this Wall Street Journal April Survey Published (Replied April 5-9):

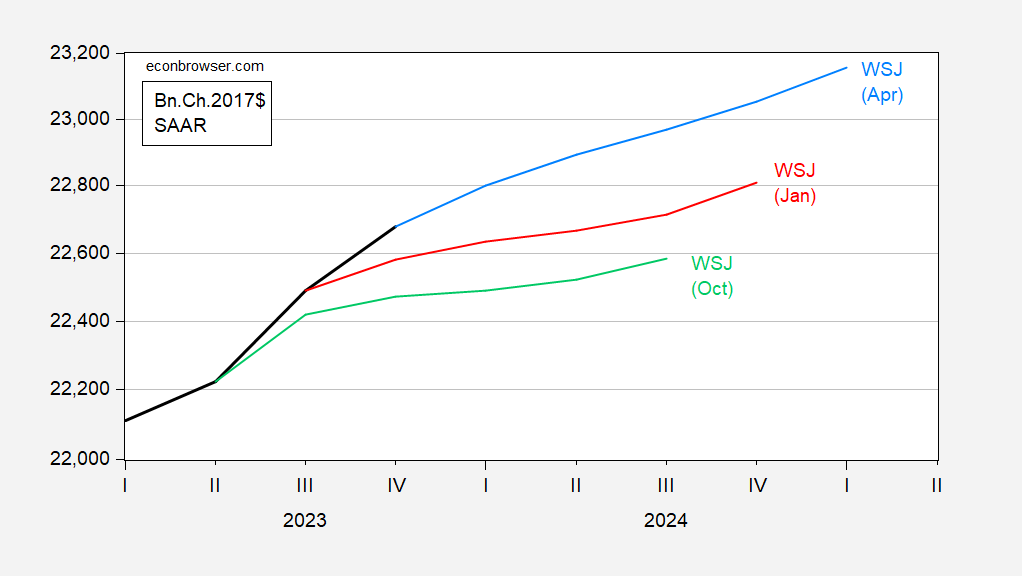

The first is the forecast GDP level of the last three surveys (7 months):

figure 1: GDP (bold black), Wall Street Journal average forecast implied level for April 2024 (blue), January 2024 (red), October 2023 (light green), all in billions of dollars. Seasonally adjusted exchange rates for 2017. Source: BEA 2023 Q4 Issue 3, Wall Street Journal survey (various issues), and author's calculations.

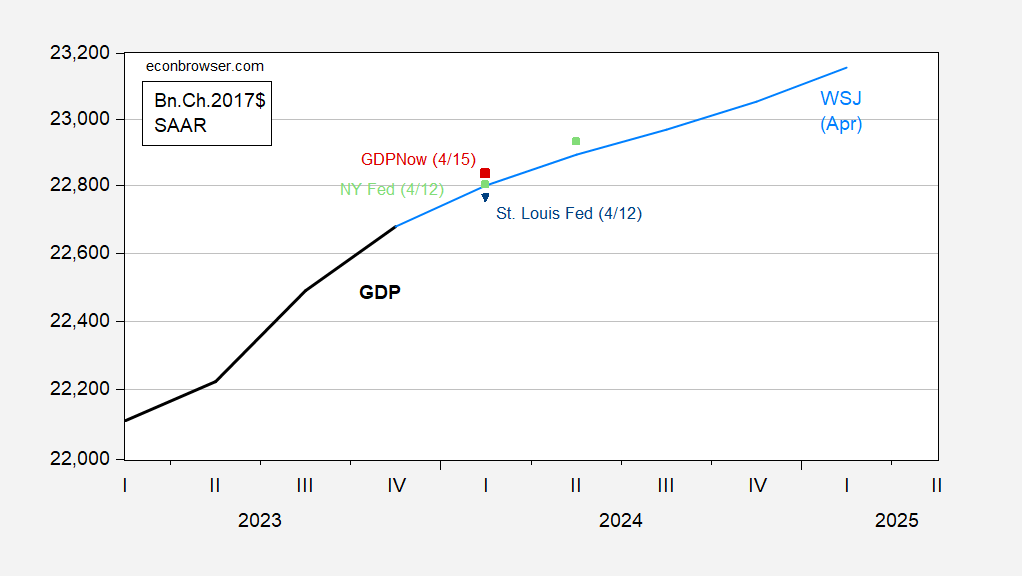

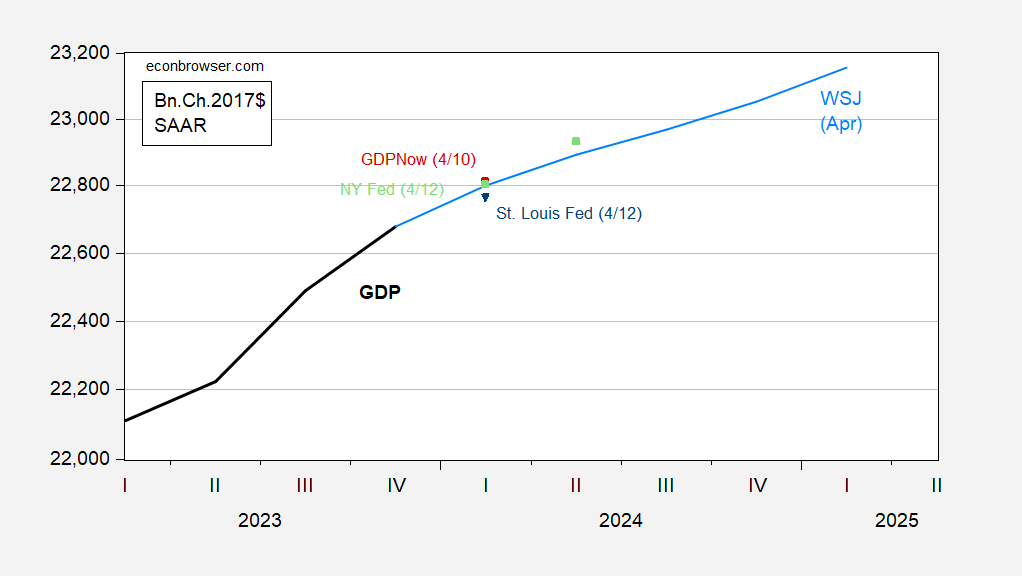

Currently, the two latest instant forecasts exceed the average forecast for the first quarter (Atlanta, New York Fed):

figure 2 [upated]: GDP (bold black), February SPF (light blue), Current GDP (4/15) (red square), New York Federal Reserve Bank (light green square), St. Louis Federal Reserve Bank (blue inverted triangle), all in bn.Ch.2017$ SAAR. Source: BEA (via FRED), Federal Reserve Bank of Philadelphia, Atlanta Fed, New York Fed, St. Louis Fed (via FRED), and author's calculations.

figure 2: GDP (bold black), February SPF (light blue), GDPNow (4/10) (red box), New York Fed (light green box), St. Louis Fed (blue inverted triangle), All units are bn.Ch.2017$Saar. Source: BEA (via FRED), Federal Reserve Bank of Philadelphia, Atlanta Fed, New York Fed, St. Louis Fed (via FRED), and author's calculations.

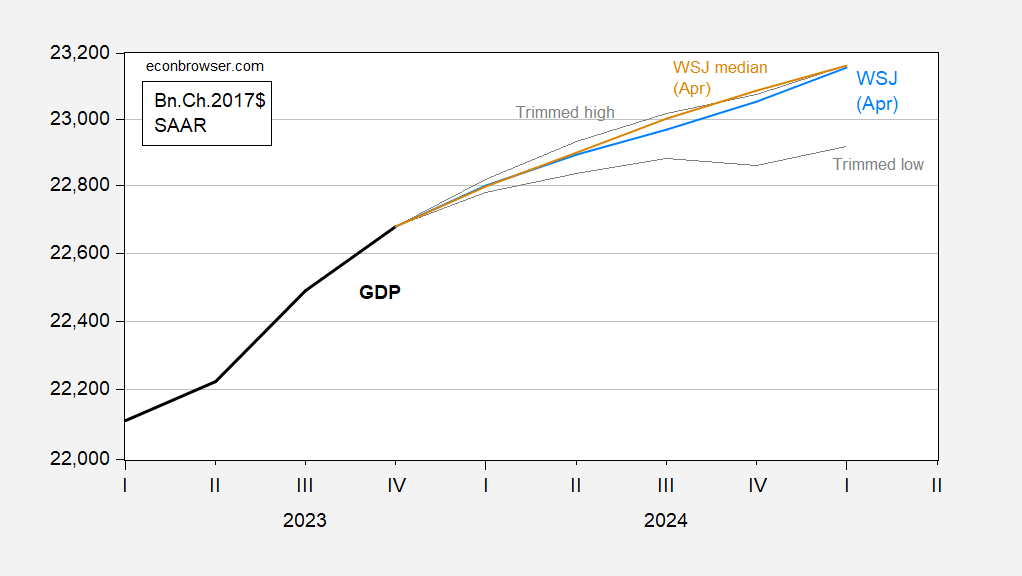

The average and median forecasts are for quarters without negative growth. Even the adjusted lower bound (removing the lowest six forecasts for 2024) doesn't show two consecutive quarters of negative growth.

image 3: GDP (bold black), WSJ April 2024 average forecast implied level (blue), median (tan), 2024 high/low 20% adjustment (gray), all in billions USD, 2017 Seasonally Adjusted (SAAR). Source: BEA 2023 Q4 Issue 3, Wall Street Journal survey (various issues), and author's calculations.

The one who lowered the price was Mike Cosgrove/Econoclast, and the one who raised the price was Song Won Sohn/SS Economics. The median is the Satyam Panday/S&P Global Rating.

Long-term optimist James Smith/EconForecaster has the highest growth forecast (3.3% if Q4/Q4 2024). Andrew Hollenhorst and Veronica Clark/Citigroup and Amy Crew Cutts/AC Cutts both forecast negative growth from the second to third quarters.

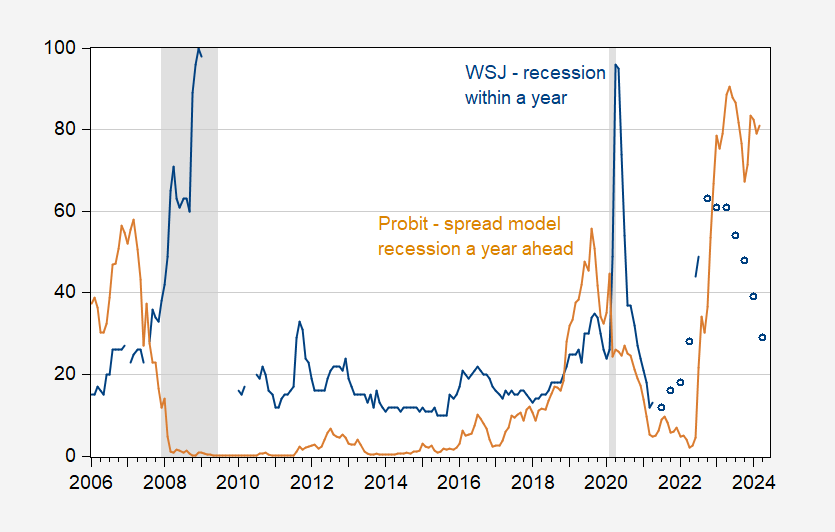

As for the recession (recall, NBER does not use the rule of thumb of two consecutive quarters of negative GDP growth to define a recession.), economists' views differ significantly from purely statistical forecasts (probabilities) based on 10-Year-March term spreads and Wall Street Journal surveys.

Figure 4: Wall Street Journal investigates recession chances within One year (blue), and probability-based recession of the 10-March spread exist One year (tan), expressed in %. Probit estimates are based on 1986-2018 (pre-pandemic). NBER-defined recession peak-to-trough dates appear gray. Source: Wall Street Journal, NBER, author's calculations.

Note that in the run-up to the 2007-09 recession, the probability model led the survey indicator, while probability and surveys rose in tandem towards the end of 2022, after which they diverged.