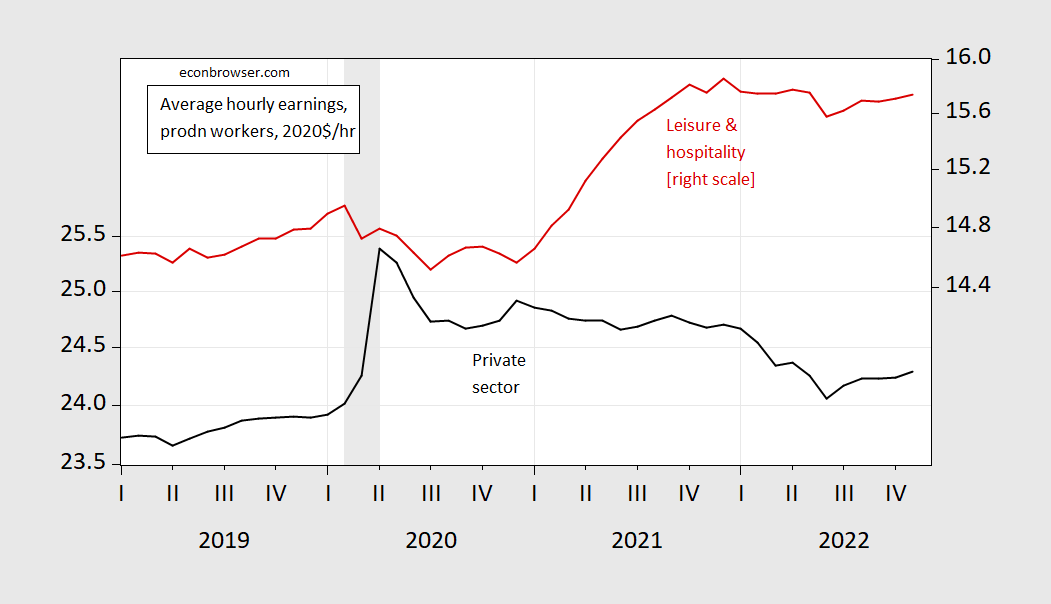

While recent reports have focused on the erosion of real wages by high inflation, average real wages in the private sector, as well as in the lowest paid leisure and hospitality workers, have indeed increased since February 2020.

figure 1: 2020 CPI deflation of real wages $/hour (production and non-supervisory workers) for the private sector (black, left log scale) and leisure and hospitality (red, right log scale). Using the Cleveland Fed’s November CPI nowcast for December 4, 2022. Dates of peak-to-trough recessions as defined by NBER are shaded in gray. Source: BLS via FRED, NBER and author’s calculations.

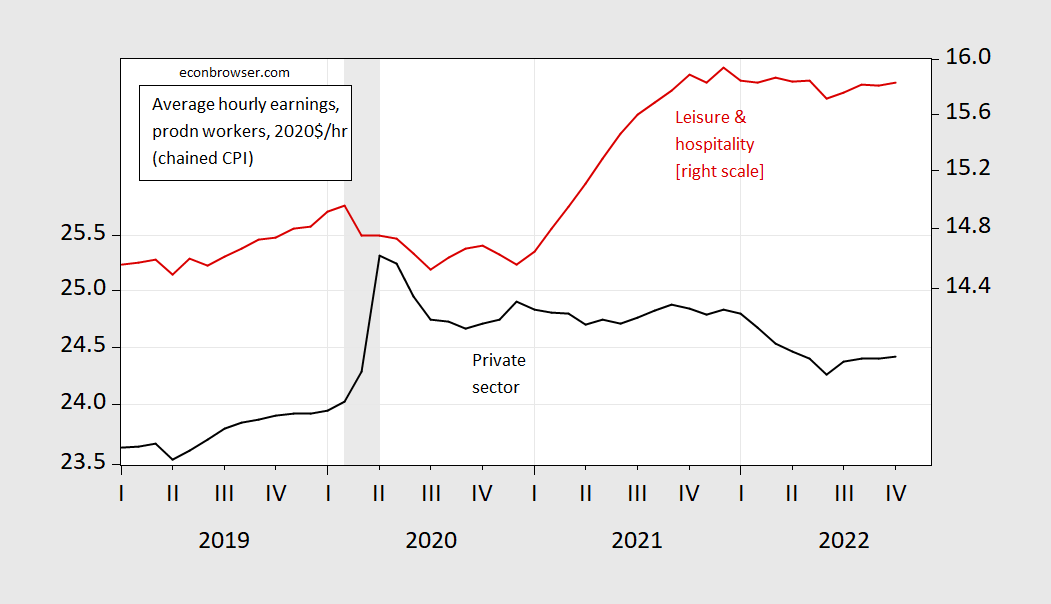

figure 2: Chained CPI deflation of real wages $/hour (production and non-supervisory workers) in the private sector (black, left log scale) and leisure and hospitality (red, right log scale) in 2020. The authors use Census X-11 to seasonally adjust chained CPI on log-transformed data. Dates of peak-to-trough recessions as defined by NBER are shaded in gray. Source: BLS via FRED, NBER and author’s calculations.

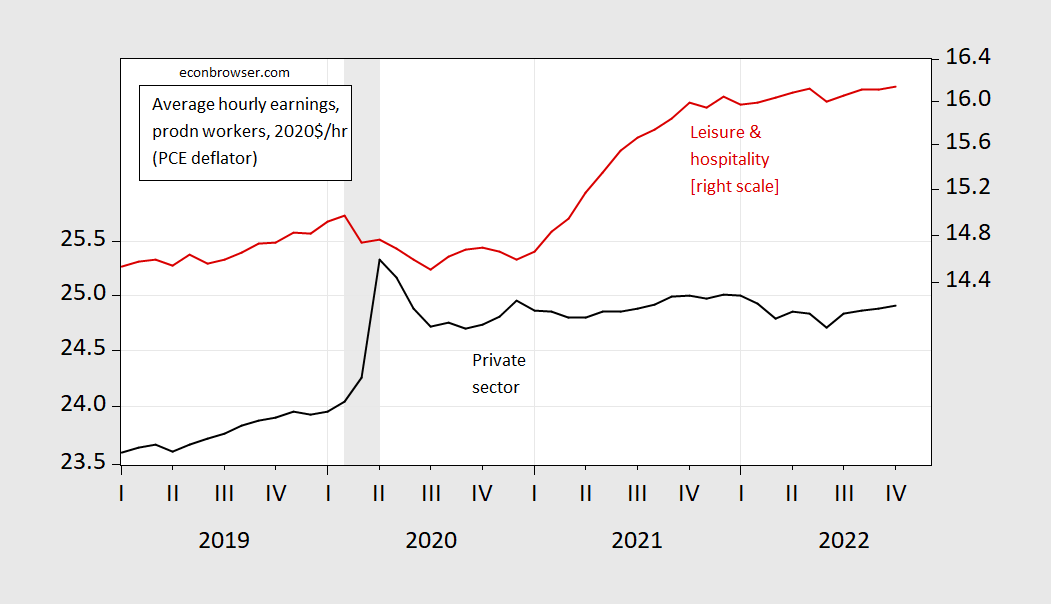

image 3: PCE deflated real wages, $2020/hour (production and non-supervisory workers) in the private sector (black, left log scale) and leisure and hospitality (red, right log scale). Dates of peak-to-trough recessions as defined by NBER are shaded in gray. Source: BLS via FRED, NBER and author’s calculations.

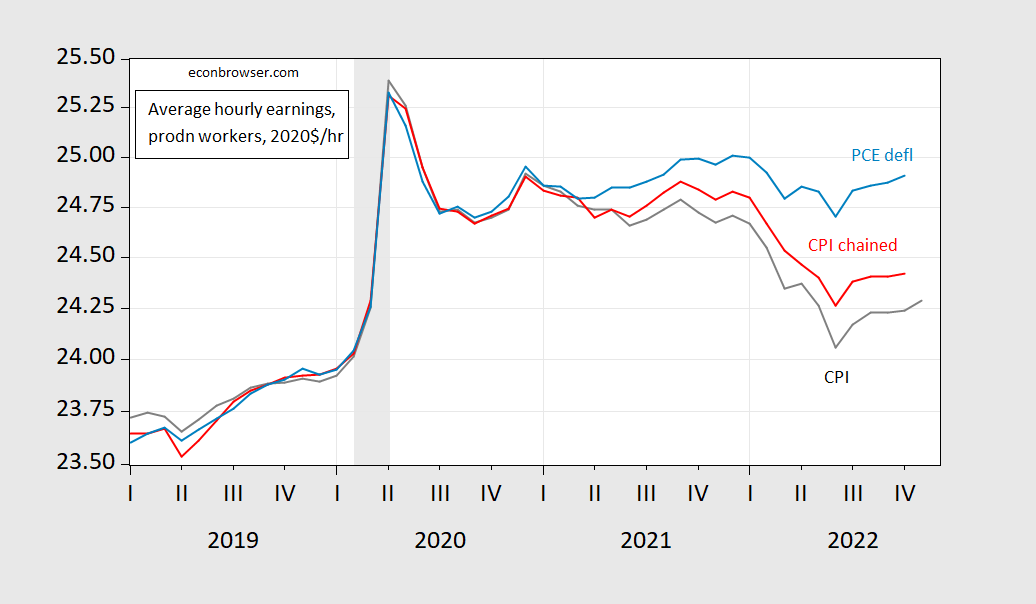

These charts highlight the importance of the deflator. Here is a comparison of average hourly gross wages for private-sector production workers and non-supervisory workers:

Figure 4: 2020 private sector CPI deflation real wages (dark grey), chained CPI (red), PCE deflation (light blue) $/hour (production and non-supervisory workers). Using the Cleveland Fed’s November CPI nowcast for December 4, 2022. Chained CPI seasonally adjusted on log-transformed data using Census X-11. Dates of peak-to-trough recessions as defined by NBER are shaded in gray. Source: BLS via FRED, Cleveland Fed, NBER and author’s calculations.

For a description of the empirically correlated differences between the CPI and PCE price deflators , see Johnson (2017). Since the CPI takes out-of-pocket costs into account, while the PCE deflator takes into account consumer spending, the difference can be significant. Owner’s equivalent rent and principal residence rent constitute the larger weight differentials associated with the CPI and PCE deflators.