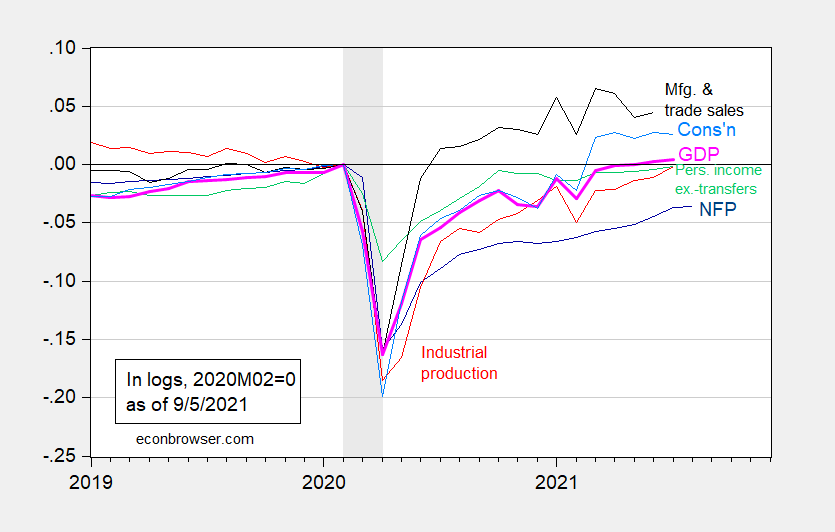

With the release of the employment situation in August, we have the following picture of the macro economy.

figure 1: Non-agricultural employment numbers released in June (dark blue), industrial production (red), excluding personal income transferred in 2012 (green), manufacturing and trade sales in 2012 (black), consumption in 2012 (light blue) Color), and the monthly GDP (pink) of Ch.2012$, all logarithms are normalized to 2020M02=0. The decline date defined by NBER is shaded in gray. Source: BLS, Federal Reserve, BEA, calculated by FRED, IHS Markit (nee Macroeconomic Advisers) (released on September 1, 2021), NBER and the author.

Obviously, the growth rate of non-agricultural employment has slowed down, continuing the established trend of non-current transfers of consumption and personal income in the July data. The increase of 235K is 515K lower than Bloomberg’s consensus of 750K. The retail industry dropped by 29K, while hospitality and leisure employment remained flat, breaking the industry’s recovery, which marked the impact of delta variants.

Reuters report:

The number of people who said they were unable to work due to the pandemic rose by 497,000 in August, the first increase since December last year.

Maybe not big influence, But a noteworthy suggestion Earlier Through high-frequency indicators (remember that the release was released before mid-August).

More about the employment release in the next article.