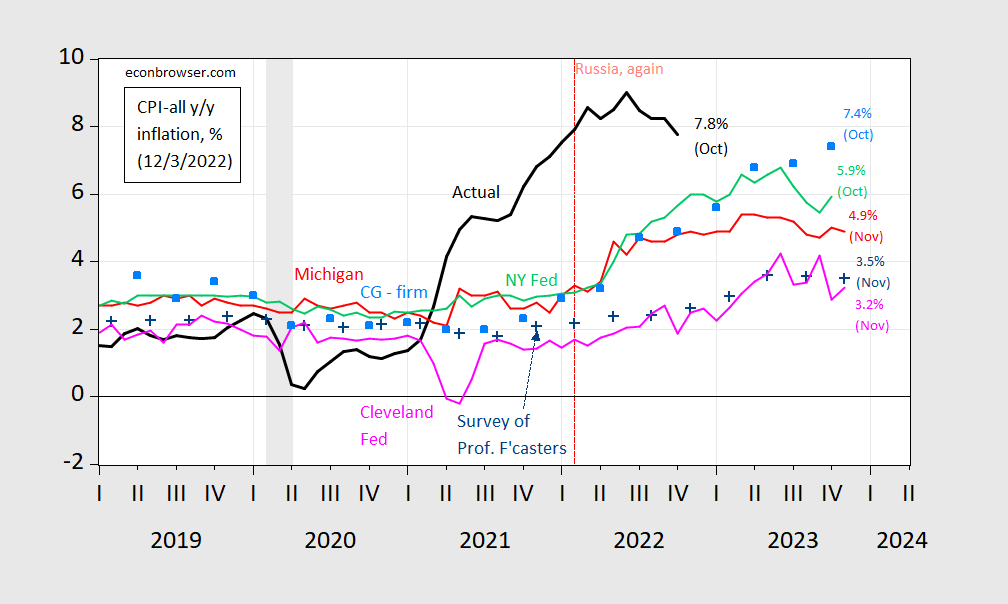

One year horizon:

figure 1: Year-over-year CPI inflation (black), median expectations from Survey of Professional Forecasters (blue+), median expectations from Michigan Consumer Survey (red), median expectations from NY Fed Survey of Consumer Expectations (light green), forecast from Cleveland Federal Reserve (pink), average from Coibion-Gorodnichenko Company Expectations Survey [light blue squares], all expressed in %. The November NBER defines the gray-shaded peak-to-trough recession dates.Sources: BLS, University of Michigan, from FRED and Investment Network, Philadelphia Fed Survey of Professional Forecasters, the fed, cleveland fed and Coibion and Gorodnichenkoand the National Bureau of Economic Research.

Forecasts based on surveys of households and firms are still higher than forecasts based on economists and expectations based on economists and market indicators (Cleveland Fed).

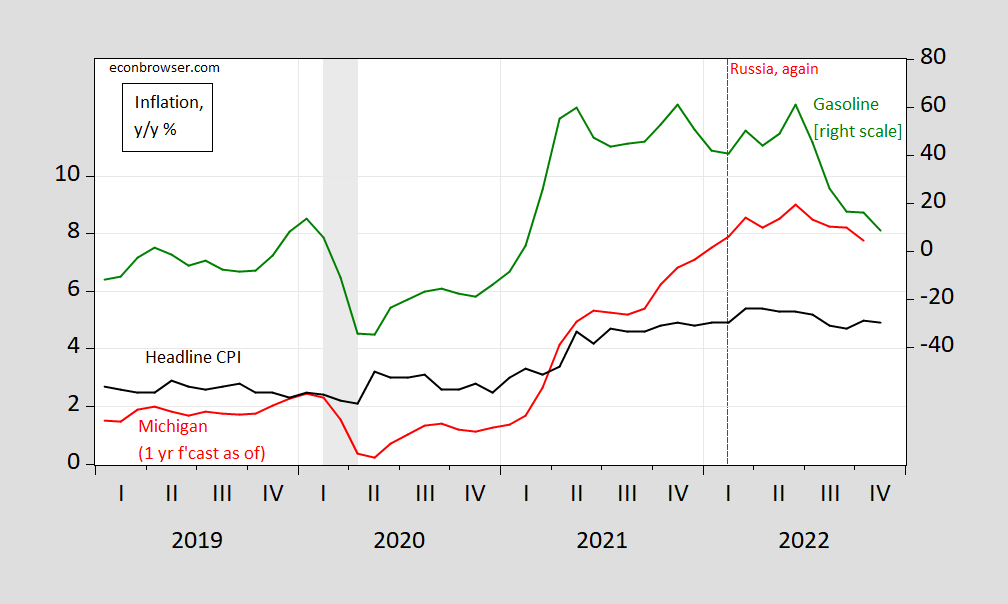

It will be interesting to see how expectations based on household surveys differ from gasoline prices in recent months. Over the 2019-2022 period, each percentage point year-on-year increase in natural gas prices is associated with about 0.3 percentage points of headline CPI inflation.

figure 2: YoY CPI Inflation (black, left scale), Michigan YoY Expected Inflation, as of the given date (red, left scale) and gasoline price inflation (green, right scale), both in %. Dates of peak-to-trough recessions as defined by NBER are shaded in gray. Sources: BLS via FRED, University of Michigan via FRED, EIA via FRED, NBER, and authors’ calculations.

On that basis, I would expect Michigan to drop even more. Of course, there are many other factors that feed into expectations (and overall CPI inflation), so I’ll leave this as an open question.

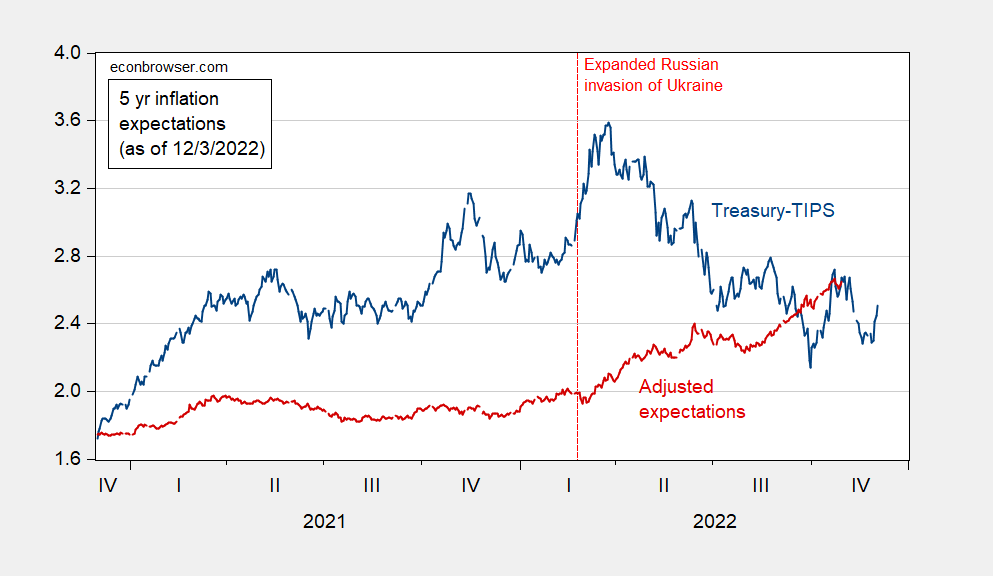

Market-based (Treasury-TIPS spread) five-year expectations:

image 3: The five-year inflation breakeven is calculated as the five-year treasury bond yield minus the five-year TIPS yield (blue), and the five-year breakeven is adjusted by inflation risk premium and liquidity premium per DKW (red), both in % . Source: FRB via FRED, Treasury, kilowatt Based on D’amico, Kim, and Wei (DKW) access 12/3, and author’s calculations.