Here’s a summary of what I got while reviewing page 91 CMS Guidance on Reducing Inflation Act (IRA) Maximum Fair Price (MFP) Negotiations Posted about 10 days ago. Below, I summarize some of the key findings.

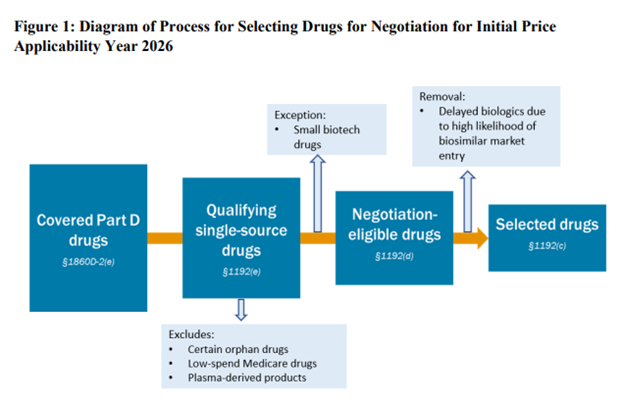

Choosing Drugs for Price Negotiations

Not surprisingly, CMS is looking for the highest cost drug of the 10 drugs to qualify for IRA initial price negotiations. Specifically, the FDA is looking for small molecules that have been on the market for 7 years and have no generics (so they can negotiate in year 9) or biologics that have been on the market for 11 years without biosimilars (so they can negotiate) in Year 13). The most costly drugs were those included in the Top 50 Eligible Single-Source Drugs for Total Part D Spend. These were determined using Part D prescription drug event (PDE) data.

There are a number of exclusions for drugs eligible for negotiation.

- orphan drug: CMS will not exclude all orphan drugs from price negotiations. Many drugs have an orphan indication, but also have another indication for a non-orphan disease. “CMS will exclude drugs or biologics that are designated as a drug for only one rare disease or condition under section 526 of the FD&C Act and are approved for only one (or more) indication(s) for such disease or condition”

- Low Cost Medicare Drugs. Drugs with a combined Medicare Part B and D cost of less than $200 million will not be negotiated. Note that this figure is not an inflation index. If not updated in time, fewer and fewer drugs will be eligible for this exclusion.

- Plasma Derived Products. These include any product derived from human whole blood or plasma.

- small biotechnology. CMS requires manufacturers to submit information about their products in order for the drug to be considered an exception under the small biotech rule. To qualify for exceptions, CMS requires (i) Manufacturer sales (based on PDE data)

- Biosimilar entry. The manufacturer of the biosimilar may request a one-year delay (“Initial Delay Request”) for the biosimilar to be entered. Biosimilar manufacturers also request a second initial price application year (“Additional Delay Request”). Therefore, the total potential delay is 2 years. The biosimilar manufacturer cannot be the same company as the reference drug (i.e. brand name) manufacturer.

drug negotiation process

As part of negotiations, CMS may consider many factors.These include non-FAMP prices, comparative effectiveness of selected drugs and their therapeutic alternatives

- medical progress: the extent to which the selected drug represents therapeutic advancement and the cost of such existing therapeutic alternatives compared to existing therapeutic alternatives for the selected drug;

- treatment options: FDA-approved prescribing information for selected drugs and their therapeutic alternatives;

- comparative effect. This includes the effects of selected medicines and their therapeutic alternatives on specific populations, including disabled, elderly, terminally ill, children and other patient populations (hereinafter referred to as “Specific Populations”).

- unmet medical need. The extent to which the selected drugs and therapeutic alternatives to drugs address unmet medical needs for which available therapies do not adequately address the treatment or diagnosis.

CMS explicitly states that it will not use QALY as part of the negotiation, declaring this information:

“Certain uses that place lower value on extending the lives of individuals in these populations, such as quality-adjusted life years (QALYs), will not be used in the negotiation process. If a study uses QALYs in the context of life Having clearly separated this use of QALY from reporting other evidence related to the factors listed in Section 1194 (e.g., clinical effectiveness, risk, harm, etc.) in paragraph (e)(2) of the act, CMS intends to consider Such separate evidence”

CMS is considering a variety of potential paradigms for setting drug prices, including:

- Part D net price and/or ASP of the selected drug’s therapeutic alternative, if available,

- The unit cost of production and distribution of the selected drug,

- The maximum price of the selected drug

- Domestic reference prices for selected drugs (e.g., Federal Supply Program prices),

- Establish “fair profit” prices for selected drugs based on whether R&D costs are recovered and profit per unit cost of production and distribution

However, they state:

“After considering these options, CMS intends to use the Part D net price (“Net Price”) and/or the ASP of the selected drug’s therapeutic substitute, as applicable, as the starting price unless this Net Price or ASP is higher than the statutory Cap, otherwise develop the main points of the MFP initial offer“

They continue:

“If there is one therapeutic alternative for the selected drug, CMS intends to use the net price of the therapeutic alternative, or ASP, if applicable, as a starting point and, if below the upper limit, to formulate CMS’s initial offer to the MFP. If multiple therapeutic options are available, CMS It is intended to consider the range of net price and/or ASP as well as the utilization of each treatment option to determine a starting point within that range. If there are no therapeutic alternatives for the selected drug, if the price of the identified therapeutic alternative is above the legal limit for MFP ( as described in Section 60.2 of this memorandum), or if there is a therapeutic alternative with a price above the statutory cap, then CMS intends to price the Determine the starting point for the initial offer.”

However, this initial price will be adjusted based on a number of factors.

- clinical benefit“Once the starting point for the initial offer has been determined and the evidence of clinical benefit has been considered, CMS intends to adjust the starting point for the initial offer based on the review of clinical benefit (this adjusted price is referred to herein as the “Initial Price”)”

- R & D costs. “If primary manufacturers do not recoup their R&D costs, CMS may consider adjusting primary”

- unit price: “If the unit cost of production and distribution is lower than the preliminary price, China Medical System may consider lowering the preliminary price, and if the preliminary price is close to the unit cost of production and distribution, China Medical System may consider adjusting the preliminary price upward”

- previous federal support. “CMS May Consider Reducing Preliminary Prices If Funding for Drug Discovery and Development Comes from Federal Sources”

- patent“CMS intends to consider the duration of available patents and exclusivity before the selected drug is no longer a single source. For example, if the selected drug has patents and exclusivity, which will last for several years, CMS may consider lower initial price

- commercial price. “If the average commercial net price is lower than the preliminary price, CMS may consider lowering the preliminary price”

Once a drug is available as a generic or biosimilar, that product will no longer be included in MFP negotiations for the next few years.

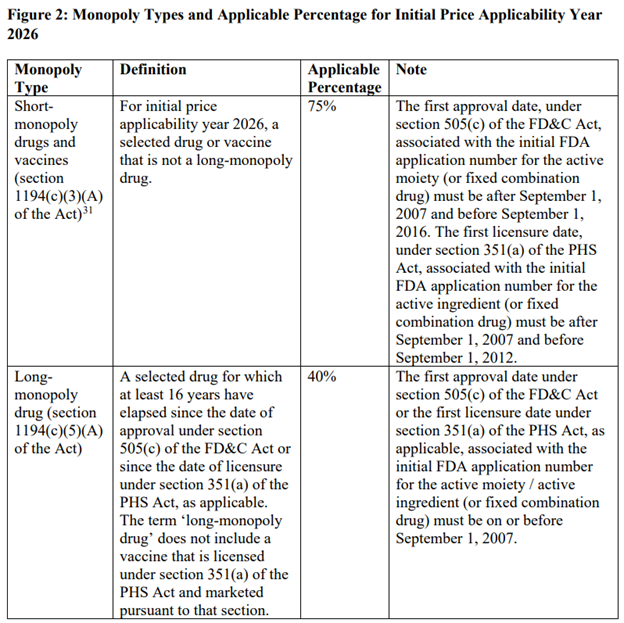

monopoly clause

The price reduction from the highest fair price will vary depending on whether the drug is short-term (12 years or less), long-term (more than 16 years) or somewhere in between. The table below describes this.

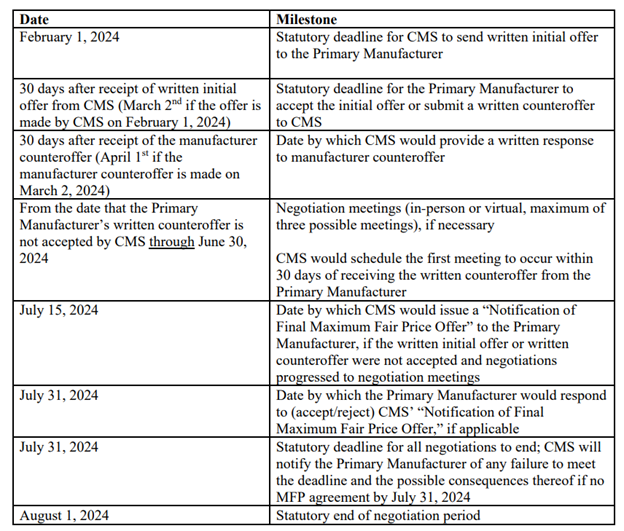

relevant date

Information that CMS will request from the manufacturer

The information that CMS requests from drug manufacturers in IRA drug price negotiations is:

- Drug prices in excess of what Medicare charges

- Non-Federal Average Manufacturer (Non-FAMP) Price: Section 1194(c)(6) of the act defines “average non-Federal average manufacturer price” as the average of non-FAMP (as defined in section 8126(h)) ( 5) The four calendar quarters of the year covered by title 38 of the US Code).

- Non-FAMP Units: Non-FAMP units are packaging units within the meaning of 38 USC Section 8126(h)(6).

- Research and development (R&D):

- Basic preclinical research fees

- Investigational New Drug (IND) Application Fee

- Completed a Phase IV trial required by the U.S. Food and Drug Administration (FDA)

- Abandoned and failed drug costs

- recover: Global total lifetime net revenue for selected drugs. Net revenue is revenue minus discounts, chargebacks and rebates.

- Prior Federal Financial Support. This includes tax credits, direct financial support, grants or contracts, and any other funding provided by the federal government to support discovery, research and/or development related to the selected drug.

- patent information. All pending and approved patent applications, including expired and non-expired patents

- Market data and sales

- Wholesale Acquisition Cost (WAC) Unit Price

- Average Manufacturer Price (AMP) Unit

- The price of 340B.These include the 340B Capped Price and the 340B Primary Vendor Program (PVP) Price

- Other federal government prices.These include: (i) Medicaid Best Price, (ii) Federal Supply Schedule (FSS) Price, and (iii) Big Four Price [i.e., price for Department

of Veterans Affairs (VA), DoD, the Public Health Service, and the Coast Guard]

- U.S. Commercial Average Net Unit Price (with and without Patient Assistance Program)

- Manufacturer’s Average Net Unit Price to Part D Program Sponsors (with and without Patient Assistance Program)

- income.This includes gross income, net income and net income without patient assistance programs

CMS also requires manufacturers to cover 8.1% of capital costs.