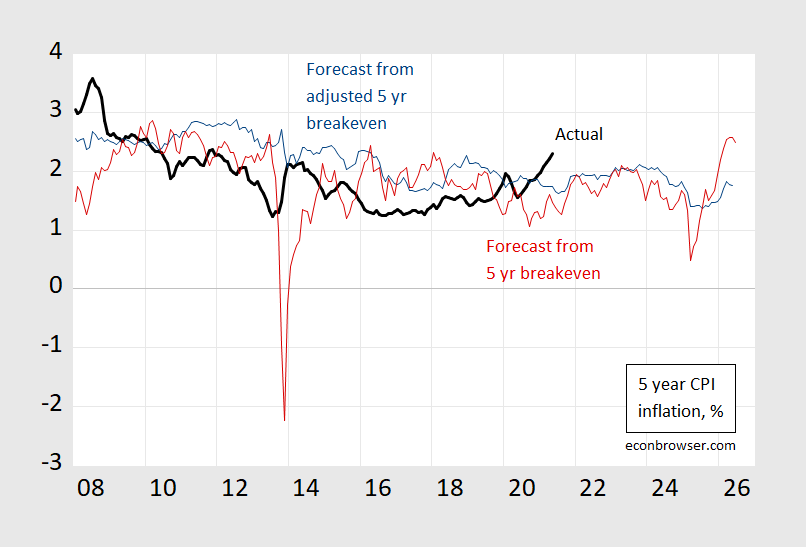

The following is an afterthought and the corresponding forecast.

figure 1: 5-year post-event CPI inflation, annualized (black), implied forecast of 5-year Treasury bond-TIPS spread (red), implied forecast of 5-year Treasury bond-TIPS spread adjusted according to inflation risk and liquidity premium , From DKW (blue), all in %. Source: BLS through FRED, Federal Reserve through FRED, Kunshan After D’amico, Kim and Wei (DKW) interviewed 6/4 and the author’s calculations.

Describe the adjustment method HerePlease note that for most of the past ten years, both forecasts have overestimated inflation. The unadjusted series was clearly missed at the end of 2013, and the adjusted series could not be matched, thus highlighting the advantages of the series.

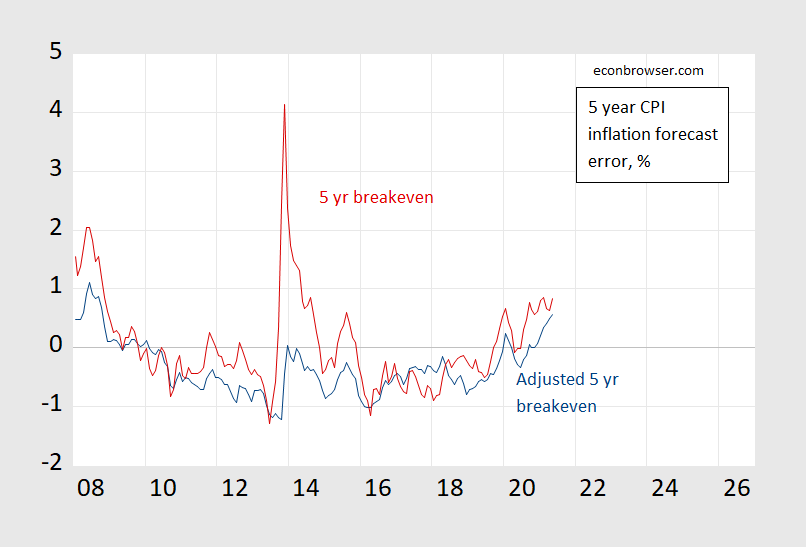

The corresponding prediction error is shown below.

figure 2: From the 5-year Treasury bond-TIPS spread (red) and the 5-year Treasury bond-TIPS spread adjusted according to inflation risk and liquidity premium, the 5-year CPI inflation forecast error from DKW (blue), both in% . Source: BLS through FRED, Federal Reserve through FRED, Kunshan After D’amico, Kim and Wei (DKW) interviewed 6/4 and the author’s calculations.

As a result of this model, although the average error associated with the unadjusted series is smaller in absolute value than the adjusted average (-0.06 pp vs. 0.35 pp), the root mean square error is larger (0.79 vs. 0.57). In addition, the adjusted series uses a significant slope coefficient of 0.81 and R-squared 0.28 to explain the actual CPI inflation; the unadjusted series produces a slope coefficient of 0.09, and the R-squared is 0.01.

Gagnon and Sarsenbayev also discussed the predicted performance of the unadjusted break-even point in the 2-year and 5-year range.

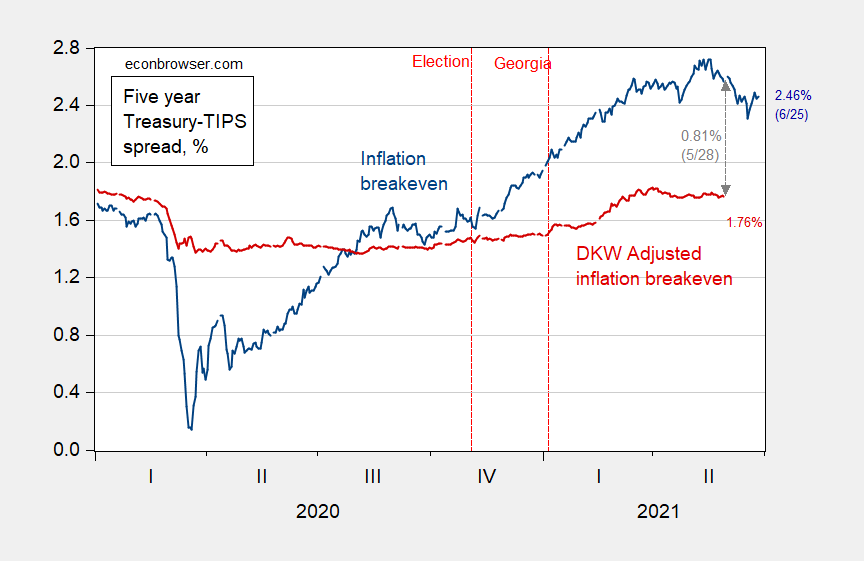

As of today, the five-year breakeven means that the average inflation rate for the next five years is 2.46%. At the end of May, the adjusted breakeven meant that the inflation rate was 0.8 percentage points lower than the unadjusted breakeven.

image 3: The five-year inflation break-even point is calculated as the five-year treasury bond yield minus the five-year TIPS yield (blue). The five-year break-even point is adjusted by the inflation risk premium and the liquidity premium per DKW, both in% unit. Source: FRB through FRED, Ministry of Finance, Kunshan After D’amico, Kim and Wei (DKW) interviewed 6/4 and the author’s calculations.