From today’s Natixis, “Mild inflationary pressures in China contrast sharply with rising export prices that are fueling global inflation”:

An obvious reason to explain China’s low inflation rate is weak demand, which was hit by the Omicron outbreak. As China continues its dynamic zero-virus strategy, a sharp drop in liquidity is affecting households’ demand for goods and services and dampening investment. As a result, China’s core consumer price (CPI) inflation fell to 0.9% y/y in April from 1.2% y/y in January (Figure 1) although headline CPI inflation did rise to 2.1% y/y in April from 0.9% y/y in February, mainly due to a surge in food prices, which surged from negative (-3.9%) in February to 1.9% in April. All in all, as long as domestic demand remains subdued, it will be difficult for the core CPI to rise too much for the rest of the year.

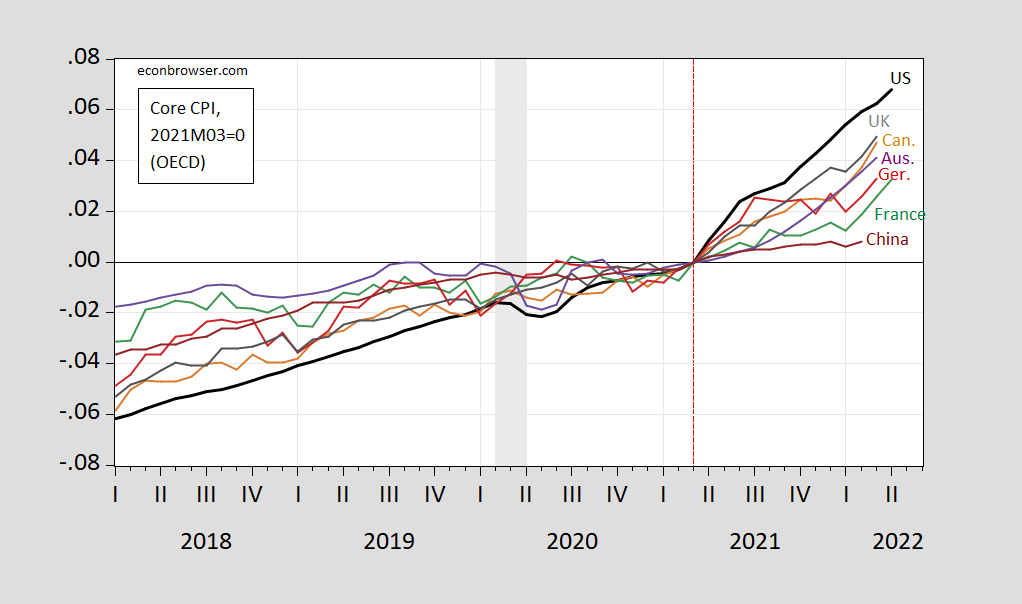

So, when you look at this picture of relative core CPI performance (from this postal):

figure 1: Core CPI, nsa, log 2021M03=0. The American series is BLS, sa. Chinese series, sa, from Ha et al. The French range does not include alcohol and tobacco. The Australian series was interpolated from quarterly data by the authors. Recession dates as defined by NBER are shaded from peak to trough in gray. Source: Bureau of Labor Statistics, OECD via FRED, Ha, Kose, Careless/World BankNBER, and the authors’ calculations.

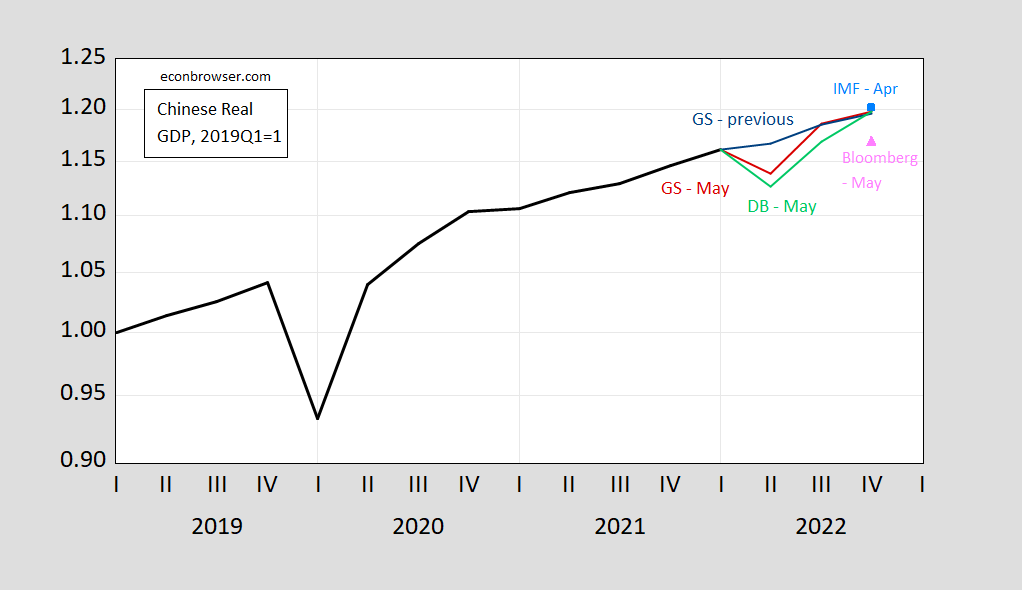

Remember, all you need to do is push your economy into negative (or near negative) growth.For growth prospects, see this graphic depiction of China’s GDP outlook (from postal).

figure 2: China’s real GDP, 2019Q1=1 (black), Goldman Sachs’ previous forecast (blue), Goldman Sachs’ May 18 forecast (red), IMF’s April World Economic Outlook forecast (sky blue square), Deutsche Bank’s May 17 forecast ( Light green), Bloomberg Economics May 20 (pink triangle). Source: National Bureau of Statistics, IMF, Goldman Sachs, Deutsche Bank, Bloomberg Economics, and author’s calculations.