So far, according to OECD Weekly Tracker (via 9/17). But (an understatement of the year), challenges have arisen.

figure 1: Weekly tracker (blue) in %. resource: OECDECRI and the authors’ calculations.

The OECD Weekly Tracker reading of 1.4 translates into an average annual growth rate of 1.4% through 9/17. How is the OECD Weekly Tracker impacting the UK? Here are two pictures of quarterly and monthly GDP (monthly is the official ONS series, not the same as the monthly US GDP I’ve been reporting, from IHS Markit).

figure 2: UK real GDP YoY at quarterly frequency (cyan) from Weekly Tracker (black) in %. The third quarter observation is for data prior to 9/17. ECRI defines recession peaks to troughs shaded in light green. Source: OECD via FRED, OECDECRI and the authors’ calculations.

image 3: UK year-on-year real GDP at monthly frequency (cyan), from Weekly Tracker (black), in %. The third quarter observation is for data prior to 9/17. ECRI defines recession peaks to troughs shaded in light green. resource: Office for National Statistics, OECDECRI and the authors’ calculations.

Based on the negative second-quarter GDP reading, and its own GDP forecast, NIESR has declared the UK in recession (again).

Now, what do you think of the new government’s (which almost everyone thinks is ill-conceived) fiscal plan? Well, to me, the reaction of the financial markets suggests a lack of credibility as long as the promised outcome will actually happen.

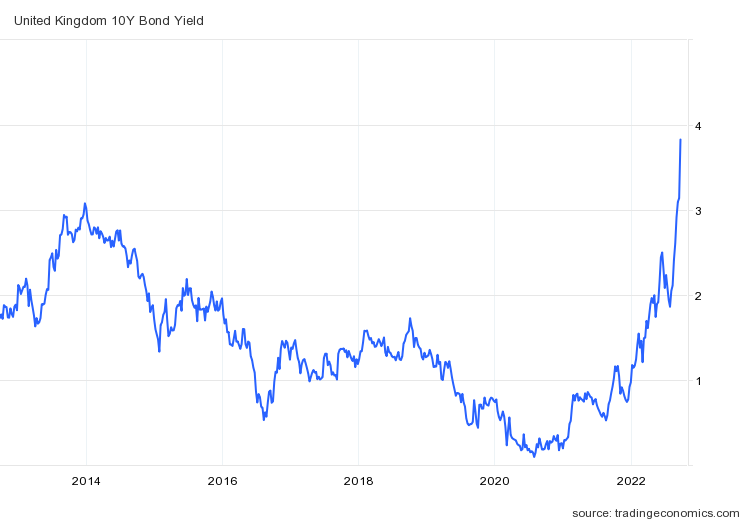

Rates on 10-year government bonds have soared — which makes sense, as increased borrowing collides with expected tighter monetary policy that should boost yields. It is not clear to me that the increase in yields is driven purely by the expected assumptions of the term structure; i.e., perhaps part of the increase is due to the increased inflation risk associated with nominal bonds (I don’t know where to get an estimate of the inflation risk premium for UK gilts ).

The fall in GBP/USD is counterintuitive (at least to me) for a country where government bonds are a complete substitute for US government bonds – i.e. in this case Uncovered interest parity will remain. However, if bonds are not fully substitutable, then one can resort to a Portfolio Balance Model. The simplest version shows that the expected large increase in the bond supply will cause the currency to depreciate. This is exactly what we see. While the so-called small budget parameters were not far from expectations, it appears that announcing two — not one — tax cuts at a time when the budget and trade deficits are already large is undermining credibility.

All I can say is: I’m glad I didn’t have to sell this financial package to anyone…

Oh, and while the first self-harm is obvious, the second can be seen in the 2016 sterling devaluation (which happened in June of that year). The fall in the real value of the pound means a deterioration in the UK terms of trade…