The lack of non-agricultural employment is obvious, and the growth of high-touch service employment tends to be flat.

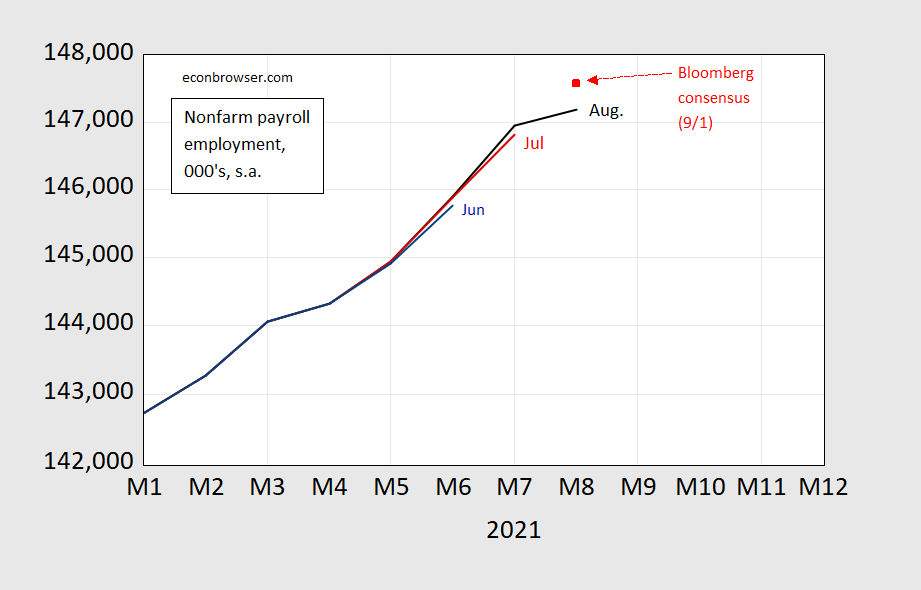

figure 1: Non-agricultural employment numbers released in June (blue), July releases (red) and August releases (black), and August Bloomberg consensus implied levels (red squares). Source: BLS, Bloomberg (9/2), author’s calculations.

Bloomberg consensus is consistent with a constant growth rate; misses exceed 500K.

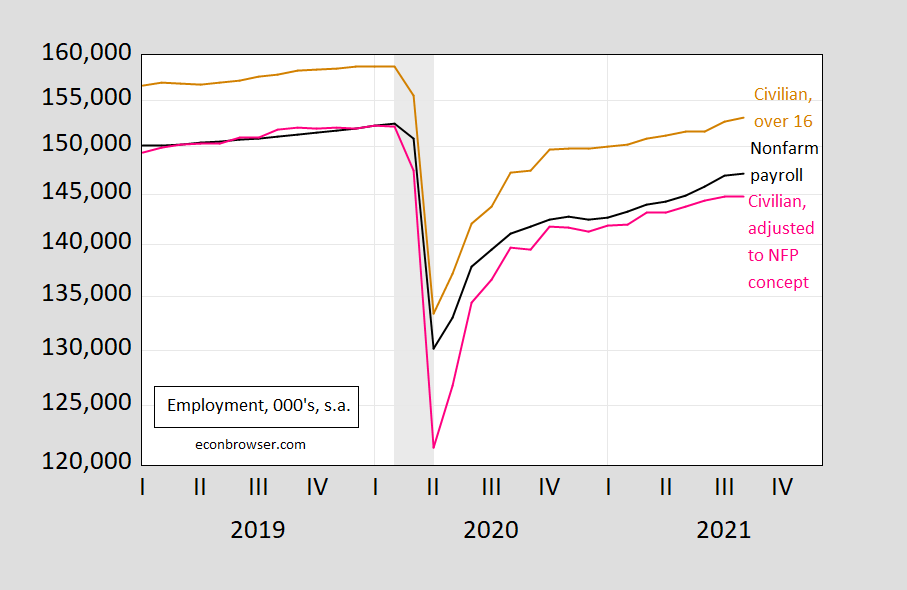

Employment from household surveys grew faster (twice in August), but not enough to change the situation significantly.

figure 2: Non-agricultural employment (black), civilian personnel over 16 years old (brown), and civilian personnel adjusted according to the NFP concept (pink). The decline date defined by NBER is shaded in gray. Source: US Bureau of Labor Statistics, US National Bureau of Statistics.

In the past year, the growth of civilian employment and non-agricultural employment was roughly the same (3.9% vs. 4.2%). The employment rate of civilians who redefine the concept of NFP is slightly slower, at 3.6%.

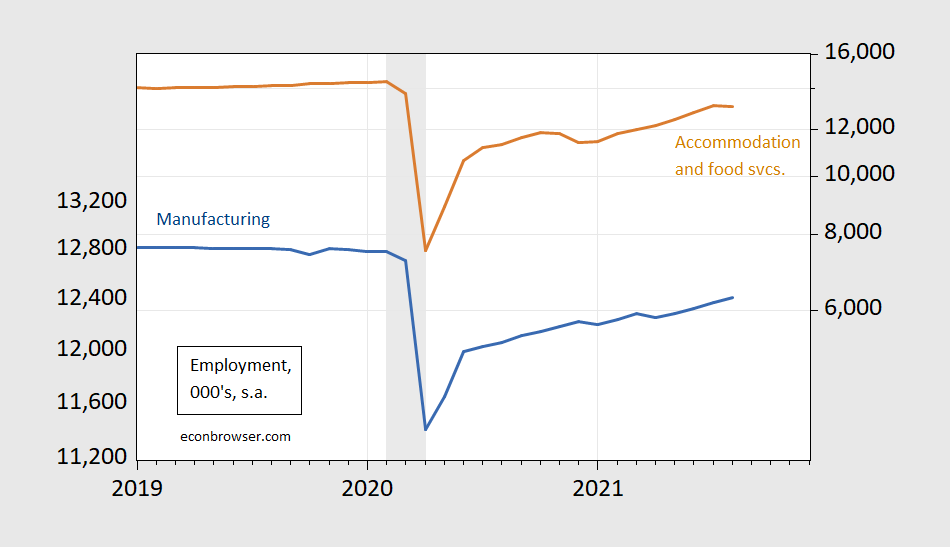

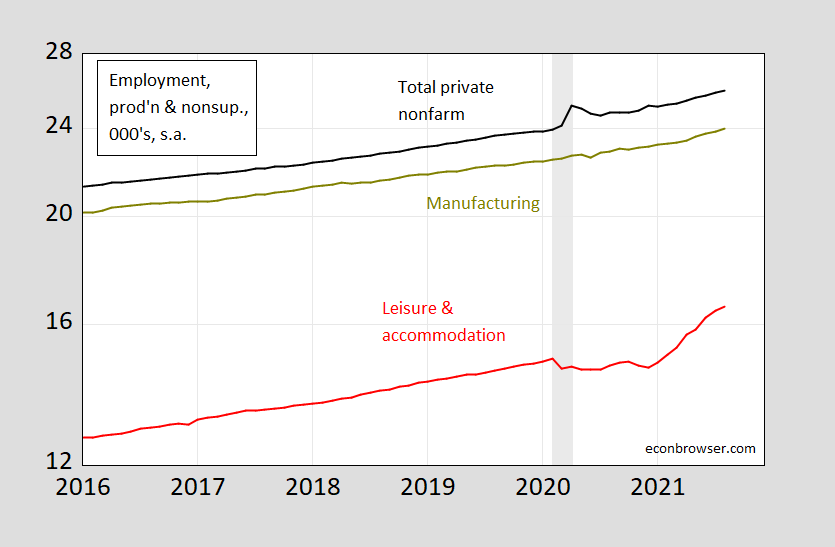

Figure 3 highlights the fact that employment in goods production (especially manufacturing) continues to grow, while employment growth in accommodation and catering services has declined slightly (the broader leisure and hotel categories are flat).

image 3: Employment in manufacturing (blue, left logarithmic scale), accommodation and food services (brown, right logarithmic scale). The decline date defined by NBER is shaded in gray. Source: US Bureau of Labor Statistics, US National Bureau of Statistics.

If the employment growth in the accommodation and food service industries in August is the same as in July (363,000), and all other types of employment also increase, then the number of non-agricultural employment will increase by nearly 400,000 (that is, 635,000 and actual 435,000)).

Torsten Slok observed (Note, 9/3):

… In August, the Delta variant prevented recruitment in the leisure and hospitality industries, but employment in warehousing and warehousing, as well as couriers and messengers increased. Overall, the employment rate of messengers and messengers is 17% higher than pre-pandemic levels. Most importantly, Covid blocked hiring in August. With the expected delta peak, we should start to see job growth pick up again in the coming months.

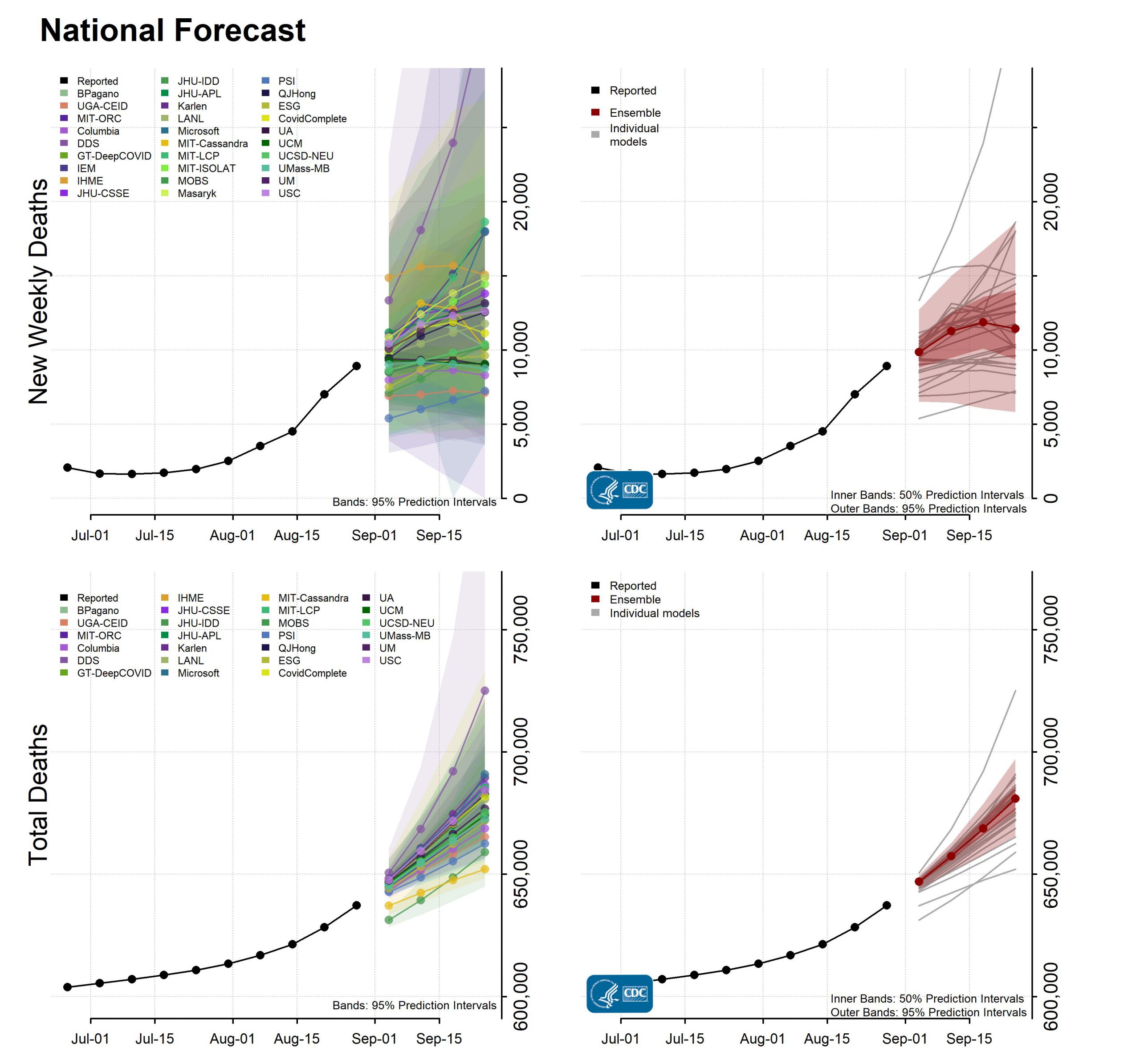

CDC’s forecast for 8/30 (released on 9/1) is as follows:

source: CDC, Visit 9/6.

The CDC overall model places the peak of death approximately 2 weeks later (3 weeks from 8/30). The question in my mind is whether the various models behind the CDC integrated model incorporate the effects of Labor Day travel and school openings-including K-12 and universities/universities.

The duality of the recovery is also reflected in the wage data.

Figure 4: Average hourly income of gross private income (black), manufacturing (yellow-green), leisure and hotel services (red), and $/hour for production and unsupervised workers. Source: BLS.

Overall and manufacturing wage growth has accelerated (as indicated by the steep slope). However, wage growth for leisure and accommodation will only accelerate with the start of vaccination-and continue until it exceeds the pre-pandemic trend (logarithm of 5%). The lack of clear evidence that the increase in welfare leads to a decrease in the labor supply means that the increase in wages may be due to other factors that inhibit supply (fear of exposure to Covid-19, other compensatory differences or restrictions on the care of children or parents, etc.).