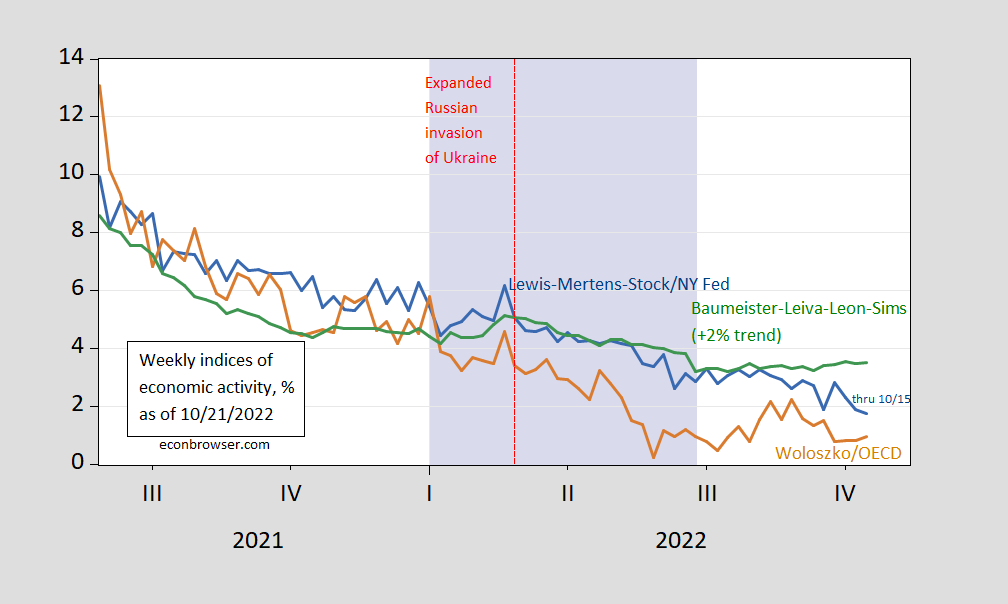

Measured by NY Fed WEI, OECD Weekly Tracker, and Baumeister, Leiva-Leon and Sims WECI.

figure 1: Lewis-Mertens-Stock (New York Fed) Weekly Economic Index (blue), Woloszko (OECD) Weekly Tracker (tan), US Baumeister-Leva-Lyon-Sims Weekly Economic Condition index plus 2% trend (green). The lilac shading indicates a hypothetical 2022H1 recession.Source: NY Fed via Fred, OECD, Wisioand the authors’ calculations.

WEI has fallen for three straight weeks, falling to 1.2% from 2.8% in the week ended Sept. 24, while Weekly Tracker and WECI both rose. Given the large variance in methodologies, it’s not surprising that the weekly tracker continues to show lower-than-WEI growth. WEI relies on correlations of ten series (eg, unemployment claims, fuel sales, retail sales) available at weekly frequencies. The weekly tracker (1.0%) is a “big data” approach that uses Google Trends and machine learning to track GDP.

The 1.2% WEI reading for the week ended Oct. 15 could be interpreted as a 1.2% quarterly growth rate if the 1.2% reading persisted throughout the quarter. The OECD Weekly Tracker reading of 1.0% could be interpreted as a 1.0% year-on-year growth through 10/15.This Baumeister et al. A reading of 1.5% was interpreted as 1.5% above the long-term trend growth rate. The average growth rate of US GDP from 2000-19 was about 2%, so that would imply a growth rate of 3.5% as of 10/15.

Since these are year-over-year growth rates, we may be in a recession in the first half because an observer asserted a few months ago, but it (still) seems unlikely.

GDPNow for the third quarter ended October 2019 was 2.9% q/q SAAR.